Is it better to pay utilities with credit card or bank account?

Is it smart to put utilities on a credit card

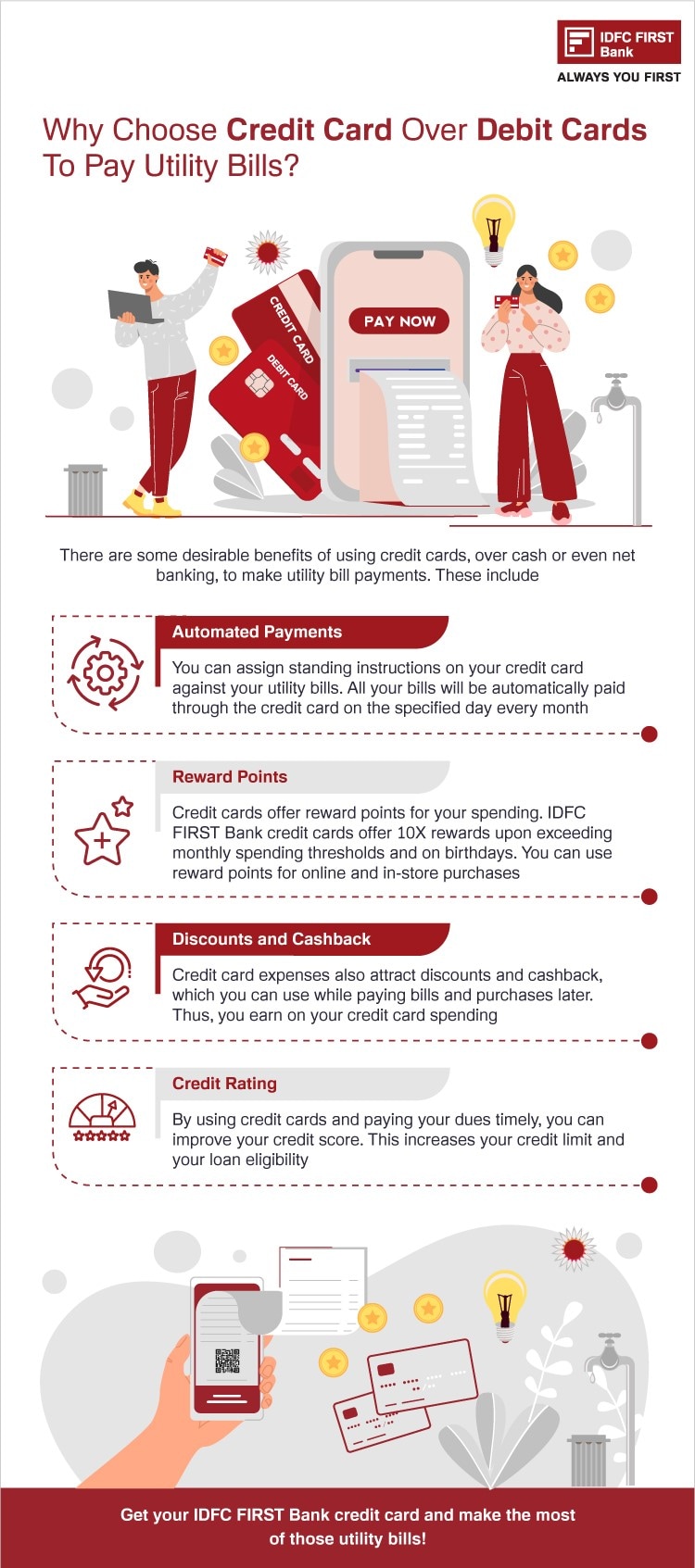

Generally speaking, paying your monthly bills by credit card can be a good idea as long as you adhere to two rules. Always pay your balance in full and on time each month. Never put bills on a credit card because you can't afford to pay them.

