Is H&R Block Deluxe worth it?

What is the difference between H&R Block Plus and Deluxe

The main difference (besides price) between the versions is that Deluxe includes more deduction forms. If you have an HSA, paid real estate taxes or mortgage interest in 2023, or have 1099 income (but no expenses) then you'll need to bump up to the Deluxe edition.

Cached

Is it worth it to have H&R Block do your taxes

If you can afford it, H&R Block is a solid option for you. It's also a good choice if you want in-person help from a tax expert. H&R Block offices provide you the freedom to start online and then switch to in-person filing if necessary.

Cached

How do I change my H&R Block from free to deluxe

To downgrade your account or change to H&R Block Free Online, just call us at 1-800-472-5625 and tell us what you need.

Do you get more money back with TurboTax or H&R Block

In a quick informal survey of his clients who've filed with both services, he told Best Life that "the consensus was that TurboTax produces slightly higher [federal] tax refunds than H&R Block."

Cached

Does HR Block Deluxe include Schedule C

A: Yes… Schedules A, B,C, D plus others are included plus related forms.

Can I use H&R Block Deluxe for rental property

On H&R Block's Deluxe plan, you can't report capital gains or rental income (Schedules D and E). If you are a freelancer or small business owner filing a Schedule C, you will need to upgrade.

How much does H&R Block charge to do taxes 2023

How much does H&R Block's tax service cost H&R Block offers a free online tax-filing program that includes simple federal and state tax returns. If you need to upgrade based on your tax situation, you'll pay $55 to $110 to complete a federal return, and $37 for each state tax return.

Is Jackson Hewitt or H&R Block better

Both have good points and in terms of the services offered, they're fairly comparable. You might choose Jackson Hewitt to file taxes if you: Want to pay a flat fee to file taxes online yourself. Need professional tax help but are looking for the lowest-cost option.

