Is Discover the same as Amex?

Is Discover card same as Amex

Discover and American Express are similar in that they are credit issuers and processors and have their own networks. While both are good stocks, one appears to be a slightly better buy.

Can I pay my Discover card with American Express

You can use your American Express credit card to pay off another credit card by doing a balance transfer, getting a cash advance, buying a money order or using a mobile payment service. It is not possible to use an American Express card as the primary payment method for another credit card account.

What bank is behind Discover Card

Discover Bank

Most cards with the Discover brand are issued by Discover Bank, formerly the Greenwood Trust Company. Discover transactions are processed through the Discover Network payment network.

CachedSimilar

What makes Discover card different

Among other benefits, Discover® Cardmembers receive: No annual fee: Youdon't have to worry about paying to use your Discover® Card because there's no annual fee. No foreign transaction fee: You won't pay a fee if you use your card abroad or make a purchase online in a foreign currency.

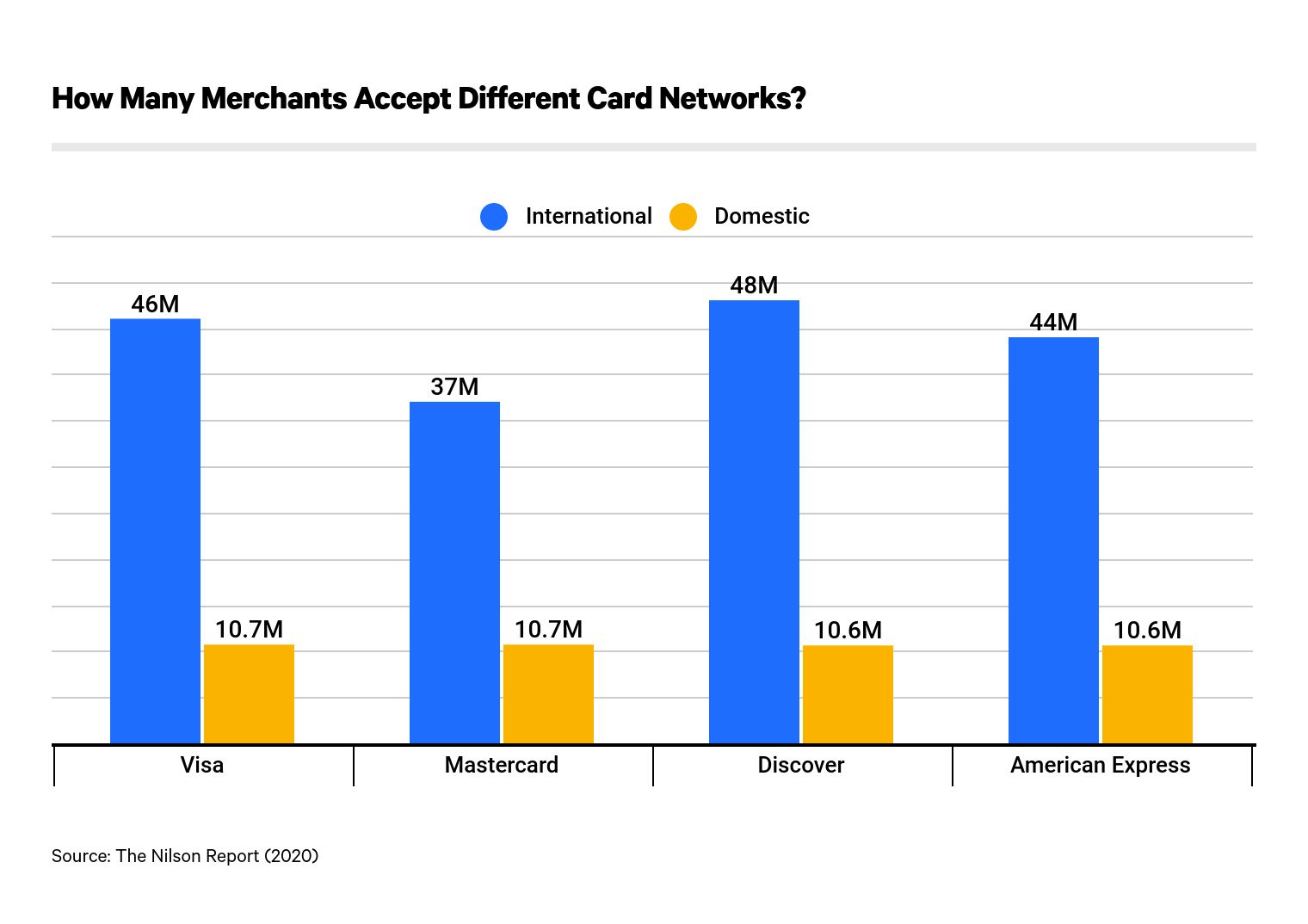

Why is Discover not accepted everywhere

Discover is a direct-to-consumer issuer, meaning that it doesn't partner with banks that help promote and distribute its products. There's about one-seventh the number of Discover cards as Visa cards, so merchants may not have as much of an incentive to accept them.

Where is Amex not accepted

Places Where American Express is Not Accepted: Cuba, Sudan, South Sudan, Iran, Syria. Major Retailers That Accept American Express: Amazon, IKEA, Sears, Target, Walmart, Lowe's, Apple, Best Buy, Staples, CVS. Major Retailers That Don't Accept American Express: Costco, small non-chain stores/restaurants.

How to transfer credit from Discover to Amex

Once in your account, head to “Account Services.” Then, select “Payment & Credit Options.” From there, you'll click on “Transfer Balances.” Then, enter the requested information like the name of your other credit card issuer, your other credit card account number and the amount you want to transfer.

Why are American Express cards not as widely accepted as Visa Mastercard and Discover

The different fees often make or break a deal for a merchant. This is why many merchants, especially small businesses, don't accept American Express. American Express' interchange fee is just too high. Providers like Visa and Mastercard charge between 1.15% and 2.5%, while Amex charges merchants between 1.43% and 3.3%.

What bank owns American Express

American Express is owned by American Express Company, a U.S.-based multinational financial services corporation headquartered in New York, NY. American Express Company was founded in 1850 and has owned American Express ever since.

What bank is American Express

