Is gain or loss debit or credit?

Is gain and loss debit or credit

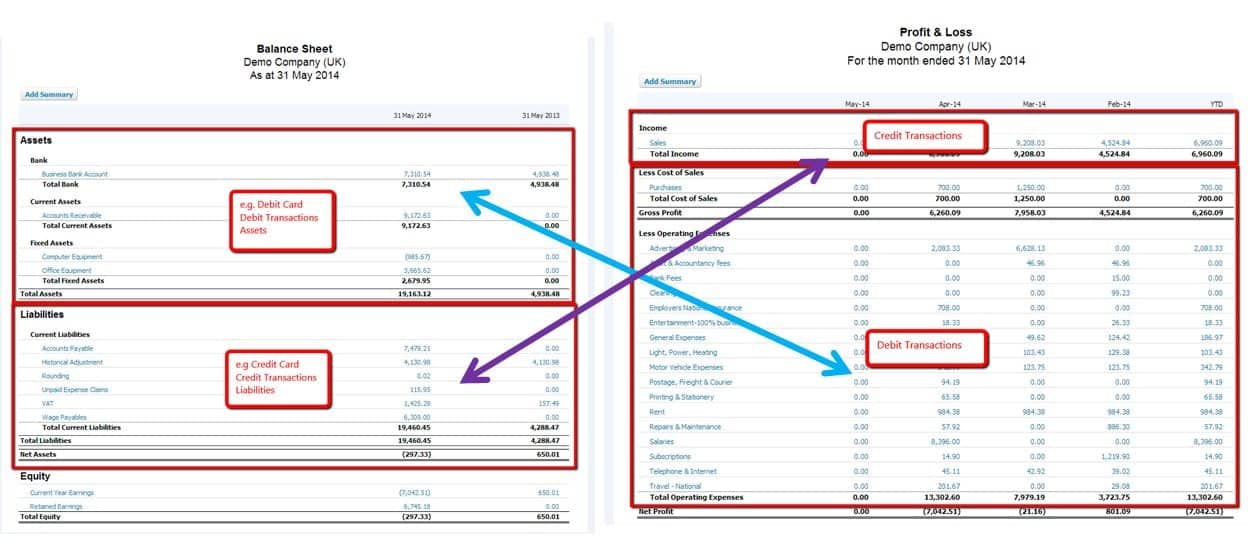

Gains are credited because they have increased or the business has realized income within the given period. On the other hand, losses are debited in the relevant accounts since there is an increase in their value once the business suffers costs within its period of operation.

Cached

Does debit mean gain or loss

A debit increases the balance and a credit decreases the balance. Gain accounts. A debit decreases the balance and a credit increases the balance.

Cached

Is a gain a debit balance

Revenues and Gains Are Usually Credited

The exceptions to this rule are the accounts Sales Returns, Sales Allowances, and Sales Discounts—these accounts have debit balances because they are reductions to sales.

Cached

What type of account is gains and losses

Unrealized income or losses are recorded in an account called accumulated other comprehensive income, which is found in the owner's equity section of the balance sheet. These represent gains and losses from changes in the value of assets or liabilities that have not yet been settled and recognized.

Cached

How do you record gain or loss

The original purchase price of the asset, minus all accumulated depreciation and any accumulated impairment charges, is the carrying value of the asset. Subtract this carrying amount from the sale price of the asset. If the remainder is positive, it is a gain. If the remainder is negative, it is a loss.

What type of account is gain

The gain is classified as a non-operating item on the income statement of the selling entity.

Is a loss a debit

Answer and Explanation: A loss is a debit because expenses usually decrease the owner's equity. Because the owner's equity is generally treated as a credit balance, the loss, which is an expense, is treated as a debit.

Is credit positive or negative

What is a credit A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account. Thus, a credit indicates money leaving an account. You can record all credits on the right side, as a negative number to reflect outgoing money.

Does gain increase debit or credit

Debits increase the value of asset, expense and loss accounts. Credits increase the value of liability, equity, revenue and gain accounts.

Does gain have a credit balance

Gain accounts have a credit balance.

What type of account is a gain

The gain is classified as a non-operating item on the income statement of the selling entity.

How do you record gains in accounting

When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of asset account.

Where are gains and losses recorded

the income statement

Gains and losses are reported on the income statement.

What is the journal entry for gain

Journal Entries for Gain on Sale of Asset

The journal entry for gain on sale of asset involves debiting cash or accounts receivable with the amount received from selling the asset. This is then followed by crediting the fixed assets account, which represents the value of the sold asset.

What type of account is losses

Nominal Accounts

Transactions related to income, expense, profit and loss are recorded under this category.

Is profit and loss debit a loss or profit

Debit balance in the profit and loss account is a loss because expenses are more than revenue.

Is loss a debit or credit in trial balance

At the end of an accounting period, the accounts of asset, expense, or loss should each have a debit balance, and the accounts of liability, equity, revenue, or gain should each have a credit balance.

Does minus mean credit or debit

Essentially a negative balance means you're in credit with your card provider rather than in debit. So your card provider owes you money, instead of you having to make a payment. While a negative balance on your bank account isn't good news, a negative balance on your credit card account should make you smile.

Is debit a plus or minus

Debit is the positive side of a balance sheet account, and the negative side of a result item. In bookkeeping, debit is an entry on the left side of a double-entry bookkeeping system that represents the addition of an asset or expense or the reduction to a liability or revenue. The opposite of a debit is a credit.

Is gain a profit or loss

From the above meaning of gain and profit, it is clear the profit that arises from events incidental to business or non-recurring in nature is called gain and profit that arises with the business operations or with those activities which are recurring in nature are called profit.