Is fees earned a normal credit?

Is fees earned a credit

Fees earned will always have a credit balance because it is a revenue and ALL revenue accounts have credit balances.

What category is fees earned

revenue account

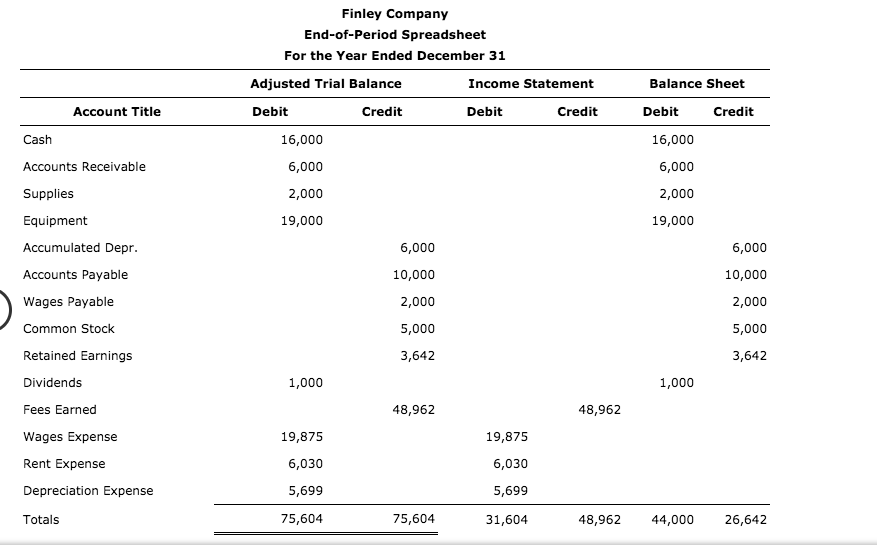

Fees earned is a revenue account that appears in the revenue section at the top of the income statement.

Cached

Is fees earned a real or nominal account

Correct Answer: d. Drawing Account, Fees Earned, Rent Expense. The nominal accounts include income, expenses, capital drawings, and dividends. Option D consists of all nominal accounts and it includes the drawing accounts (a contra-equity account, the fees earned (an income account), and the…

What is the normal credit balance in accounting

In accounting, a normal balance refers to the debit or credit balance that's normally expected from a certain account. This concept is commonly used in the double-entry method of accounting. In a business asset account, for instance, the normal balance would consist of debits (i.e., money that's coming in).

Is fees earned a debit or credit normal balance

Fees Earned is a CREDIT balance account. Therefore, it increase with a CREDIT and decreases with a DEBIT. Notes Payable is a CREDIT balance account.

Is fee earned a debit or credit

Fees earned (Income) are Credited (Cr.) As per the golden rules of accounting for (nominal accounts) incomes and gains are to be credited. So, fees earned are credited to the financial books.

Is fees unearned a debit or credit

Recording unearned revenue

After the goods or services have been provided, the unearned revenue account is reduced with a debit. At the same time, the revenue account increases with a credit. The credit and debit will be the same amount, following standard double-entry bookkeeping practices.

What is an example of a normal credit balance

Examples of Credit Balances

A credit balance is normal and expected for the following accounts: Liability accounts such as Accounts Payable, Notes Payable, Wages Payable, Interest Payable, Income Taxes Payable, Customer Deposits, Deferred Income Taxes, etc.

What are normal credit terms

When customers purchase your merchandise or services, you expect them to pay within a specific period of time (generally, 30 days). As a result of this promise, you agree to give up an immediate cash inflow until a later date. The credit terms of most businesses are either 30, 60, or 90 days.

Is unearned fees earned a debit or credit

Unearned revenue is a liability for the recipient of the payment, so the initial entry is a debit to the cash account and a credit to the unearned revenue account.

What are fees earned on account

Fees Earned on Account are revenues earned for services performed or delivered to customers as of the period, but the related amount was not yet received in cash. This amount requires recognition of an account receivable.

Is legal fees earned a normal debit or credit balance

According to the "golden rules" of accounting, expenses are recorded as nominal accounts and have a debit balance. Legal expenses are costs incurred by a company in relation to its business operations, such as fees paid to lawyers for their services. Therefore, legal expenses should be recorded as a debit.

Is unearned fees a credit

Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned revenue account. The credit and debit are the same amount, as is standard in double-entry bookkeeping. Also, each transaction is always recorded in two accounts.

What type of account and normal balance is unearned fees

Unearned revenue is a liability account that reports amounts received in advance of providing goods or services. When the goods or services are provided, this account balance is decreased and a revenue account is increased.

What does not have a normal credit balance

Accounts where a credit balance is NOT the normal balance include the following: Asset accounts (other than contra asset accounts such as Allowance for Doubtful Accounts and Accumulated Depreciation) Expense accounts (other than a contra expense account)

Is fees earned an asset or liability

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.

What are the 5 credit related terms

This review process is based on a review of five key factors that predict the probability of a borrower defaulting on his debt. Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral.

What are the three terms of credit

Terms of credit comprise interest rate, collateral and documentation requirement, and the mode of repayment.

Is money earned a credit or debit

Revenue. In a revenue account, an increase in debits will decrease the balance. This is because when revenue is earned, it is recorded as a debit in the bank account (or accounts receivable) and as a credit to the revenue account.

Is fees earned a debit or credit in accounting

Fees earned (Income) are Credited (Cr.) As per the golden rules of accounting for (nominal accounts) incomes and gains are to be credited. So, fees earned are credited to the financial books.