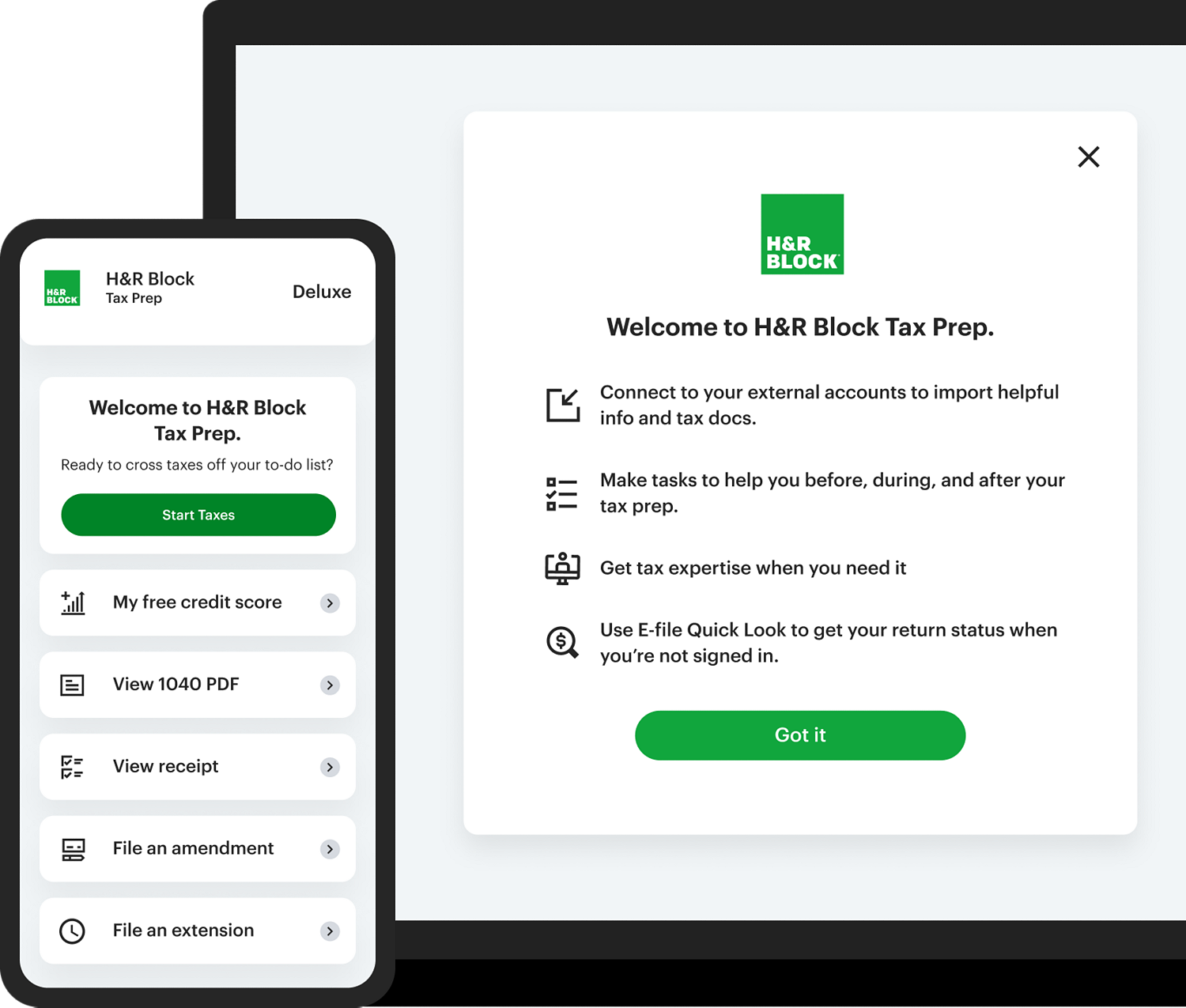

What is H&R Deluxe

H&R Block Deluxe Tax Software offers everything homeowners and investors need to easily complete federal and state taxes, including step-by-step guidance and FREE tax advice via online chat. Refund Bonus Offer: Terms and Conditions Amazon.com Gift Card offer is for federal refunds only.

How much does H&R Block charge

How Much Does H&R Block Cost

| DIY online filing | Computer software | |

|---|---|---|

| Federal return cost | $0 – $110 | $29.95 – $89.95 |

| State return cost | $0 – $37 | $0 – $39.95, plus $19.95 to e-file |

| Federal + state | $0 – $147 | $54.95 (for Deluxe + State) – $89.95, plus $19.95 to e-file |

Feb 21, 2023

How do I get the biggest tax refund this year

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Why did the IRS reduce my refund TurboTax

If your refund was less than you expected, it may have been reduced by the IRS or a Financial Management Service (FMS) to pay past-due child support, federal agency nontax debts, state income tax obligations, or unemployment compensation debts owed to a state.

Do I need deluxe or premium H&R Block

The Deluxe version adds real estate taxes and self-employed income; Premium adds support for investments, including cryptocurrency; and Self-Employed adds Schedule C deductions and asset depreciation. The company has a $220 small business product (up from $145) under its Block Advisors banner.

How long does H&R Block Deluxe last

Use Deluxe e-file for your federal taxes, and we'll store your docs and info for up to six years so that you can access it later.

Who is the cheapest to file taxes with

Comparing Tax Software Costs

| Tax Service | Pricing | Free Version |

|---|---|---|

| TaxAct | $24.95-$64.95 ($44.95 per state) | Yes, basic 1040 for federal |

| H&R Block | $35-$84 ($37 per state) | Yes, basic 1040 for federal and state |

| FreeTaxUSA | free fed ($14.99 per state) | Yes, all federal returns |

| Cash App Taxes | Free | Yes, basic 1040 for federal and state |

Who is better Jackson Hewitt or H&R Block

Both have good points and in terms of the services offered, they're fairly comparable. You might choose Jackson Hewitt to file taxes if you: Want to pay a flat fee to file taxes online yourself. Need professional tax help but are looking for the lowest-cost option.

What’s the best tax refund company

Compare the Best Tax Preparation Service Providers

| Company | Cost | Refund Advance |

|---|---|---|

| H&R Block Best Overall | $85 | Yes |

| Jackson Hewitt Best for Ease of Use | Variable | Yes |

| TurboTax Live Best Online Experience | $209-$399 | Yes |

| EY TaxChat Best for Self-Employed | $199 | No |

How do I get the biggest tax refund

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Do I need to buy new H & R Block software every year

Share: Every year, tax law changes require that we build new editions of our software programs. If you want to use H&R Block to file old taxes from your **PreviousYearNo10**-2023 returns, we've made it easy to purchase back editions of H&R Block Tax Software.

How many times can you use H&R Block software

Each of H&R Block's software options allows you to file multiple returns – up to five federal returns. Most of our software options include one personal state return, as well.