Is insurance based on credit?

Are insurance rates based on credit

Most U.S. insurance companies use credit-based insurance scores along with your driving history, claims history and many other factors to establish eligibility for payment plans and to help determine insurance rates.

Cached

What is insurance score based on

An insurance score is a score calculated from information on your credit report. Credit information is very predictive of future accidents or insurance claims, which is why Progressive, and most insurers, uses this information to help develop more accurate rates.

CachedSimilar

Can you be turned down for insurance because of your credit score

In some cases, your credit won't be used to determine your insurance premium. If you live in California, Hawaii, Massachusetts or Michigan your credit score isn't a rating factor.

Cached

How are insurance rates determined

Insurance companies use credit scores and history to determine your premium on insurance.

Do car insurance companies run your credit

Do all auto insurance companies check your credit Most insurers use credit checks to create a credit-based insurance score to help set your rate. Some insurers provide auto insurance with no credit check, which might seem appealing if you have a poor credit history.

What is a good credit score for car insurance

A good insurance score is roughly 700 or higher, though it differs by company. You can improve your auto insurance score by checking your credit reports for errors, managing credit responsibly, and building a long credit history.

What causes insurance score to drop

What makes your insurance score decrease Anything that makes your credit score worse will negatively impact your insurance score. Being late on your bills and debt payments, taking out excessive lines and types of credit and maintaining a high credit utilization rate can reduce (worsen) your insurance score.

What is a good credit based insurance score

776 to 997

According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score. So, what is a good insurance score Anything over 775.

What are 3 factors that determine the price of your insurance

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

How can you reduce your premium

7 easy ways to help lower your car insurance premiumsChoose car safety and security features.Set higher deductibles on your auto insurance.Take a defensive driving course.Park your car in a garage.Compare auto insurance quotes.Bundle insurance policies.Get good grades.

Do you have to have good credit for car insurance

Some insurers provide auto insurance with no credit check, which might seem appealing if you have a poor credit history. But purchasing car insurance from a company that doesn't check credit doesn't necessarily mean you'll pay a lesser rate than you will with a company that checks your credit.

Does Allstate use credit scores

It's important to understand that while Allstate uses certain elements from your credit history, we never see your credit score, and we're not evaluating your overall credit worthiness. We simply use elements from your credit report that have proven effective in predicting insurance losses.

What is an average insurance score

626 – 775

What is a good insurance score

| Score range | Rating |

|---|---|

| 776 – 977 | Good |

| 626 – 775 | Average |

| 501 – 625 | Below average |

| 200 – 500 | Poor |

Nov 29, 2023

What is the highest insurance score you can have

The higher your insurance score, the better an insurer will rate your level of risk in states where insurance scores are a rating factor. According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

Does Progressive look at credit scores

California, Hawaii, Massachusetts, Michigan, and Washington do not allow the use of credit scores to determine car insurance rates whatsoever. So, your credit score will not affect your rates with Progressive in these states.

What 4 factors influence the cost of insurance

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

What is used to determine the price of insurance

All insurance companies use data and statistics to predict levels of risk for various individuals or groups. This risk calculation information is also used to develop rating plans. Generally, higher risk factors will result in higher premium rates and lower risk factors will drive premiums lower.

Can I ask my insurance company to lower my premium

Auto insurance prices are non-negotiable, so you can't ask your car insurance company to lower your rates. However, there are several ways to find more affordable premiums. Compare quotes from multiple insurers. Although states regulate the cost of car insurance, different companies offer varying rates.

What affects the amount of an insurance premium

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose.

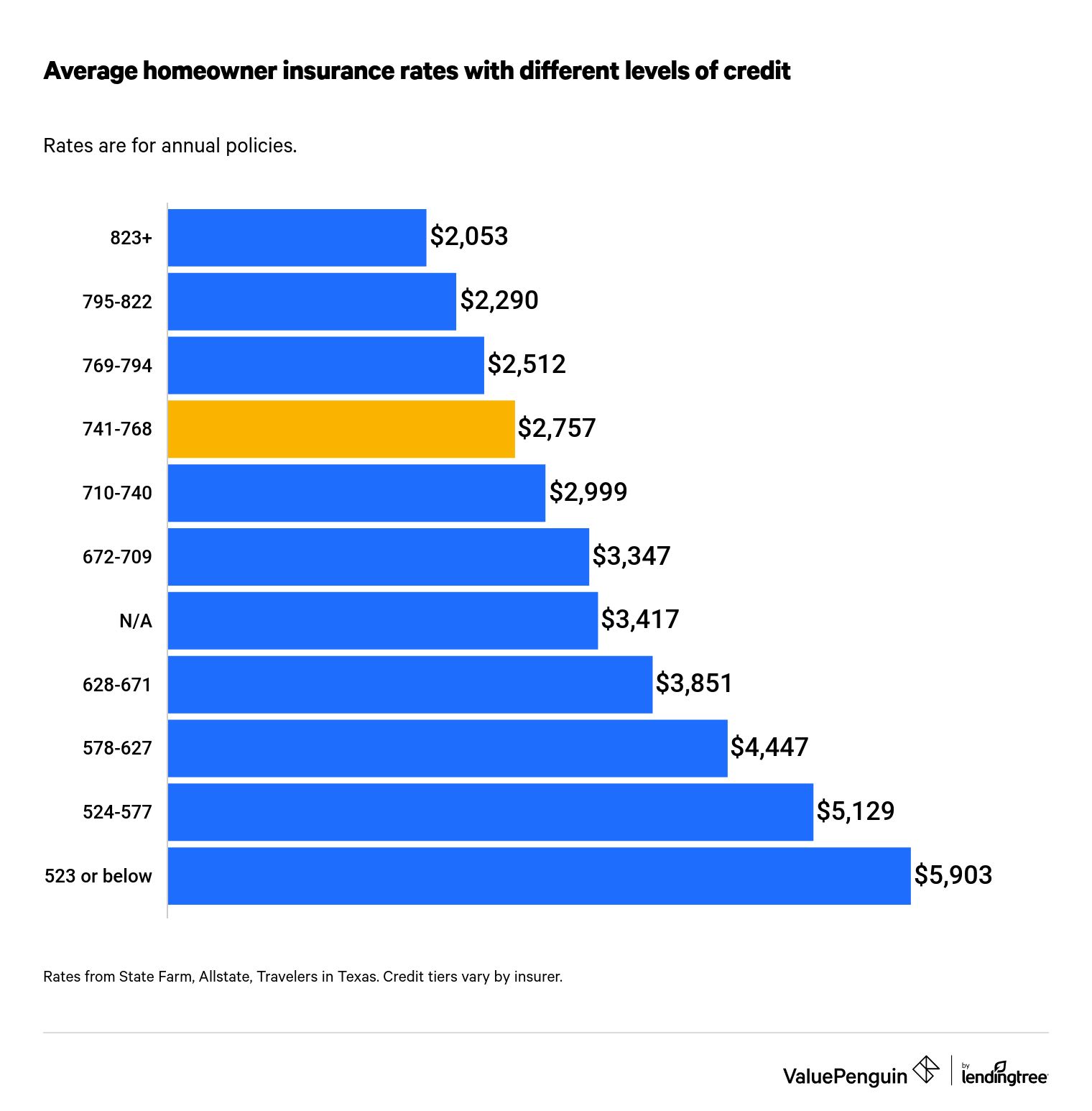

Does car insurance depend on credit

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states.