Is everyone really approved at DriveTime?

Does DriveTime verify income

Valid driver's license. Proof of income (determined through a pay stub, bank statements and/or employer verification) Proof of auto insurance (we can help you obtain insurance if you don't already have a provider)

Does DriveTime pre approval hurt your credit

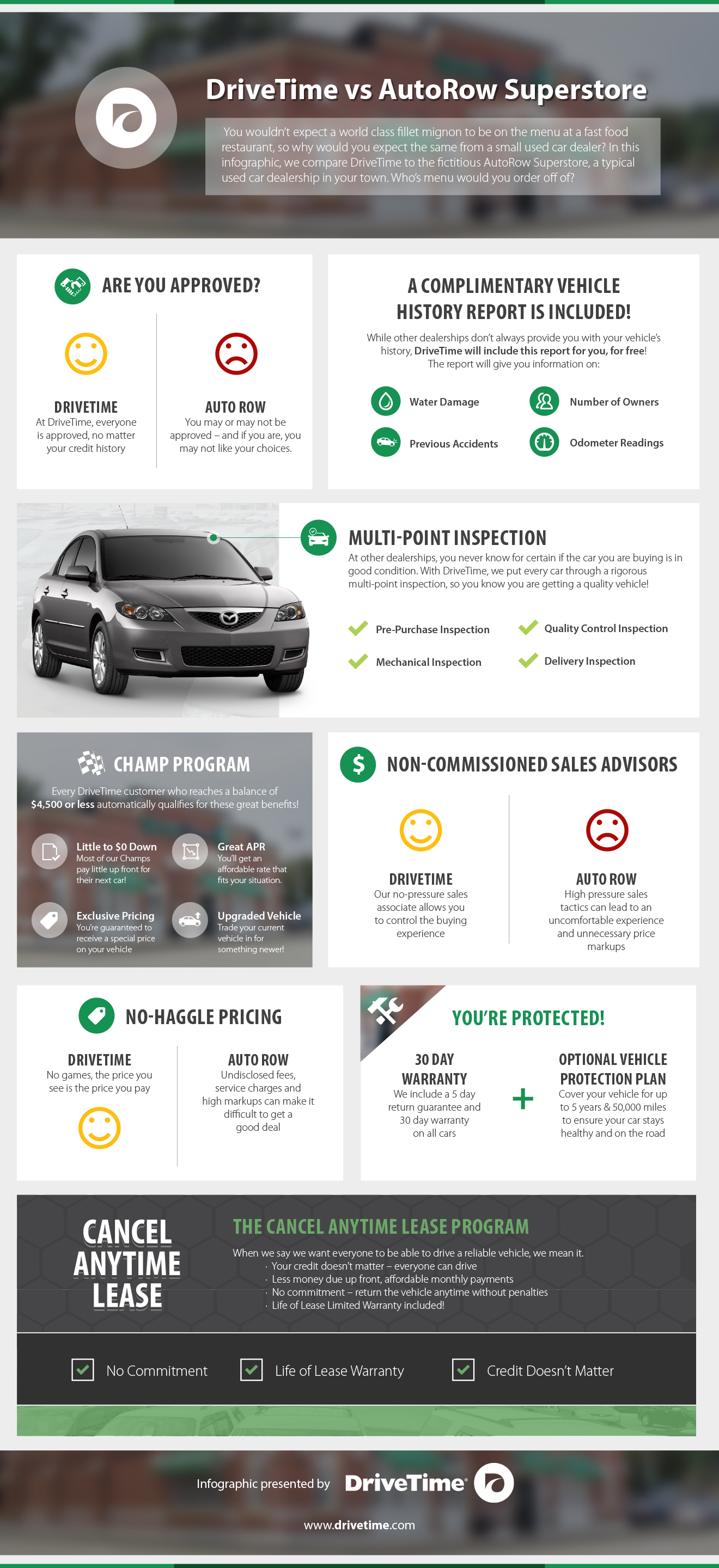

The great thing about DriveTime is they build customized approvals. They won't find fault with you if your credit score is not its best. Fair warning, they will run your credit. However, weary shoppers should feel some relief knowing they'll take everything into consideration as well.

