Is it better to have collision or comprehensive?

At what point does collision insurance stop being beneficial for a consumer

You should drop your collision insurance when your annual premium equals 10% of your car's value. If your collision insurance costs $100 total per year, for example, drop the coverage when your car is worth $1,000 since, at that point, your insurance payments are too close to your car's value to be worthwhile.

Is it important to have comprehensive and collision coverage

Having comprehensive and collision coverage can provide vital extra protection, especially if you are leasing or financing your car or driving a high-value vehicle. You can drop comprehensive and collision coverage if you have a low-value car, or you can afford to pay out-of-pocket in the event of a total loss.

Cached

Is it better to have a $500 deductible or $1000

A $1,000 deductible is better than a $500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you'll pay lower premiums. Choosing an insurance deductible depends on the size of your emergency fund and how much you can afford for monthly premiums.

Is full coverage both comprehensive and collision

So what does full coverage car insurance cover In most cases, it includes liability, comprehensive, and collision coverage. Collision and comprehensive will protect you and your vehicle if you get into an accident.

What is a good collision deductible

Comprehensive coverage: Deductibles for comprehensive coverage, which covers damage to the vehicle from a non-driving peril, like extreme weather, theft and vandalism, are typically set at $500 or $1,000. Collision coverage: Drivers can typically choose to pay $500 or $1,000 as their collision deductible.

Should I lower my collision deductible

Most insurance professionals recommend choosing a deductible you can comfortably afford to pay. If you want a lower premium, you could consider a higher deductible if you can afford it. However, if a $1,000 deductible is not feasible, it may make sense to take the lower deductible and pay a higher premium.

Is it okay to not have comprehensive insurance

Comprehensive insurance is optional, and you can legally drive a car you own only with basic protection. Bear in mind, however, that if you lease a car, the lender might require you to take out this type of cover for the period you have finance on it.

What is comprehensive coverage good for

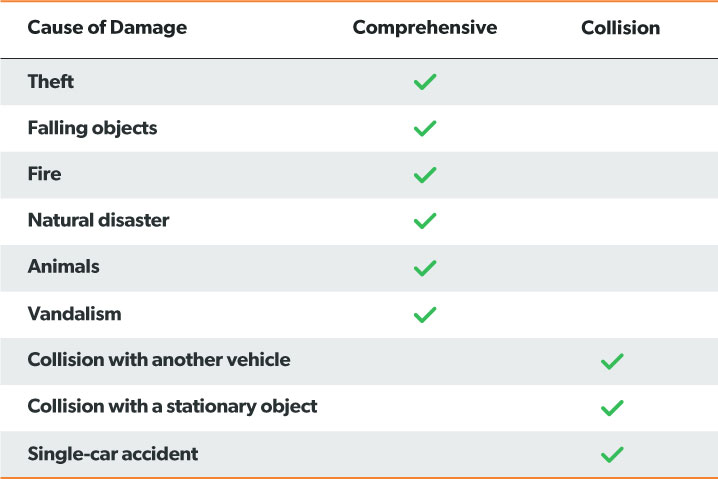

Comprehensive insurance coverage is defined as an optional coverage that protects against damage to your vehicle caused by non-collision events that are outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature.

What is a good deductible for collision

Before you choose a deductible, most insurance professionals recommend you figure out what you can afford to pay if your car is damaged in an accident. If your budget allows for a maximum out-of-pocket expense of $500, you probably should not choose a deductible higher than $500.

What is considered high deductible

A high deductible plan (HDHP) can be combined with a health savings account (HSA), allowing you to pay for certain medical expenses with money free from federal taxes. For 2023, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,400 for an individual or $2,800 for a family.

Does comprehensive coverage mean full coverage

No, comprehensive insurance is not full coverage, but it is a key component of full coverage car insurance, along with collision insurance and any state-mandated types of coverage. Comprehensive insurance covers non-accident-related vehicle damage caused by things like vandalism or a natural disaster.

Is $500 collision deductible good

The average car insurance deductible is $500, which, if a claim is filed, will generally be less than whatever the cost of repairs are for a serious accident. If the cost of repairs is less than your deductible, you should not file a claim.

Do you want a high or low collision deductible

In general, drivers who are more likely to file an auto insurance claim will have lower total costs with a low-deductible car insurance plan. Conversely, drivers who don't file a claim will typically save with a higher deductible plan.

Is it better to have a $500 deductible or $250

Deductible choices typically range from $250 to $2,000, with $500 representing the most common deductible choice. A lower deductible—such as $250 or $500—will mean higher auto insurance rates. That's because the lower the deductible, the more your car insurance company will need to pay out if you make a claim.

Is it worth getting comprehensive

If you want to have peace of mind on the road, comprehensive coverage can be worth it as it will help to repair or replace your vehicle when damage is sustained from events other than an auto accident.

How important is comprehensive insurance

Comprehensive insurance coverage pays for just about anything that could happen to your car outside of an accident. You can make a claim against this policy if your car is stolen, vandalized, or damaged in any covered event except a collision.

What will comprehensive insurance not cover you from

What damage is not covered by comprehensive coverage Comprehensive coverage does not cover damages caused by hitting another vehicle or object. These incidents are covered under collision coverage. It will also not cover normal wear and tear on your vehicle.

How much should I put in collision

A good rule of thumb is that you should have collision insurance on your car until the cost exceeds 10% of the vehicle's value. However, even then, you should not drop collision insurance if you cannot afford to pay out of pocket to repair or replace your car after an accident that's your fault.

Is it good to have a $0 deductible

Is a zero-deductible plan good A plan without a deductible usually provides good coverage and is a smart choice for those who expect to need expensive medical care or ongoing medical treatment. Choosing health insurance with no deductible usually means paying higher monthly costs.

Which is better high deductible or low

A lower deductible plan is a great choice if you have unique medical concerns or chronic conditions that need frequent treatment. While this plan has a higher monthly premium, if you go to the doctor often or you're at risk of a possible medical emergency, you have a more affordable deductible.