Is fuel cheaper with a fuel card?

Do you save money with fuel card

If you have a fleet of cars, vans, electric vehicles or HGVS, this provides massive savings on a long-term basis. If you're using a fleet card only temporarily, then you won't get the same benefits as that. However, the cards are still very convenient for business owners and professionals.

How much do you save on fuel card

Fuel cards generally offer savings of around two to three pence per litre on the national average pump price which, when multiplied across a fleet of company cars and vans, or a HGV haulier, could amount to significant savings every year. However, they do often restrict where your drivers can fill up with fuel.

What is the disadvantage of fuel card

Disadvantages: Restricted to Business Use Only – Fuel card accounts can only be set up by businesses, so can't be set up for personal use. Find out more about who can apply for fuel cards here.

Is it worth to have a fuel card

Yes. Fuel cards can help drivers of any vehicle to save money. Cards can give discounts on pump prices, but the discount amount can vary depending on the station and your fuel card provider. Sole traders and businesses can easily get fuel card savings to greatly reduce fuel costs in the long term.

What is the benefit of a fuel card

Fuel cards are the only payment method that offers discounts on fuel. When you select a fuel card, you commit to a specific supplier to provide all the fuel you need to run your fleet. In exchange, you benefit from a lower fuel price, which is usually 1–2 pence per litre below the normal forecourt price.

Why should I use a fuel card

Better fuel efficiency

While there are many tips drivers can try to save money on fuel, fleet cards help you take a data-focused approach. Fuel cards capture more robust data at most brand-name fuel stations, including information like price per gallon, location, driver ID, and odometer readings.

What are the benefits of a fuel card

Fuel cards are the only payment method that offers discounts on fuel. When you select a fuel card, you commit to a specific supplier to provide all the fuel you need to run your fleet. In exchange, you benefit from a lower fuel price, which is usually 1–2 pence per litre below the normal forecourt price.

What are the advantages of fuel cards

Benefits of a fuel card: interest-free credit.Greater control over business expenses.Simple monitoring of MPG and fleet efficiency.Fuel card benefit: easy monitoring of multiple fuel cards and all purchases.Improved security is part of the benefits of a fuel card.Fuel card benefits for new businesses.

Should I use fuel card or credit card

Fuel cards are specifically designed for use at fueling stations and provide access to discounted fuel prices and other features that can help reduce costs associated with running a trucking operation. Credit cards offer more flexibility but have higher fees and interest rates.

How does the fuel card work

Present your card to the petrol station cashier. When prompted, put your unique PIN into the point of sale (POS) terminal. Provide details of mileage if required (some businesses record mileage) The cashier will then process the payment.