Cached

What’s the lowest credit score DriveTime will accept

What do you need to qualify for Drive Time Auto Loans Applicants with a credit score of at least 600 and up to 840 may be eligible for Drive Time Auto Loans. The minimum age to be eligible is 18 or the state minimum, whichever is higher.

What credit report does DriveTime use

Experian is one of the three major credit reporting bureaus in the United States. They also provide vehicle data, which is included in DriveTime's AutoCheck® Vehicle History Report.

Does DriveTime require pay stubs

To purchase a vehicle please bring your: Valid driver's license. Proof of income (determined through a pay stub, bank statements and/or employer verification) Proof of auto insurance (we can help you obtain insurance if you don't already have a provider)

Does DriveTime use GPS trackers

PHOENIX — Drive Time announced it has selected Inilex to be the supplier of GPS-based vehicle tracking and recovery solutions for its 89 dealership locations.

Can you be denied a car loan after pre approval

Can a car loan be denied after approval Though rare, it is possible to believe you are fully approved and learn later that your car loan was denied after purchase. The good news is that car loan denials after approval are indeed very rare, and the reason they happen at all is tied to the fine print of a contract.

Does pre approval guarantee a car loan

Preapproval is still just an estimate — it doesn't guarantee approval of financing. Whether you get prequalification or preapproval, you'll still have to clear a formal application process.

Can I get a car with 500 credit score with no money down

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.

What credit score do you need to put nothing down on a car

Generally speaking, banks require a minimum credit score of 600 to give an auto loan without any down payment. However, you CAN buy a car with a score of 400 or a score of 850. There are a lot of variables that weigh into determining your loan eligibility and interest rates available.

Do DriveTime cars have trackers

Do you track my car with a GPS unit DriveTime vehicles come equipped with a GPS location device which we may utilize in certain, restricted circumstances. You may also utilize third-party apps to locate and track your vehicle.

Can DriveTime disable my car

DriveTime doesn't install kill switches of any kind, but it does often finance vehicles with pre-installed GPS systems, spokesman Chris Piper told Bloomberg.

Does DriveTime put trackers on cars

Do you track my car with a GPS unit DriveTime vehicles come equipped with a GPS location device which we may utilize in certain, restricted circumstances. You may also utilize third-party apps to locate and track your vehicle.

How many months of pay stubs do you need for a car

Generally speaking, lenders want to see at least six months of pay stubs for adequate proof of income. However, local banks and credit unions may accept three months of pay stubs, especially if you have a long-lasting relationship or good rapport with the bank.

How can you tell if your car has a tracking device on it

One way to find a GPS tracker is to use a bug detector that can scan both the inside and outside of a vehicle. It is also possible to physically detect a GPS tracker in known locations, such as in the OBD port, under the backseat or underneath the car.

What can mess up a pre-approval

So here are the six biggest mistakes to avoid once you have been pre-approved for a mortgage:Late payments. Be sure that you remain current on any monthly bills.Applying for new lines of credit.Making large purchases.Paying off and closing credit cards.Co-signing loans for others.Changing jobs.

Can a loan be denied after signing loan documents

Yes, a loan can be denied after approval, but it rarely happens. It's more common for a loan to be denied after preapproval, which is a preliminary process that you can use to estimate how much you can borrow and what rates you may qualify for.

Can you be denied after pre-approval

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval. If this happens, do not despair.

Does pre-approved mean approved for car

What Does it Mean to Be Preapproved for a Car Loan Lenders will sometimes give preapproved car loans to borrowers who qualify for certain loan terms. This is approval for a loan on a conditional basis. The lender approves an estimated amount of money and an estimated interest rate that the borrower can receive.

What is the lowest credit score needed to buy a car

In general, you'll need a credit score of at least 600 to qualify for a traditional auto loan, but the minimum credit score required to finance a car loan varies by lender. If your credit score falls into the subprime category, you may need to look for a bad credit car loan.