Is it better to go for a 20-year or 30-year mortgage?

Is it worth going to a 20-year mortgage

If your goal is to build equity in your home more quickly, the 20-year mortgage is a better option. With more equity, you increase your financial net worth, can take out a more substantial home equity loan and can tap into greater equity for another mortgage or other financial pursuit.

Cached

Is it better to get a 15-year mortgage or pay extra on a 30 year mortgage

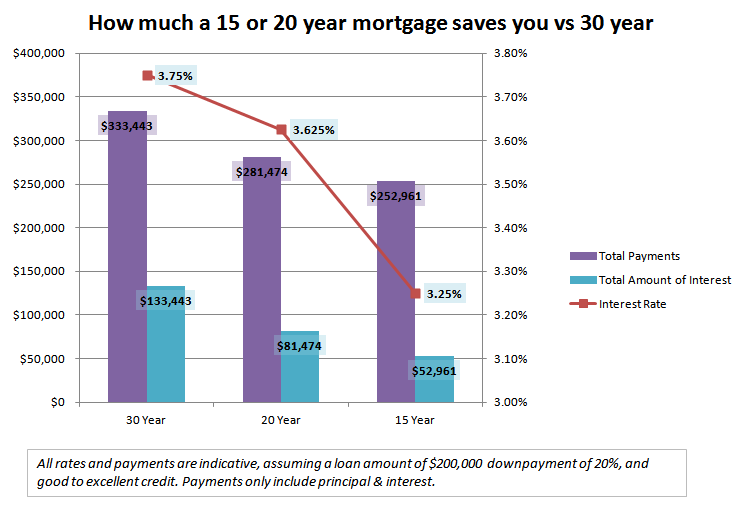

People with a 15-year term pay more per month than those with a 30-year term. In exchange, they are given a lower interest rate. This means that borrowers with a 15-year term pay their debt in half the time and possibly save thousands of dollars over the life of their mortgage.

What are the disadvantages of a 30 year mortgage

Disadvantages of a 30-Year MortgageHigher interest rate.Loan balance remains higher for longer.Spend more in interest over the life of the loan.Home equity is slow to build.Making monthly payments over a long period of time.

Cached

Do you pay less interest on a 20-year mortgage

Pros of a 20-year mortgage

Saves you money on interest: Expect a lower interest rate on a 20-year mortgage compared to a 30-year mortgage. By saving about 0.25% to 0.40% on your rate and paying off your home loan 10 years faster, you'll pay much less in interest compared to a 30-year loan.

Cached

Why might a person choose a 20-year mortgage loan over a 30 year loan

People who choose a 20-year mortgage do so because they will pay much less in interest than they would on a 30-year mortgage. That benefit stems from a shorter term and a lower interest rate. Generally, the longer the term, the higher the rate on conventional conforming loans, FHA and VA loans, and jumbo loans.

What is the top age for mortgage

Summary: maximum age limits for mortgages

Many lenders impose an age cap at 65 – 70, but will allow the mortgage to continue into retirement if affordability is sufficient. Lender choices become more limited, but some will cap at age 75 and a handful up to 80 if eligibility criteria are met.

What happens if I pay 2 extra mortgage payments a year

Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you'll have fewer total payments to make, in-turn leading to more savings.

Is paying off a 30 year mortgage in 15 years worth it

Refinancing from a 30-year, fixed-rate mortgage into a 15-year fixed-rate note can help you pay down your mortgage faster and save lots of money on interest, especially if rates have fallen since you bought your home. Shorter mortgages also tend to have lower interest rates, resulting in even more savings.

At what age should you no longer have a mortgage

You should aim to have everything paid off, from student loans to credit card debt, by age 45, O'Leary says. "The reason I say 45 is the turning point, or in your 40s, is because think… Monthly mortgage payments make sense for retirees who can do it comfortably without sacrificing their standard of living.

What is a good mortgage rate for 30-year fixed

Current mortgage and refinance interest rates

| Product | Interest Rate | APR |

|---|---|---|

| 30-Year Fixed Rate | 7.13% | 7.15% |

| 20-Year Fixed Rate | 7.11% | 7.14% |

| 15-Year Fixed Rate | 6.61% | 6.64% |

| 10-Year Fixed Rate | 6.63% | 6.66% |

At what age should you pay off your mortgage

In fact, O'Leary insists that it's a good idea to be debt-free by age 45 — and that includes having your mortgage paid off. Of course, it's one thing to shed a credit card balance by age 45. But many people don't first buy a home until they reach their 30s.

What happens if you make 1 extra mortgage payment a year on a 20-year mortgage

Okay, you probably already know that every dollar you add to your mortgage payment puts a bigger dent in your principal balance. And that means if you add just one extra payment per year, you'll knock years off the term of your mortgage—plus save thousands of dollars in interest.

What is the most common mortgage term

30 years

A mortgage allows a borrower a certain amount of time to pay off the loan. The most common amount of time, or “mortgage term,” is 30 years in the U.S., but some mortgage terms can be as short as 10 years. Most people with a 30-year mortgage won't keep the original loan for 30 years.

What are the pros and cons of a 30-year mortgage

30-year mortgage pros and cons

| 30-Year Mortgage Pros | 30-Year Mortgage Cons |

|---|---|

| Lower monthly payments | More interest paid over the life of the loan in total |

| Potentially bigger home buying budget | Slightly higher interest rates than 15-year fixed-rate mortgages |

Can a 70 year old get a 25 year mortgage

Lenders have set the maximum age limit for a traditional mortgage to range from age 70 to a maximum of age 80. You can see how borrowers, aged 70, would be unable to secure a 25-year mortgage as they would be 95 years old when they were done paying off the loan.

Can a 55 year old get a 30 year mortgage

There's no age limit for getting or refinancing a mortgage. Thanks to the Equal Credit Opportunity Act, seniors have the right to fair and equal treatment from mortgage lenders.

When should you not pay extra on your mortgage

You have high-interest debt.

Rather than make extra payments toward your mortgage principal, consider paying down high-interest debt first. This can include credit card, student loan, medical, and car loan debt, just to name a few. This one boils down to a difference of simple dollars and cents.

Is it smart to pay extra on your mortgage

There can be some real benefits—both financial and emotional—to prepaying your mortgage. You reduce your total interest payments, you reduce your monthly spending needs, and you have the security of a predictable financial benefit and the psychological benefits of knowing you are out of debt.

What is the most brilliant way to pay off your mortgage

Pay a lump sum toward the principal balance

Making a lump sum payment toward your mortgage will decrease what you owe and save money on interest. If you receive some sort of windfall, such as an inheritance or a large tax refund, you can also consider making a lump sum payment toward your mortgage.

At what age should you be debt free

The Standard Route. The Standard Route is what credit companies and lenders recommend. If this is the graduate's choice, he or she will be debt free around the age of 58.