Is it better to pay on due date?

Is paying a bill on the due date okay

A credit card payment can't be considered late if it was received by 5 p.m. on the day that it was due, according to the CARD Act. Some card issuers may set a later due date if you pay your bill online, giving you even more time pay.

Is paying on the due date considered late

Credit card companies generally can't treat a payment as late if it's received by 5 p.m. on the day it's due (in the time zone stated on the billing statement), or the next business day if the due date is a Sunday or holiday.

Cached

Should I pay credit card on or before due date

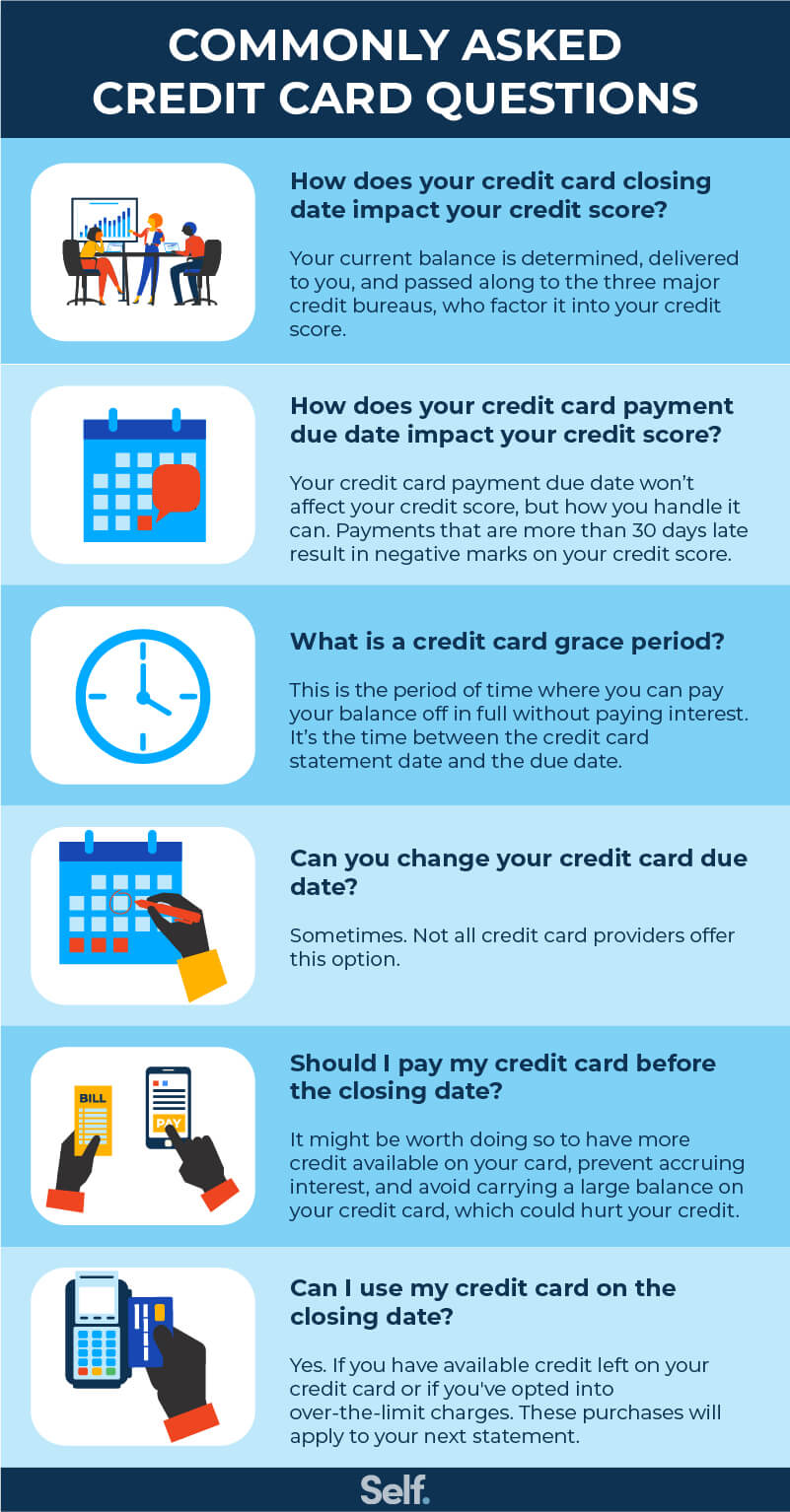

The best time to pay a credit card bill is a few days before the due date, which is listed on the monthly statement. Paying at least the minimum amount required by the due date keeps the account in good standing and is the key to building a good or excellent credit score.

Cached

Is it better to pay bills early or on due date

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. If you can afford to do it, paying your credit card bills early helps establish good financial habits and may even improve your credit score.

Is it bad to pay a bill a day late

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Will a 1 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

What happens if you pay credit card on due date

In reality, you will pay interest on the outstanding amount starting from the payment due date. The rate of interest cost can be as high as 45% annualized. So, it is always better to clear your entire dues by the payment due date.

Does it hurt credit to pay before due date

By making an early payment before your billing cycle ends, you can reduce the balance amount the card issuer reports to the credit bureaus. And that means your credit utilization will be lower, as well. This can mean a boost to your credit scores.

What is the best time to pay credit card bill

The best time to pay your credit card bill is before it's late. You can avoid late payment fees when you make at least your minimum payment by the due date. And if you can pay your full balance before the due date, you can avoid accruing interest charges.

Is it better to have bills due on the same day

While changes may take a few billing cycles to go into effect, having the same due date for multiple bills can simplify your life. And it can be helpful to set up your bills for right after payday if you're concerned about overspending and not having enough money left to pay them later.

How many days before due date should I pay my credit card

Paying credit card bills any day before the payment due date is always the best way to avoid penalties. Paying credit card bills any day before the payment due date is always the best. You'll avoid late fees and penalties. However, making payments even earlier can have even more benefits.

How much does a 2 day late payment affect credit score

A payment made one day late—or even a few days late—won't result in the payment being reported as late. And since credit scores are based on credit report contents, a late payment that isn't reported won't affect your scores.

Is it bad to pay credit card too early

No. It's not bad to pay your credit card early, and there are many benefits to doing so. Unlike some types of loans and mortgages that come with prepayment penalties, credit cards welcome your money any time you want to send it.

Does it hurt credit to pay credit card early

If you are looking to increase your score as soon as possible, making an early payment could help. If you paid off the entire balance of your credit card, you would reduce your ratio to 40%. According to the Consumer Financial Protection Bureau, it's recommended to keep your debt-to-credit ratio at no more than 30%.

Should I pay my bill before the due date

Paying early also cuts interest

Not only does that help ensure that you're spending within your means, but it also saves you on interest. If you always pay your full statement balance by the due date, you will maintain a credit card grace period and you will never be charged interest.

How bad will 1 late payment affect credit

Once a late payment hits your credit reports, your credit score can drop as much as 180 points. Consumers with high credit scores may see a bigger drop than those with low scores. Some lenders don't report a payment late until it's 60 days past due, but you shouldn't count on this when planning your payment.

What happens if you are 1 day late on a credit card payment

If you pay your credit card bill a single day after the due date, you could be charged a late fee in the range of $25 to $35, which will be reflected on your next billing statement. If you continue to miss the due date, you can incur additional late fees. Your interest rates may rise.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Is it bad to pay your credit card a day early

No. It's not bad to pay your credit card early, and there are many benefits to doing so. Unlike some types of loans and mortgages that come with prepayment penalties, credit cards welcome your money any time you want to send it.

Is it better to pay a bill early or on time

Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.