Is H&R Block responsible for mistakes?

Who is liable if tax preparer makes mistake

Am I Responsible If My Tax Preparer Makes a Mistake Yes. If you signed on the bottom line, you are responsible for a mistake on your tax returns and you are on the hook for any penalties the IRS charges. That said, the professional who prepared your return may offer to reimburse you for any losses due to errors.

Cached

What happens if H&R Block files your taxes wrong

If you e-filed your 2023 return with H&R Block's online program, we can offer you some assistance. To file an amendment, you need Form 1040X, available from the dashboard or main menu of the H&R Block Online program. With it, you can correct errors or mistakes on filed tax returns.

What happens if my tax preparer makes a mistake

What Happens If A Tax Preparer Makes A Mistake Even if the preparer makes an error, you are still responsible for paying the penalties. If the error resulted from your omission of information, you're responsible for it, and you'll need to correct it with your tax preparer.

Cached

Who gets in trouble if taxes are done wrong

You cannot go to jail for making a mistake or filing your tax return incorrectly. However, if your taxes are wrong by design and you intentionally leave off items that should be included, the IRS can look at that action as fraudulent, and a criminal suit can be instituted against you.

Can I sue my tax preparer made a mistake

If your tax preparer has committed negligence or malpractice, you can sue them for that behavior. Depending on where you live, it may be rare, however, for you to recover 100 percent of the money you lost.

How much money will the IRS fine a tax preparer who has made a mistake filing a client’s taxes caused by lack of due diligence

The penalty is $1,000 ($10,000 for a corporate tax return) for helping underestimate a person's tax liability on their tax return. We may assess this penalty only once for documents relating to the same taxpayer for a single tax period or event.

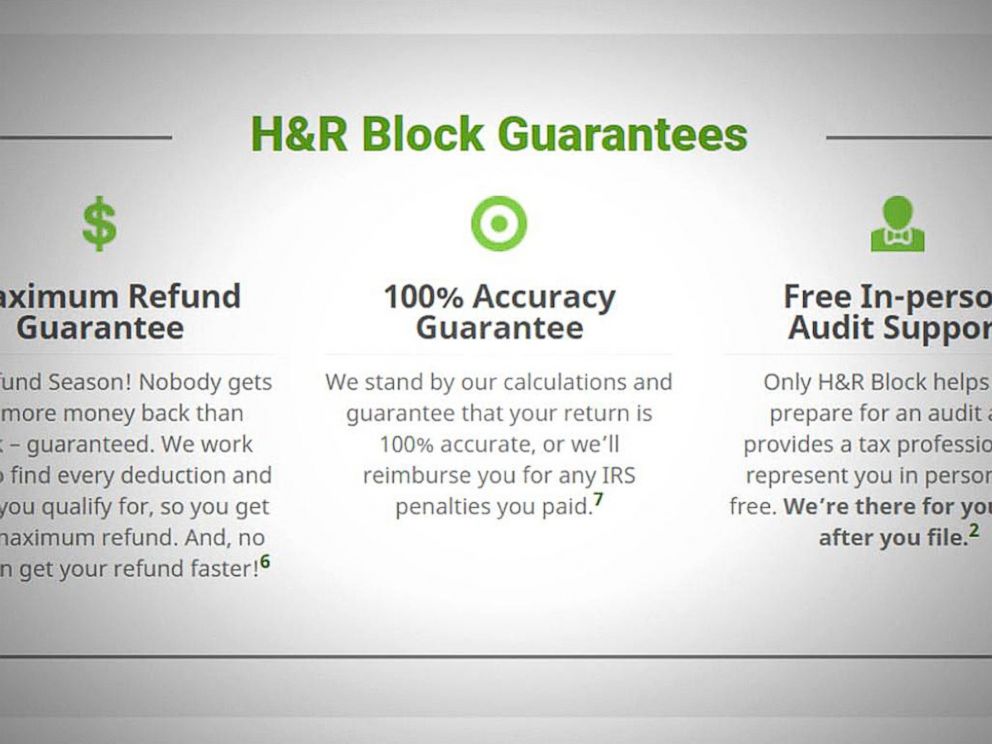

Who pays if H&R Block makes a mistake

If the H&R Block tax preparation software makes an error on your return, we will reimburse you for any resulting penalties and interest up to a maximum of $10,000. Terms and conditions apply; see H&R Block's Accurate Calculations Guarantee for details. Not available for changes in tax laws after January 1, 2023.

