Is insurance expense considered an asset?

Is insurance expense an asset

Life insurance plans which have a cash value component are considered an asset. Insurance is an expense to a business and is carried as prepaid expense (paid in advance) under the head of current assets in the balance sheet of a company till it is paid.

Is insurance expense an asset or equity

asset

All insurance policies become an asset once the plan matures — that is, you have paid for it and are credited with a lump sum.

Is insurance expense a liability

Insurance expense does not go on the balance sheet because it reflects a specific amount you have spent, rather than an asset or liability at a particular moment in time.

Cached

What would insurance expense be classified as

Insurance is an excellent example of a prepaid expense, as it is always paid for in advance.

What is insurance expense in balance sheet

Insurance expense is that amount of expenditure paid to acquire an insurance contract. This expense is incurred for all insurance contracts, including property, liability, and medical insurance.

How do you record insurance as an asset

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current asset account, Prepaid Insurance. The prepaid amount will be reported on the balance sheet after inventory and could part of an item described as prepaid expenses.

Are expenses considered liabilities or assets

Expenses are what your company pays on a monthly basis to fund operations. Liabilities, on the other hand, are the obligations and debts owed to other parties. In a way, expenses are a subset of your liabilities but are used differently to track the financial health of your business.

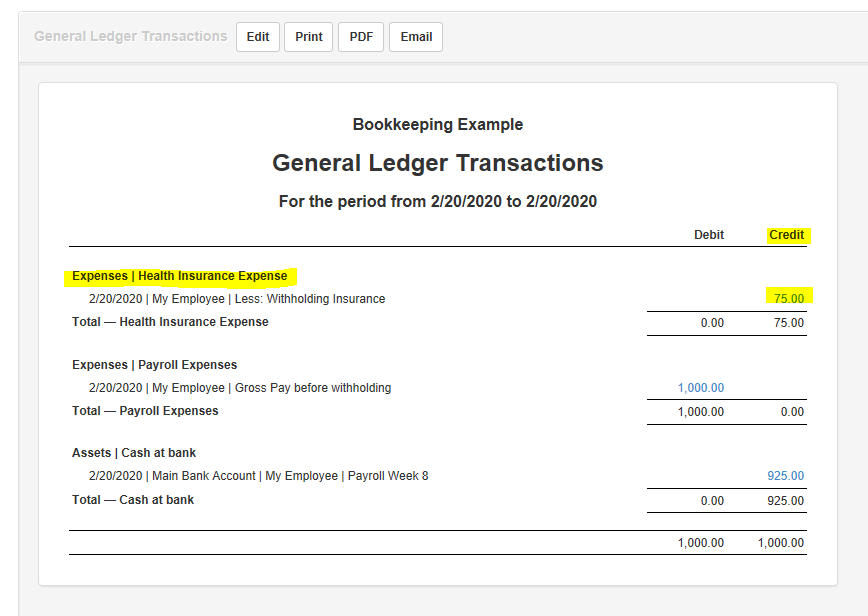

How is insurance expense recorded

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current asset account, Prepaid Insurance. The prepaid amount will be reported on the balance sheet after inventory and could part of an item described as prepaid expenses.

Where is insurance expense in accounting

The company records this expenditure in the prepaid expense account as a current asset.

Where does insurance go on a balance sheet

When the insurance coverage comes into effect, it is moved from an asset and charged to the expense side of the company's balance sheet. Insurance coverage, though, is often consumed over several periods. In this case, the company's balance sheet may show corresponding charges recorded as expenses.

What should be recorded as an asset

An asset is anything of value or a resource of value that can be converted into cash. Individuals, companies, and governments own assets. For a company, an asset might generate revenue, or a company might benefit in some way from owning or using the asset.

What type of expenses are assets

What is an Asset An asset is an expenditure that has utility through multiple future accounting periods. If an expenditure does not have such utility, it is instead considered an expense. For example, a company pays its electrical bill.

What expenses are liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

Which of the following is not considered an asset

Answer and Explanation: b) Accounts payable is not an asset.

What are 10 examples of assets

What are the Main Types of AssetsCash and cash equivalents.Accounts Receivable.Inventory.Investments.PPE (Property, Plant, and Equipment)Vehicles.Furniture.Patents (intangible asset)

What expenses are not liabilities

Liabilities are the debts your business owes. Expenses include the costs you incur to generate revenue. For example, the cost of the materials you use to make goods is an expense, not a liability. Expenses are directly related to revenue.

Where do expenses go on balance sheet

The income statement shows the financial results of a business for a designated period of time. An expense appears more indirectly in the balance sheet, where the retained earnings line item within the equity section of the balance sheet will always decline by the same amount as the expense.

What is the difference between an asset and an expense

An asset is a business resource that offers economic benefit to the business in the future. An expense is a resource that the business has already consumed during the operations of the company for a specific accounting period.

What falls under assets

Assets include physical items such as machinery, property, raw materials and inventory, and intangible items like patents, royalties and other intellectual property.

Which of the following is not an asset

Answer and Explanation: b) Accounts payable is not an asset.