Is it bad to cosign for a credit card?

Does Cosigning a credit card affect your credit

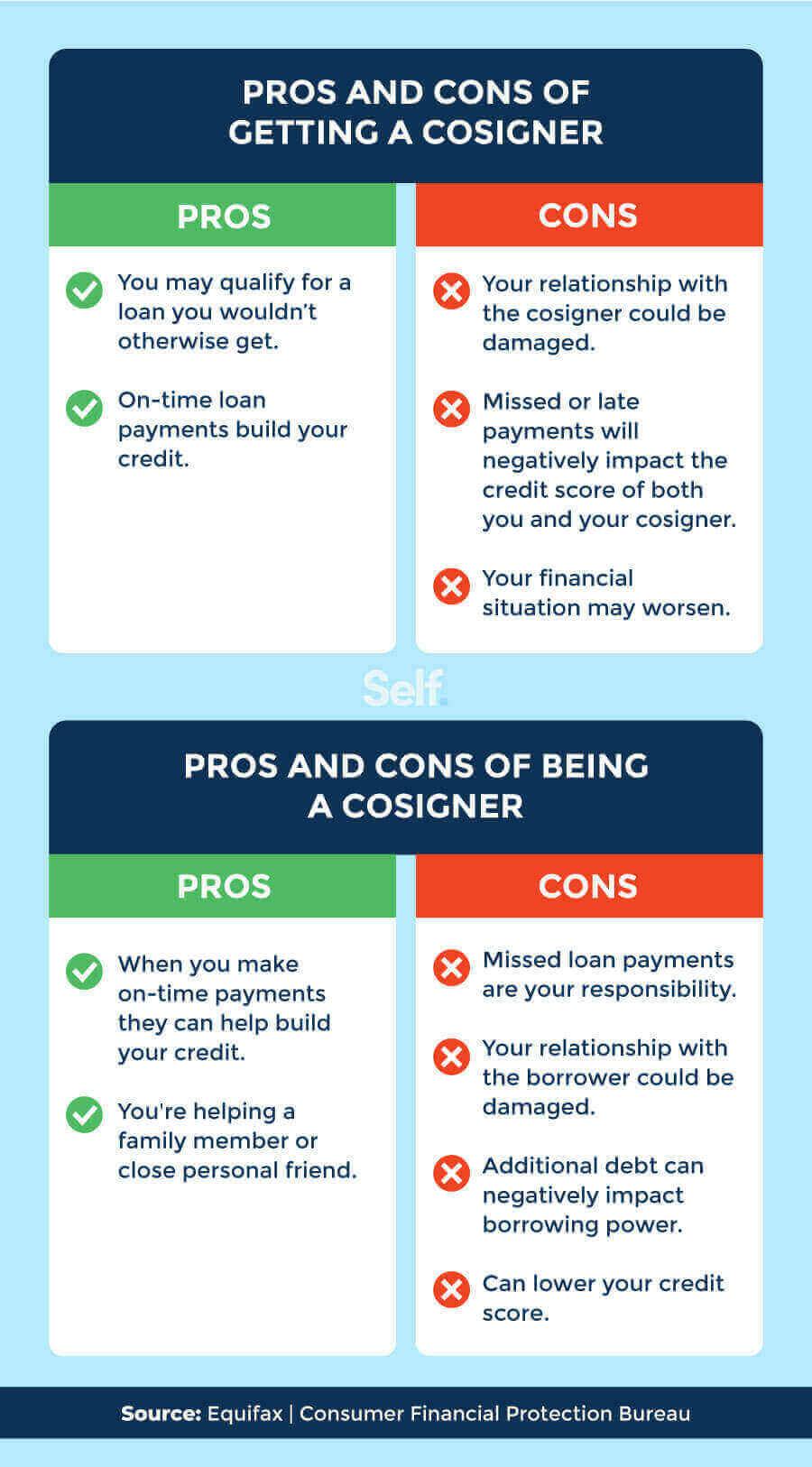

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Cached

Do cosigned credit cards build credit

Applying for a credit card with a co-signer — that is, another person who agrees to share responsibility for charges made on the card — is a good way to build a positive credit history. In the past, applying for a credit card with a co-signer was a common way to increase your approval odds.