American Express National Bank (Member FDIC) is the personal banking arm of popular credit card issuer American Express.

Why would anyone use Discover card

Staying true to its roots, the card still has no annual fee and doesn't charge foreign transaction fees. Discover won't charge a late fee for the first missed or late payment, either. 9 Each of your monthly statements also comes with a free FICO score.

Why is discover card not widely accepted

Why isn't Discover as widely accepted as Visa or Mastercard Discover is a direct-to-consumer issuer, meaning that it doesn't partner with banks that help promote and distribute its products.

Is it hard to get approved for a Discover it card

For this card, you generally need a good to excellent credit score to qualify. According to FICO, a 'good' credit score is a score between 670 and 739.

Does Amazon not accept Discover

Credit cards currently accepted include Visa, Mastercard, Discover, American Express, Diners Club, and JCB. The Amazon.com store card is available for use with selected merchants. In some circumstances, you might be limited to using Visa and Mastercard credit cards.

Why don’t people take American Express

The different fees often make or break a deal for a merchant. This is why many merchants, especially small businesses, don't accept American Express. American Express' interchange fee is just too high. Providers like Visa and Mastercard charge between 1.15% and 2.5%, while Amex charges merchants between 1.43% and 3.3%.

Why is Amex so popular

American Express is one of the leading card issuers in the United States. It's known for its top-notch customer service and some of the best rewards available. From ultra-elite business travel cards to everyday rewards, American Express has credit cards that are a good choice for many different types of cardholders.

Should I have 3 credit cards

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

What happens if you don’t pay American Express in full

Interest charges accrue when you don't pay the bill off in full. Pay Over Time charges an interest rate that is the same across the Green, Gold and Platinum products. As of August 2023, cardholders who use the feature will pay an APR between 15.99% to 22.99%, depending on creditworthiness.

Why does no one accept American Express

The different fees often make or break a deal for a merchant. This is why many merchants, especially small businesses, don't accept American Express. American Express' interchange fee is just too high. Providers like Visa and Mastercard charge between 1.15% and 2.5%, while Amex charges merchants between 1.43% and 3.3%.

Why American Express credit cards are hard to get

Yes, it's hard to get an American Express card because you will need a good or excellent credit score for approval, along with enough income for monthly bill payments. The easiest American Express cards to get are those that require a minimum of good credit for approval, as opposed to excellent credit only.