Is equipment purchase an expense?

How do you account for equipment purchases

When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the account you pay for the asset from. Remember to make changes to your balance sheet to reflect the additional asset you have and your reduction in cash.

Cached

Is purchasing equipment an expense on income statement

When equipment is purchased, it is not initially reported on the income statement. Instead, it is reported on the balance sheet as an increase in the fixed assets line item.

Cached

Is purchase of equipment an asset

What type of asset is equipment Equipment is considered a noncurrent asset – or fixed asset. A noncurrent asset is a long-term investment that your company makes that is not likely to become cash within an accounting year or does not easily convert to cash.

Is purchase an asset or expense

Accounting for the Goods Purchased

Their cost could be recorded in an expense account (such as Cost of Goods Sold) Their cost could be recorded in an asset account (such as Inventory)

What account is purchasing equipment

asset

The purchase of property, plant, or equipment results in a debit to the asset section of the balance sheet. The credit is based on what form of payment you use as the customer. If you use cash, then you would credit cash.

How do I classify equipment purchases in QuickBooks

How to Record a Fixed Asset Purchase in QuickBooks OnlineOpen the Fixed Asset Item List. From the menu bar, select List > Fixed Asset Item List.Add a New Item. Click the “Item” button in the lower-left corner of the list window.Select Account.Purchase Information Section.Asset Information Section.Save.

Why is purchases an expense

A purchase is classified as a “cost” when it is something that is related to an asset. It's an “expense” when it is related to the ongoing operations of a business. For example, if you own a retail business of some kind and you buy a new building.

Is purchase an inventory or expense

When you purchase inventory, it is not an expense. Instead you are purchasing an asset. When you sell that inventory THEN it becomes an expense through the Cost of Goods Sold account.

Where does equipment purchase go on a balance sheet

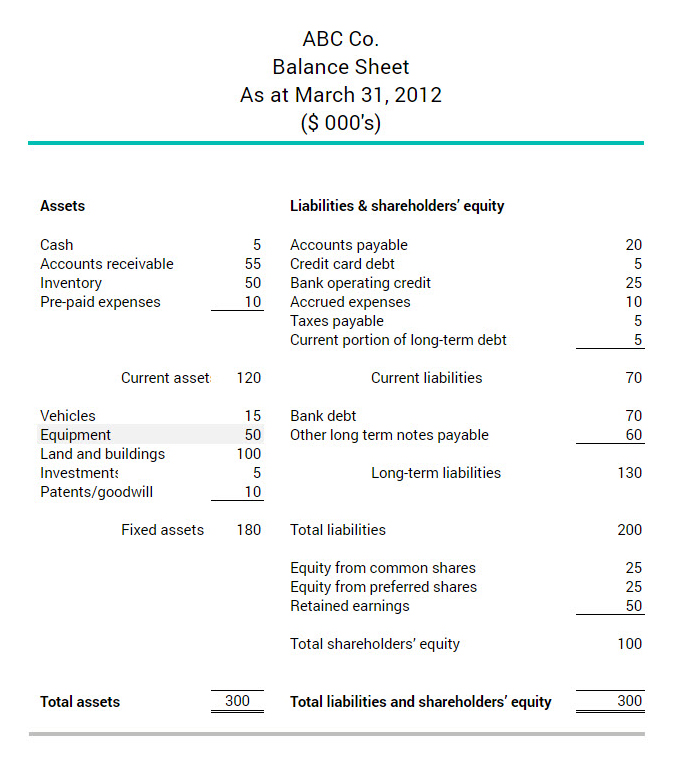

Is Equipment on the Balance Sheet Yes, equipment is on the balance sheet. It is listed under “Noncurrent assets”. Noncurrent assets are added to current assets, resulting in a “Total Assets” figure.

Is a purchase an expense

A purchase is classified as a “cost” when it is something that is related to an asset. It's an “expense” when it is related to the ongoing operations of a business. For example, if you own a retail business of some kind and you buy a new building.

Is purchase an expense or liability

expense

Purchases is an expense of the business – so it decreases the profit (and hence the equity) and if it is on credit then it increases the liability. Separately, if any of the purchases are unsold then we have inventory.

Is a purchase account an expense

While the Purchases Accounts are normally classified as temporary expense accounts, they are actually hybrid accounts. The purchase accounts are used along with freight in, and the beginning and ending inventory to determine the cost of goods sold (COGS).

How do I record purchase of new equipment in QuickBooks

How to Add a Fixed Asset Item in QuickBooksOpen the Fixed Asset Item List.Add a New Item.Select Account.Input Purchase Information.Fill in the Asset Information.Save and Close.

Can a purchase be an expense

The purchase cost will be capitalised and appear in the balance sheet where it will be depreciated. However, the ink and paper bought for use with the printer is an expense as this is consumed and would be used up during the year. The purchase cost of these is an expense and will go into the profit and loss.

Where do purchases go in accounting

Cash purchases are recorded more directly in the cash flow statement than in the income statement. In fact, specific cash outflow events do not appear on the income statement at all.

How do you record asset purchases on a balance sheet

To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same amount. For example, a temporary staffing agency purchased $3,000 worth of furniture.

What are purchases classified as in accounting

Purchases – Used to record all purchases of merchandise for resale, this is one of the largest expense accounts of a merchandiser. It is classified as a cost of goods sold account.

What purchases are liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities can be contrasted with assets. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

Can I list previously purchased equipment as a business expense

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment for the current tax year — instead of writing off the purchase over the course of several years, which is called depreciation. The equipment can be new or used, as long as it's new to you.

What is the journal of purchased equipment for on account

Purchased Equipment On Account Journal Entry is an accounting term that refers to the recording of a business's purchase of necessary equipment for use in their operations. It involves tracking each item purchased, its cost, and whether it was acquired using cash or on credit.