Is it better to pay off debt or save?

Is it better to keep money or pay off debt

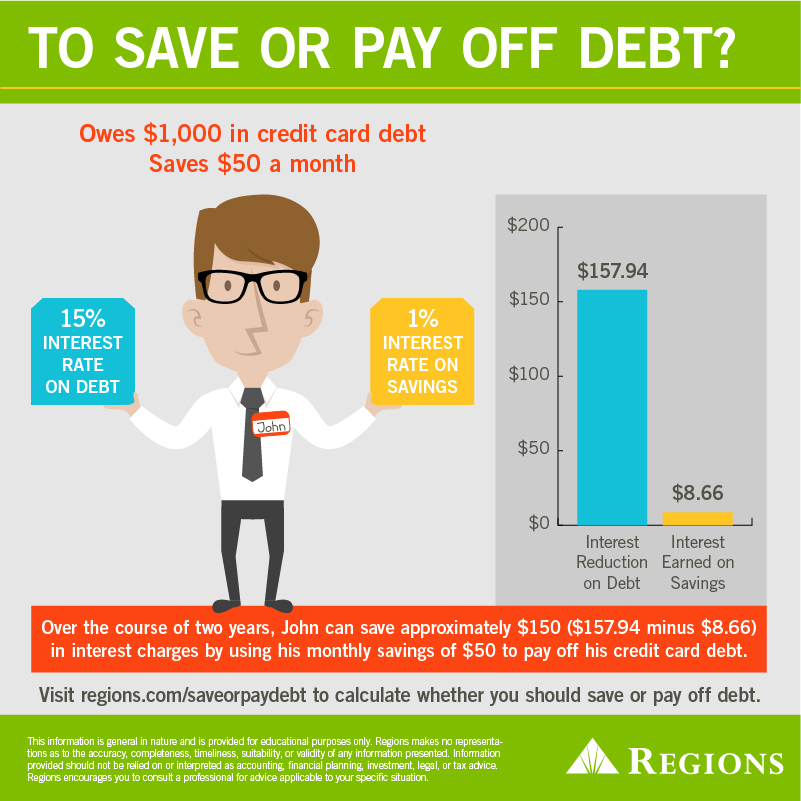

You will rarely be able to earn more on your savings, than you'll pay on your borrowings. So, as a rule of thumb plan to pay off your debts before you start to save.

What are the disadvantages of paying off debt

ConsPrepayment penalties.Impact on your credit score.Miss out on an opportunity to pay off debt.

Is it good to pay off debt in full

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Do millionaires pay off debt or invest

They stay away from debt.

Car payments, student loans, same-as-cash financing plans—these just aren't part of their vocabulary. That's why they win with money. They don't owe anything to the bank, so every dollar they earn stays with them to spend, save and give!

How much debt is too much

Debt-to-income ratio targets

The biggest piece of your DTI ratio pie is bound to be your monthly mortgage payment. The National Foundation for Credit Counseling recommends that the debt-to-income ratio of your mortgage payment be no more than 28%. This is referred to as your front-end DTI ratio.

Is it worth it to be debt-free

Living a debt-free lifestyle can save you money and allow you to start working toward your financial goals. It also can help raise your credit score — and lower your stress levels. Living a debt-free life starts with paying down debt, and that's where Tally can help.

How much debt is too high

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high.

What age should you be debt free

The Standard Route. The Standard Route is what credit companies and lenders recommend. If this is the graduate's choice, he or she will be debt free around the age of 58.

Is it true that most millionaires make over $100 000 a year

Choose the right career

And one crucial detail to note: Millionaire status doesn't equal a sky-high salary. “Only 31% averaged $100,000 a year over the course of their career,” the study found, “and one-third never made six figures in any single working year of their career.”

Is $30,000 in debt a lot

Many people would likely say $30,000 is a considerable amount of money. Paying off that much debt may feel overwhelming, but it is possible. With careful planning and calculated actions, you can slowly work toward paying off your debt. Follow these steps to get started on your debt-payoff journey.

Is $20,000 a lot of debt

“That's because the best balance transfer and personal loan terms are reserved for people with strong credit scores. $20,000 is a lot of credit card debt and it sounds like you're having trouble making progress,” says Rossman.

Are people with no debt happier

That's another reason those who are debt-free might be happier and healthier. They might be better able to afford unexpected health challenges, many of which require money to solve. They might have the means to pay for good health insurance, pay for a therapist, or sign up with a personal trainer.

At what age should you be debt free

The Standard Route. The Standard Route is what credit companies and lenders recommend. If this is the graduate's choice, he or she will be debt free around the age of 58.

What is the average debt of a 35 year old

35—49 year olds = $135,841

Primarily because of home mortgages, older millennials in this generation maintain a higher average debt, according to Experian. Credit card debt is the next main source of debt, followed by education and auto loans.

What is the average debt of a 30 year old

The average credit card debt for 30 year olds is roughly $4,200, according to the Experian data report. Compared to people in their 50s, this debt is not so high. According to Experian, the people in their 50s have the highest average credit card debt, at around $8,360.

What salary is considered very rich

Based on that figure, an annual income of $500,000 or more would make you rich. The Economic Policy Institute uses a different baseline to determine who constitutes the top 1% and the top 5%. For 2023, you're in the top 1% if you earn $819,324 or more each year. The top 5% of income earners make $335,891 per year.

What creates 90% of millionaires

owning real estate

“90% of all millionaires become so through owning real estate.” This famous quote from Andrew Carnegie, one of the wealthiest entrepreneurs of all time, is just as relevant today as it was more than a century ago. Some of the most successful entrepreneurs in the world have built their wealth through real estate.

How much debt is unhealthy

Debt-to-income ratio targets

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high.

What is an OK amount of debt

A common rule-of-thumb to calculate a reasonable debt load is the 28/36 rule. According to this rule, households should spend no more than 28% of their gross income on home-related expenses, including mortgage payments, homeowners insurance, and property taxes.

What percentage of Americans live debt free

What percentage of America is debt-free According to that same Experian study, less than 25% of American households are debt-free. This figure may be small for a variety of reasons, particularly because of the high number of home mortgages and auto loans many Americans have.