Is fees earned an account receivable?

What type of account is fees earned

revenue account

Fees earned is a revenue account that appears in the revenue section at the top of the income statement.

Cached

Is fees earned a debit or credit account

credit balance

Fees earned will always have a credit balance because it is a revenue and ALL revenue accounts have credit balances.

What is an example of an account receivable

An example of accounts receivable includes an electric company that bills its clients after the clients received the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills.

Cached

What are fees receivable

Receivable Fees means distributions or payments made directly or by means of discounts with respect to any participation interests issued or sold, and other fees paid to a Person that is not a Restricted Subsidiary, in connection with any Receivables Facility.

Is fees earned an asset

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.

Is service fees earned an asset

No, service revenue is not an asset. Assets are defined as resources with economic value that a business owns. Whereas service revenue is a business' earnings from providing goods and services to its customers. So, service revenue is considered a revenue (or income) account and not an asset.

Is fees earned a liability or asset

In accounting, fees earned is a revenue account. Similar to all revenue accounts, it increases equity. Recording fees earned usually results in the increase of an asset account such as cash or accounts receivable however, this does not affect the classification of the fees earned as an equity account.

Is unearned fees earned a debit or credit

Unearned revenue is a liability for the recipient of the payment, so the initial entry is a debit to the cash account and a credit to the unearned revenue account.

What assets are accounts receivable

Accounts receivable or AR is the money a company is owed by its customers for goods and services rendered. Accounts receivable is a current asset and shows up in that section of a company's balance sheet.

What activity is accounts receivable

Accounts receivable is an accounting term that refers to sales for which payment has not yet been received. The customer has not paid for the good or service received at the time of the transaction.

Are fees accounts payable

Accounts payable (AP) refer to the obligations incurred by a company during its operations that remain due and must be paid in the short term. As such, AP is listed on the balance sheet as a current liability. Typical payables items include supplier invoices, legal fees, contractor payments, and so on.

How do you record fees in accounting

To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts payable or cash, depending on whether you've paid for the expense at the time you recorded it.

Is fees unearned an asset or liability

liability

Unearned revenue is recorded on a company's balance sheet as a liability. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer.

Is fees earned an accrual

(Under the accrual basis of accounting, fees earned are reported in the time period in which they are earned and not in the period in which the company receives payment.)

Is fees earned service revenue

Under the accrual basis of accounting, the Service Revenues account reports the fees earned by a company during the time period indicated in the heading of the income statement. Service Revenues include work completed whether or not it was billed.

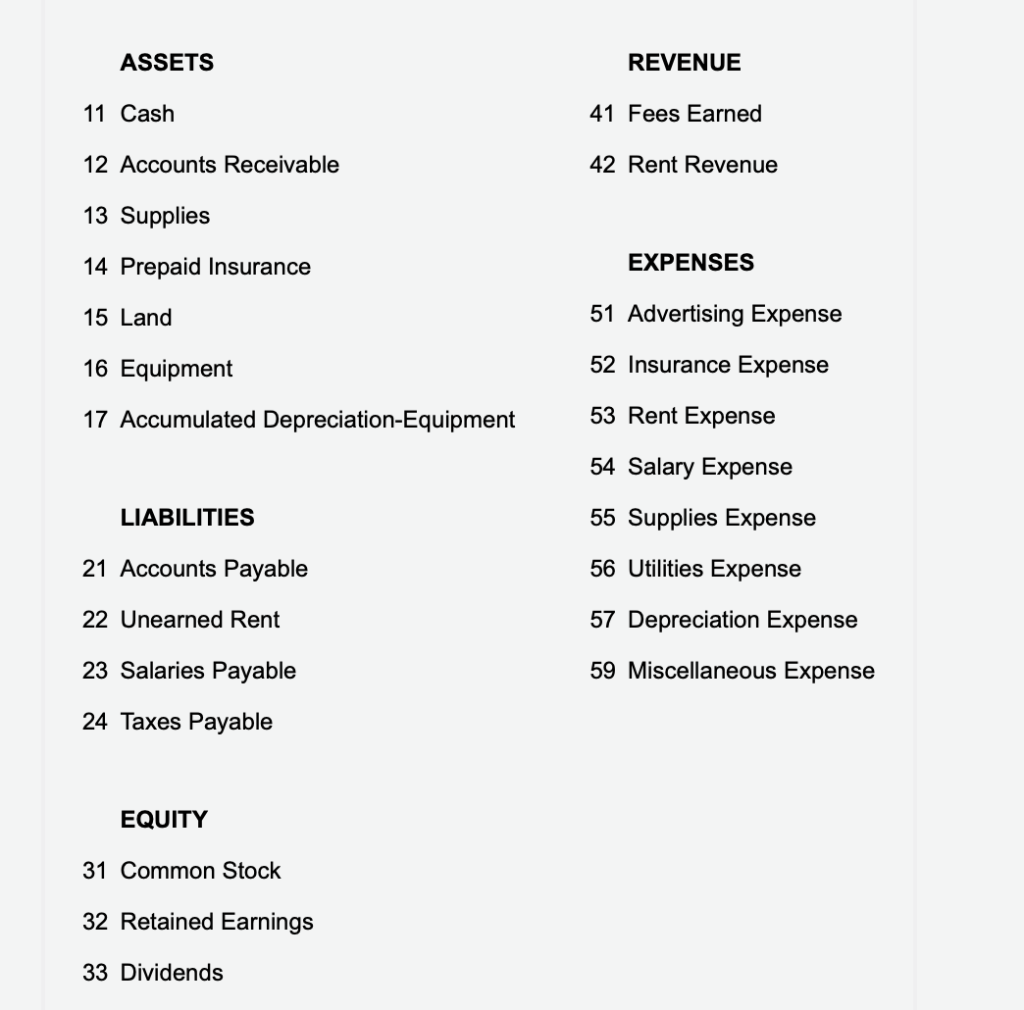

What type of accounts are interest receivable and fees receivable

What type of accounts are Interest Receivable and Fees Receivable Receivables are asset accounts. Assets appear on the left side of the accounting equation and asset accounts will normally have debit balances.

Is unearned fees an asset or liability

liability

Is unearned revenue a liability In short, yes. According to the accounting reporting principles, unearned revenue must be recorded as a liability. If the value was entered as an asset rather than a liability, the business's profit would be overstated for that accounting period.

What are accounts receivable classified on the balance sheet as

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 – 60 days. They are classified on the Balance Sheet as current assets.

What is considered accounts receivable asset

Accounts receivable or AR is the money a company is owed by its customers for goods and services rendered. Accounts receivable is a current asset and shows up in that section of a company's balance sheet.

What goes with accounts receivable on journal entry

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.