Cached

Does Cosigning still build credit

Having a co-signer on the loan will help the primary borrower build their credit score (as long as they continue to make on-time payments). It could also help the co-signer build their credit score and credit history, if the primary borrower makes on-time payments throughout the course of the loan.

Cached

What does it mean to cosign for a credit card

A cosigner on a credit card application may improve your chances to be approved. A cosigner takes full responsibility for paying back a loan if the primary borrower doesn't pay the debt. Most major credit card issuers don't allow cosigners but do allow adding an authorized user to an account.

What are the risks of Cosigning

Precautions to Take Before You Cosign

Be sure you can afford to pay the loan. If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

Whose credit score is used with a co-signer

Whose credit score is used when buying a car with a co-signer Lenders can consider the credit scores of both borrowers when co-signing an auto loan. If you have a lower credit score, having a co-signer with a higher score could work in your favor.

How do I get off a cosigned credit card

If you want to be removed from the account, you'll have to call the credit card provider and be prepared to negotiate. If the other account holder would qualify for the card on their own, the credit card company may approve your request. If not, your only option is to pay off any outstanding debt and close the account.

Is cosigning ever a good idea

The benefits of cosigning a loan

It can be a great way, for example, to help your child build credit. When a young adult is just starting out, it can be hard to get a loan or credit card with a decent interest rate because they lack the credit history that lenders use to determine if a prospective borrower is reliable.

Can you remove yourself as a cosigner

Fortunately, you can have your name removed, but you will have to take the appropriate steps depending on the cosigned loan type. Basically, you have two options: You can enable the main borrower to assume total control of the debt or you can get rid of the debt entirely.

Is it ever a good idea to cosign

The bottom line is this: co-signing on a loan for anyone is never a good idea. If you feel compelled, lend them some money with a written agreement on how it is to be repaid. But never put your credit on the line by co-signing documents with a lender.

Is it smart to cosign

The bottom line. The decision to sign on as a co-signer comes down to the trust you have in the primary borrower. If you believe they will meet their payments and are willing to risk your own finances, then helping a friend or family member may be the right thing to do. Otherwise, it is best to say no to this agreement …

Can I cosign with a 650 credit score

Typically, a cosigner needs a credit score of 670 or better to be approved. This range is usually classified as very good to excellent credit.

How high does a co-signer’s credit have to be

Although there might not be a required credit score, a cosigner typically will need credit in the very good or exceptional range—670 or better. A credit score in that range generally qualifies someone to be a cosigner, but each lender will have its own requirement.

Can I remove myself as a cosigner on a credit card

If there isn't a current balance on the account, some credit card issuers may be willing to remove your name, provided the original borrower has decent credit. You or the original borrower can call and ask if this is an option.

Can I take myself off as a cosigner for credit card

If you decide it's best for you to be relieved of your co-signer duties, there are a few options you can try: Ask the card issuer directly. The first option you should try is simply asking the issuer of the credit card to remove you as a co-signer.

Why is it risky to be a co-signer

The lender can sue the cosigner for interest, late fees, and any attorney's fees involved in collection. If the primary borrower falls on hard times financially and cannot make payments, AND the cosigner fails to make the payments, the lender may also decide to pursue garnishment of the wages of the cosigner.

How do I protect myself as a cosigner

5 ways to protect yourself as a co-signerServe as a co-signer only for close friends or relatives. A big risk that comes with acting as a loan co-signer is potential damage to your credit score.Make sure your name is on the vehicle title.Create a contract.Track monthly payments.Ensure you can afford payments.

Does removing a cosigner hurt their credit

Cosigner's Credit Score No Longer Affected

But they won't be affected by your payment habits once you remove them from your loan.

What is the risk of being a cosigner

Be sure you can afford to pay the loan. If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

Can I get a 50K loan with a 650 credit score

For a loan of 50K, lenders usually want the borrower to have a minimum credit score of 650 but will sometimes consider a credit score of 600 or a bit lower. For a loan of 50K or more, a poor credit score is anything below 600 and you might find it difficult to get an unsecured personal loan.