Is H&R Block under investigation

TurboTax and H&R Block Used “Unfair and Abusive Practices,” State Regulator Finds. The investigation, which is ongoing, came after a ProPublica series showed that millions of Americans were coerced into paying for tax filing they should get for free.

Will the IRS fix my taxes if I made a mistake

The IRS may correct certain errors on a return and may accept returns without certain required forms or schedules. In these instances, there's no need to amend your return. However, file an amended return if there's a change in your filing status, income, deductions, credits, or tax liability.

Will the IRS fix my taxes if I filed them wrong

You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits. However, you don't have to amend a return because of math errors you made; the IRS will correct those.

Do you get in trouble for doing your taxes wrong

You can go to jail for filing your taxes wrong but only if you have been doing so intentionally. You won't go to jail if you've made an honest mistake while filing your taxes. The IRS will give you an opportunity to rectify your tax problems.

Is it worth paying for H&R Block

Its online options make it easy to import tax documents and to look at tax returns from previous years (if you're a returning customer). If you can afford it, H&R Block is a solid option for you. It's also a good choice if you want in-person help from a tax expert.

Does H&R Block have a good reputation

H&R Block has a rating of 1.49 stars from 244 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers complaining about H&R Block most frequently mention customer service, tax return, and last year problems. H&R Block ranks 51st among Tax Preparation sites.

Who is HR Block owned by

HRB Innovations, Inc.

H&R Block is a registered trademark of HRB Innovations, Inc. TurboTax® and Quicken® are registered trademarks of Intuit, Inc. TaxAct® is a registered trademark of TaxAct, Inc. Windows® is a registered trademark of Microsoft Corporation.

How long does it take IRS to correct their mistake

° When to file: Generally, to claim a refund, you must file Form 1040X within three years from the date you filed your original return or within two years from the date you paid the tax, whichever is later. ° Processing time: Normal processing time for amended returns is 8 to 12 weeks.

Will the IRS let me know if I made a mistake

Different amount: If the refund isn't the amount you expected, you should receive a notice explaining why. If you don't receive a notice or you believe the IRS changed your refund incorrectly, contact the IRS or order a transcript to find out about any IRS changes.

Does the IRS catch tax mistakes

Phew! If the IRS does see a significant error, they may conduct an audit, which can happen either by mail or in person, with three possible outcomes: The IRS decides all is well and the return stays the same. The IRS proposes one or more changes and you agree to it and/or pay more taxes, interest, or a penalty.

Is it worth paying someone to do your taxes

Paying a tax professional is also wise if you now receive income from many different sources, have investment losses you need help dealing with, received an inheritance, or settled an estate. Any one of these can lead to more deductions or credits for you, tax preparers say.

How much does H&R Block charge

How Much Does H&R Block Cost

| DIY online filing | Computer software | |

|---|---|---|

| Federal return cost | $0 – $110 | $29.95 – $89.95 |

| State return cost | $0 – $37 | $0 – $39.95, plus $19.95 to e-file |

| Federal + state | $0 – $147 | $54.95 (for Deluxe + State) – $89.95, plus $19.95 to e-file |

Feb 21, 2023

Does H&R Block work with IRS

Finding Internal Revenue Service (IRS) Information

We can help! File in an H&R Block office, file using tax software, or file online to do your taxes. Filling out IRS forms will be simple and painless with H&R Block's trusted support.