Is it a good idea to lock your credit card?

Does locking a credit card affect your credit

Like a credit freeze, a credit lock doesn't hurt your credit. It restricts access to your credit files so no one, including you, can open a new credit account before unlocking them. You'll also need to place locks with each of the three credit-reporting agencies for full protection.

What is a major downside of locking your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

Cached

Is it a good idea to lock your credit

Locking or freezing your credit file may help prevent criminals from opening fraudulent accounts in your name. If you don't plan on applying for any new credit in the near future and your state doesn't allow credit freezing fees, a freeze may be the way to go.

Cached

Does locking your card stop payments

Locking your debit card will prevent transactions with your debit card until you unlock it. Keep in mind that this won't prevent automatic bill payments or other scheduled transfers from occurring.

What’s the difference between locking and freezing your credit

Freezes are free, while CreditLock is part of paid subscriptions. CreditLock can be managed instantly, but security freeze changes could take longer. Unlike a freeze, CreditLock alerts you of attempts to access your locked Experian credit report.

Can you lock your credit to prevent identity theft

A security freeze, also known as a credit freeze, is one way you can help protect your personal information against fraud or identity theft.

How long should I keep my credit locked

How long does a credit lock last As with a credit freeze, your credit lock will remain until you ask the credit bureaus to remove it, either temporarily or permanently. For the best protection, keep your credit lock in place until you are ready to apply for a credit card or loan.

When should you lock your card

Reasons to lock your credit card

If you have reason to suspect that your credit card number has been compromised, a card lock is one way to keep third parties from making purchases on your account — though you'll probably also want to contact your issuer to report credit card fraud and request a new card.

How many times can you lock your card

Automatic payments usually are not affected. Most locks are indefinite, but depending on the issuer, a lock could lift automatically after one week. Issuers usually do not limit how many times you can lock or unlock a card.

Does freezing credit prevent identity theft

What Is a Security Freeze A “security freeze” blocks access to your credit unless you have given your permission. This can prevent an identity thief from opening a new account or getting credit in your name. All consumers can get a free security freeze online, by phone or by mail.

What does it mean to lock your credit card

A card lock or credit card freeze prevents anyone from making new purchases on your credit card account. Most credit card locks still allow recurring automatic transactions, such as subscriptions or bills, to go through.

Can someone steal my identity if my credit is frozen

Because most businesses will not open credit accounts without checking your credit report, a freeze can stop identity thieves from opening new accounts in your name. Be mindful that a freeze doesn't prevent identity thieves from taking over existing accounts.

What is a credit lock vs freeze

”Locks” your credit file and makes it inaccessible to lenders. “Freezes” your credit file so that potential lenders can't access it. Use a mobile app or service to instantly lock and unlock each individual credit file. You'll need a separate “Lock” tool for each credit bureau.

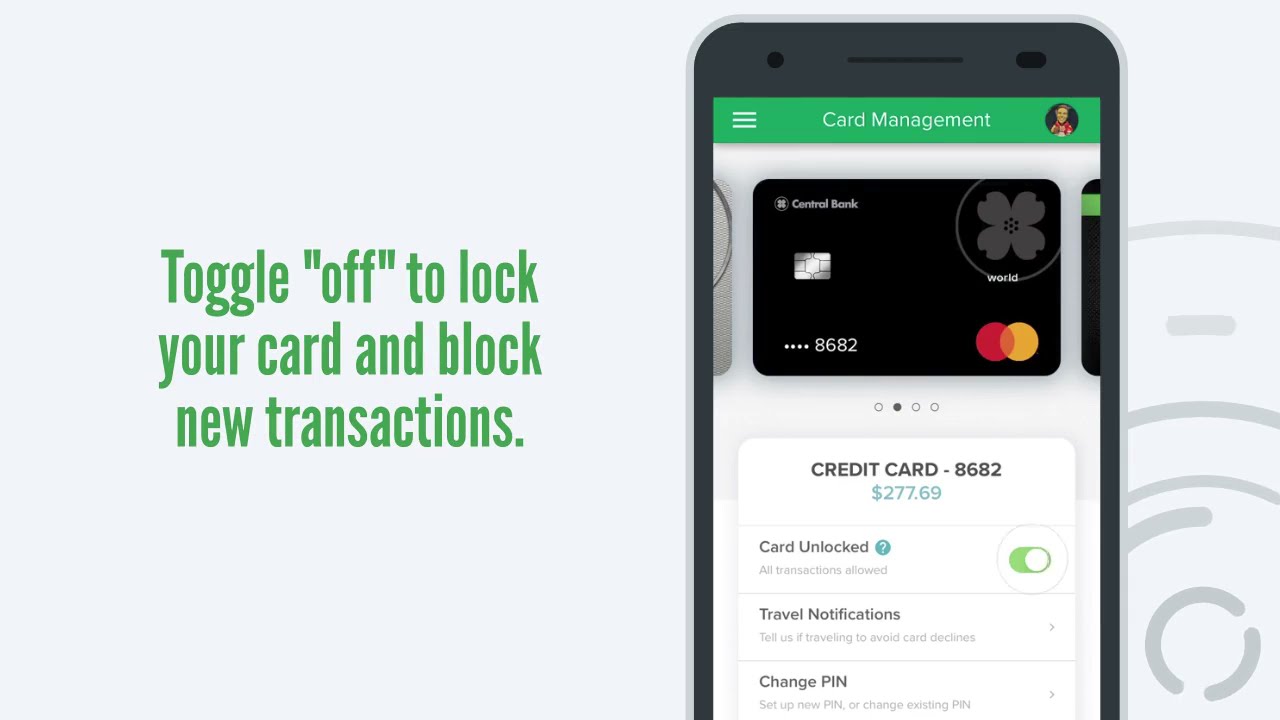

What does locking your card do

Card Lock is a security feature which allows you to block new authorizations on your debit card and/or credit card. If you misplace your card, locking can prevent criminals from using your card, until you need to report the card as Lost/Stolen.

How many times can you lock and unlock your card

Most locks are indefinite, but depending on the issuer, a lock could lift automatically after one week. Issuers usually do not limit how many times you can lock or unlock a card.

How long does a card lock last

Reduce the time your card is blocked.

Paying your bill with that same card means your final charge will most likely replace the block in a day or two. But if you pay that bill with a different card — or with cash or a check — the block may last up to 15 days.

Is locking credit the same as freezing

Differences between a credit freeze and a credit lock

And under a federal law passed in 2023, credit bureaus are required to let you freeze and unfreeze your credit free of charge. A credit lock is simply an agreement between you and a credit bureau to pause any new accounts in your name.

What is the difference between a security freeze and a credit freeze

A security freeze prevents prospective creditors from accessing your credit file. Creditors typically won't offer you credit if they can't access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name.

How long does a credit card lock last

Most locks are indefinite, but depending on the issuer, a lock could lift automatically after one week. Issuers usually do not limit how many times you can lock or unlock a card.

Is there a difference between credit freeze and credit lock

A credit freeze may offer stronger protection than a credit lock. This means you're not financially responsible if someone exploits your credit during the freeze. And under a federal law passed in 2023, credit bureaus are required to let you freeze and unfreeze your credit free of charge.