Is equity a withdrawal?

Is withdrawal an asset or equity

Curtis, Withdrawals is part of the equity section of the balance sheet. This account represents the amount of investment taken by the depositor or investor for his/her personal use. This decreases the outstanding capital balance of the depositor and the entire business as well.

Does withdrawal affect equity

Withdrawals by owner are transfers of cash from a business to its owner. These cash transfers reduce the amount of equity left in a business, but have no impact on the profitability of the entity.

Cached

What type of account is a withdrawal

Cash Account – This account is used for keeping the records of payments done by cash, withdrawals, and deposits.

What is equity withdrawal simple

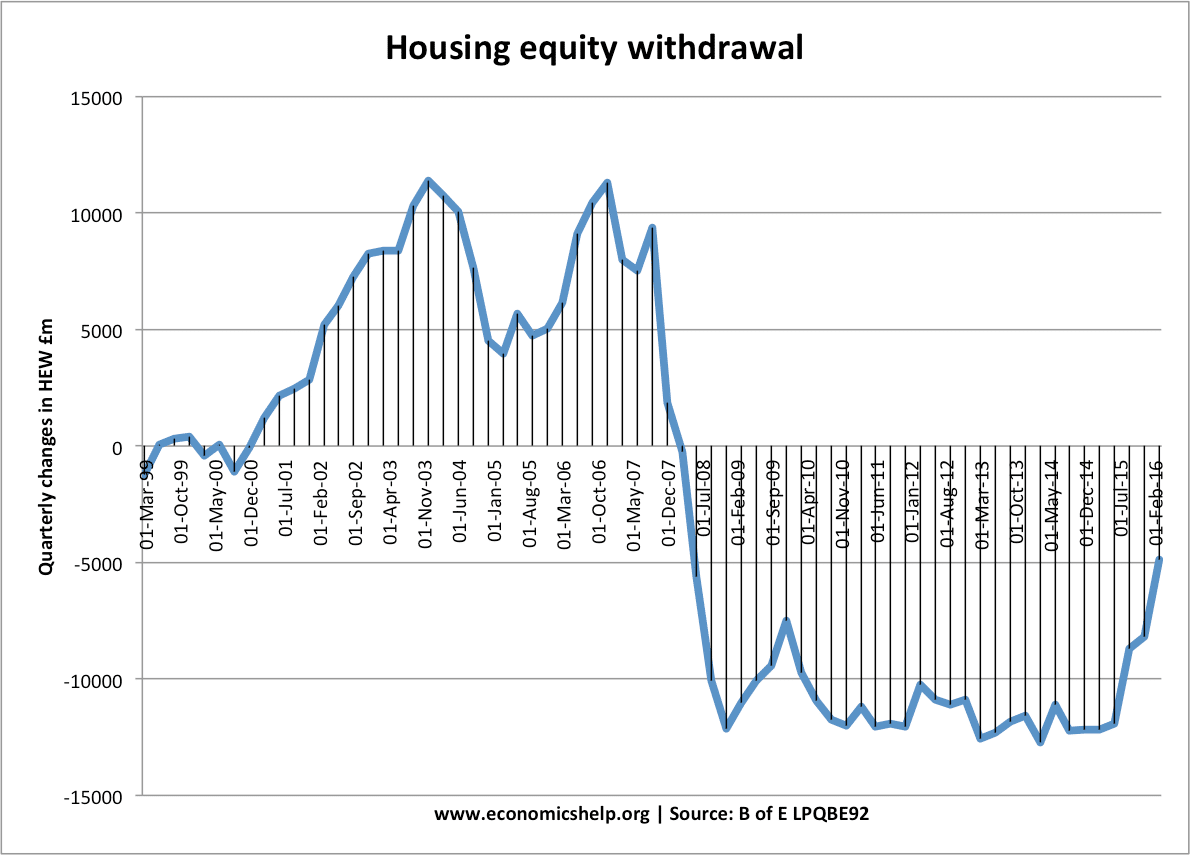

Mortgage equity withdrawal is borrowing that is secured on the housing stock but not invested in it, so it represents additional funds available for reinvestment or to finance consumption spending. Mortgage equity withdrawal was an important source of finance in the 1980s.

Why is withdrawal an equity

"Owner Withdrawals," or "Owner Draws," is a contra-equity account. This means that it is reported in the equity section of the balance sheet, but its normal balance is the opposite of a regular equity account. Because a normal equity account has a credit balance, the withdrawal account has a debit balance.

Is equity an asset or debt

Equity is also referred to as net worth or capital and shareholders equity. This equity becomes an asset as it is something that a homeowner can borrow against if need be. You can calculate it by deducting all liabilities from the total value of an asset: (Equity = Assets – Liabilities).

Is drawing an equity

The drawing account is a contra equity account, and is therefore reported as a reduction from total equity in the business. Thus, a drawing account deduction reduces the asset side of the balance sheet and reduces the equity side at the same time.

What is equity in accounting

The equity meaning in accounting refers to a company's book value, which is the difference between liabilities and assets on the balance sheet. This is also called the owner's equity, as it's the value that an owner of a business has left over after liabilities are deducted.

What is an example of withdrawal

She made a withdrawal from her checking account. He underwent rehab to help him through his withdrawal from heroin. She experienced symptoms of nicotine withdrawal after she quit smoking.

Where do withdrawals go on a balance sheet

On your balance sheet, you would typically record an owner withdrawal as a debit. If the withdrawal is made in cash, this can easily be quantified at the exact amount withdrawn. If the withdrawal is of goods or similar, the amount recorded would typically be a cost value.

Is equity considered debt

Debt and equity financing are two very different ways of financing your business. Debt involves borrowing money directly, whereas equity means selling a stake in your company in the hopes of securing financial backing.

What type of asset is equity

The primary difference between Equity and Assets is that equity is anything invested in the company by its owner. In contrast, the asset is anything that the company owns to provide economic benefits in the future.

Is drawing equity or liability

Drawings are neither liability nor an asset, as it is a contra entry it involves the owner's capital account and drawings account.

What is the difference between equity and drawings

The owner's draw is money or assets taken out of business for one's own use, while the owner's equity is composed of funds such as money that one has invested in the business. Only partnerships, sole proprietorship, and limited liability companies are the only types of businesses that can have owner's draw.

What does equity mean in a balance sheet

The balance sheet (also referred to as the statement of financial position) discloses what an entity owns (assets) and what it owes (liabilities) at a specific point in time. Equity is the owners' residual interest in the assets of a company, net of its liabilities.

Where does equity go on a balance sheet

Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company. Since they own the company, this amount is intuitively based on the accounting equation—whatever assets are left over after the liabilities have been accounted for must be owned by the owners, by equity.

What are the two types of withdrawals

According to the Substance Abuse and Mental Health Services Administration (SAMHSA), there are two types of withdrawal: acute withdrawal and protracted withdrawal.

What are the three withdrawals

Withdrawals, also called leakages, are those elements in the macro economy that leave the circular flow of income. There are three main withdrawals (W); savings (S), taxation (T) and import spending (M).

Are drawings an asset or equity

It is a current asset of the company and is one of the many assets that can be withdrawn from the business by the owner(s) for their personal use.

What is classified as equity

Shareholders' equity is the amount that the owners of a company have invested in their business. This includes the money they've directly invested and the accumulation of income the company has earned and that has been reinvested since inception.