Is it better to clear debt or save?

Is it better to save money or pay off debt

You will rarely be able to earn more on your savings, than you'll pay on your borrowings. So, as a rule of thumb plan to pay off your debts before you start to save.

Is it better to have no debt or a little debt

In most cases, it makes sense to start by paying off any high-interest debt. High-interest debt costs you more in interest—and the longer you have it, the more you'll end up paying overall. Usually, high-interest debts include things like personal loans, private student loans and credit cards.

Cached

Is it better to pay off debt all at once or slowly

The lower your balances, the better your score — and a very low balance will keep your financial risks low. But the best way to maintain a high credit score is to pay your balances in full on time, every time.

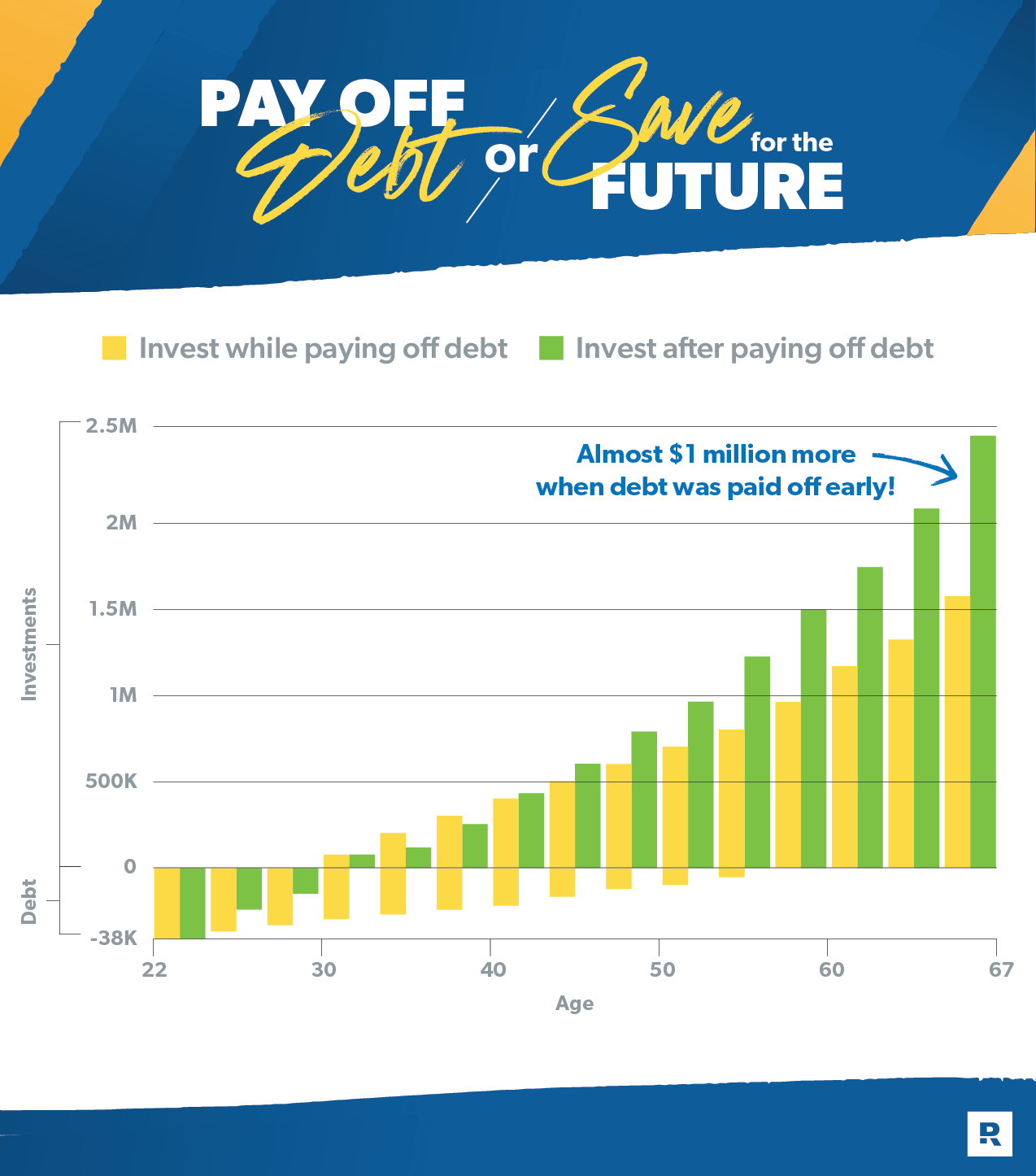

Is paying off debt more important than investing

In general, if you can expect a higher return on your investments than the interest rate that you pay on your debt, you should consider your investment options. Paying off debt is important, but you need to invest in your future.

Cached

Do millionaires pay off debt or invest

They stay away from debt.

Car payments, student loans, same-as-cash financing plans—these just aren't part of their vocabulary. That's why they win with money. They don't owe anything to the bank, so every dollar they earn stays with them to spend, save and give!

Is it good to pay off debt in full

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Are people with no debt happier

That's another reason those who are debt-free might be happier and healthier. They might be better able to afford unexpected health challenges, many of which require money to solve. They might have the means to pay for good health insurance, pay for a therapist, or sign up with a personal trainer.

Is it good to be completely debt free

Living a debt-free lifestyle can save you money and allow you to start working toward your financial goals. It also can help raise your credit score — and lower your stress levels. Living a debt-free life starts with paying down debt, and that's where Tally can help.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Is being debt free the new rich

Between mortgage loans, credit cards, student loans, and car loans, it's not uncommon for the typical American to have one or more types of debt. The ones who are living debt-free may seem like a rarity, but they aren't special or superhuman, nor are they necessarily wealthy.

What are the disadvantages of paying off debt

ConsPrepayment penalties.Impact on your credit score.Miss out on an opportunity to pay off debt.

What age should you be debt free

The Standard Route. The Standard Route is what credit companies and lenders recommend. If this is the graduate's choice, he or she will be debt free around the age of 58.

What debt is unforgivable

1. WHICH DEBTS ARE NEVER FORGIVEN Bankruptcy never forgives child and spousal support or alimony, criminal fines and restitution, and claims from drunk driving accidents.

How much debt is too high

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

At what age should you be debt free

The Standard Route. The Standard Route is what credit companies and lenders recommend. If this is the graduate's choice, he or she will be debt free around the age of 58.

Does paying twice a month increase credit score

While making multiple payments each month won't affect your credit score (it will only show up as one payment per month), you will be able to better manage your credit utilization ratio.

Why does the 15 3 credit hack work

The 15/3 hack can help struggling cardholders improve their credit because paying down part of a monthly balance—in a smaller increment—before the statement date reduces the reported amount owed. This means that credit utilization rate will be lower which can help boost the cardholder's credit score.

Is it bad to pay off debt in full

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

What is the average debt of a 35 year old

35—49 year olds = $135,841

Primarily because of home mortgages, older millennials in this generation maintain a higher average debt, according to Experian. Credit card debt is the next main source of debt, followed by education and auto loans.