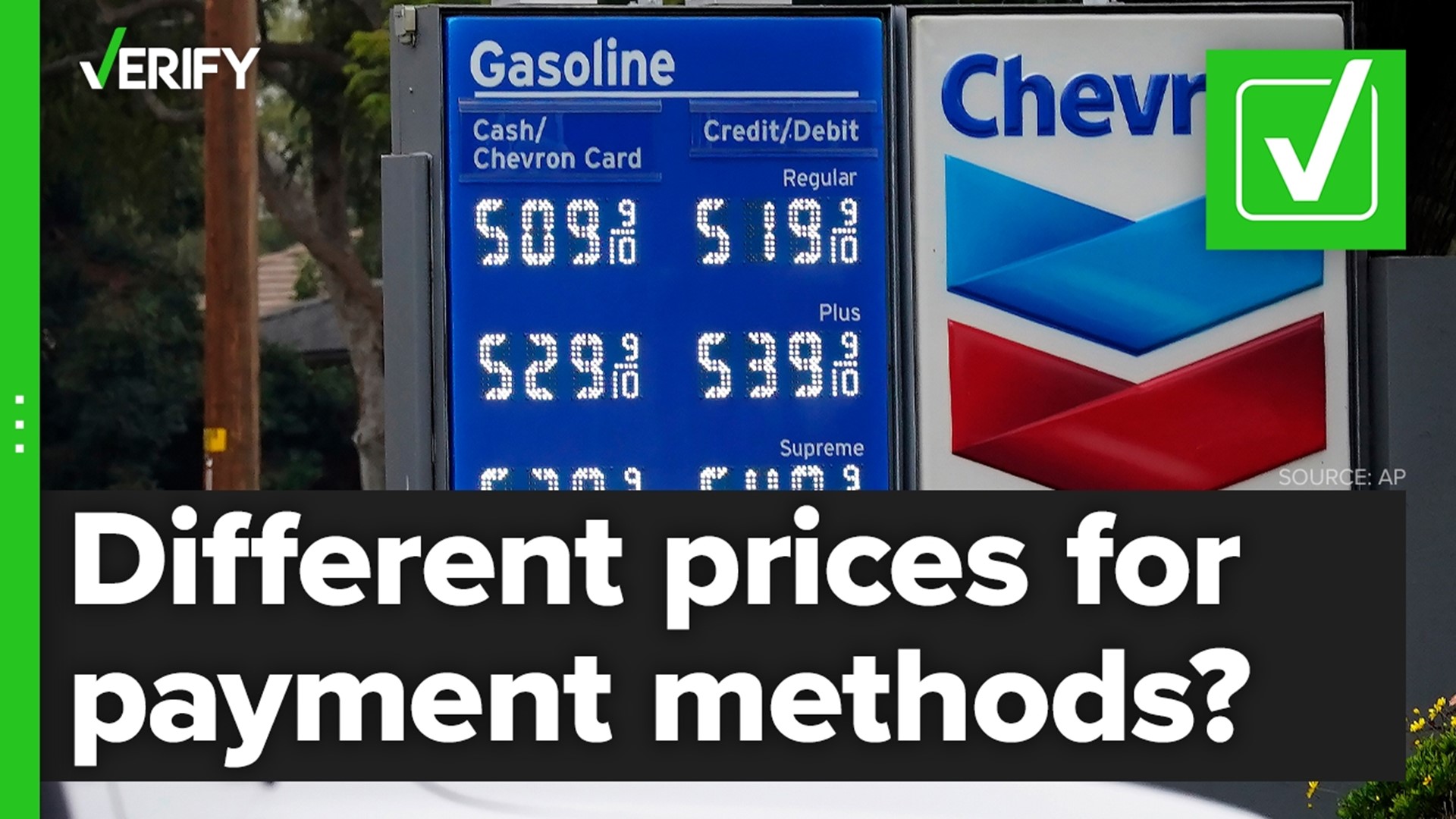

Why is gas more expensive with card

Gas stations are in fact legally allowed to charge a customer extra if they choose to use a credit card to purchase gas. This is because the gas station owners pay an interchange fee to the payment networks. They often pass this fee on to the consumer to recoup that additional cost.

What is the advantage of fuel card

Driver convenience, reduced paperwork and purchase control are the main benefits, but many fuel cards offer fuel discounts and reward schemes that make them great value as well. The benefits vary from one fuel card to another, and not all offer the same benefits as Shell Card.

What is the advantage of a fuel card

Fuel cards are the only payment method that offers discounts on fuel. When you select a fuel card, you commit to a specific supplier to provide all the fuel you need to run your fleet. In exchange, you benefit from a lower fuel price, which is usually 1–2 pence per litre below the normal forecourt price.

Why is gas cheaper with cash then card

Credit card companies charge gas stations a fee to process each transaction. The fee is usually 2-3% of the purchase price. So, that said, gas stations would rather you pay cash.

What is the point of a gas card

Gas credit cards provide discounts, cash back or other rewards when you buy gas. There are two main types of gas credit card: branded gas station cards and general rewards cards. Branded gas credit cards provide discounts on a single fuel brand; general rewards cards provide benefits for a broader range of purchases.

Why did the gas station charge me $100 credit card

The $100 hold ensures that there are enough funds on your card to pay for gas. When you're finished pumping, the station will charge you for the actual purchase amount, and the $100 gas hold will be released once the transaction is completed, which can take several days.

Is it better to spend cash or card

As long as you can pay your bill in full each month, using a credit card is typically more advantageous than using cash for in-person purchases. You need to use a credit card for online transactions as you can't pay in cash.

What is the best way to save money on gas

How to Save Money on GasShop around for the best gas prices.Combine your errands.Take advantage of cash-back apps.Use that cruise control.Keep your tires inflated.Ditch the extra weight.Join gas rewards programs.Join a warehouse membership.

Is the $175 hold on card for gas

$125.00 used to be the maximum hold charge but due to rising gas prices, Visa and MasterCard raised it to $175. The exact hold fees are set by individual gas stations. How to avoid the hold fees is to always use credit as opposed to debit.

What are the disadvantages of using card instead of cash

Cons of debit cardsThey have limited fraud protection.Your spending limit depends on your checking account balance.They may cause overdraft fees.They don't build your credit score.