Cached

Should I pay bills with card or bank account

Unpaid fees or penalties can hurt your credit score if the bank sends your account to collections. Using a credit card for automatic payments helps ensure that your payments go through even if your checking account balance is in the single digits. Just be sure to pay the balance when you get your credit card bill.

Cached

Should I pay utility bills with credit card or debit card

The bottom line. Be aware of any convenience fees you'll incur by paying your bills with credit cards. It's best to use credit only for products and services that won't charge a fee, and using cash, debit or bank transfer for the rest.

Cached

Is it OK to pay utility bills with credit card

The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes, can often be paid with a credit card but with a processing fee. Loan payments, are usually check or bank withdrawal payments only.

Cached

What items should you not purchase with a credit card

Purchases you should avoid putting on your credit cardMortgage or rent.Household Bills/household Items.Small indulgences or vacation.Down payment, cash advances or balance transfers.Medical bills.Wedding.Taxes.Student Loans or tuition.

What is the best way to pay bills

How to pay bills on timeGet organised. Get a folder and keep your bills in it.Choose a payment method that suits you.Check your bills regularly.Don't let your bills get on top of you.Make sure you're not paying too much.Pay online or phone banking.Other payment methods.

What is the safest way to pay monthly bills

What is the safest method of payment for paying bills The safest method of payment for paying bills is to use a credit card. That's because a credit card number does not give anyone a way to get access to your cash. With a credit card number, they can make a charge on your account.

What is the best and safest way to pay bills

Using a credit card is one of the safest ways to pay your bills. If problems arise, you can dispute the charge with your credit card company. Additionally, many credit cards offer fraud protection in case your card is stolen or used without permission.

What are 5 things credit card companies don t want you to know

7 Things Your Credit Card Company Doesn't Want You to Know#1: You're the boss.#2: You can lower your current interest rate.#3: You can play hard to get before you apply for a new card.#4: You don't actually get 45 days' notice when your bank decides to raise your interest rate.#5: You can get a late fee removed.

What are 2 dangers to avoid when using a credit card

Read on to learn about five common credit card risks, plus tips for managing credit cards.Getting into credit card debt.Missing your credit card payments.Carrying a balance and incurring heavy interest charges.Applying for too many new credit cards at once.Using too much of your credit limit.

Is it better to pay bills through bank

Letting your bank pay your bills

It's much more efficient than visiting every single biller's website. Through your bank's website, you'll know exactly how much money you have in your checking and savings accounts and whether you can afford to make a bill payment.

What is the safest way to pay your bills

By and large, credit cards are easily the most secure and safe payment method to use when you shop online. Credit cards use online security features like encryption and fraud monitoring to keep your accounts and personal information safe.

What is the most effective way to pay bills

Paying by Direct Debit means your bills are paid on time, so you'll avoid late-payment charges. Some companies offer discounts for customers who pay by Direct Debit.

What is the safest way to auto pay bills

Set it up as online bill pay through either your bank or credit card. Do NOT use automated debit transactions. Set up alerts in advance of your bill due dates to make sure you have money to cover the bills. Always check your statements carefully for incorrect, duplicate or fraudulent transactions.

What are two things that you should never buy with a credit card

Purchases you should avoid putting on your credit cardMortgage or rent.Household Bills/household Items.Small indulgences or vacation.Down payment, cash advances or balance transfers.Medical bills.Wedding.Taxes.Student Loans or tuition.

What you must never do while using credit cards

The 5 types of expenses experts say you should never charge on a credit cardYour monthly rent or mortgage payment.A large purchase that will wipe out available credit.Taxes.Medical bills.A series of small impulse splurges.Bottom line.

Is it safe to pay bills with checking account

Online bill pay is included with an online bank account, and online bank accounts are generally very safe. Banking sites protect your accounts in a number of ways, including multifactor authentication, alerts for suspicious activity and website encryption.

What is the safest way to pay your monthly bills

Using a credit card is one of the safest ways to pay your bills. If problems arise, you can dispute the charge with your credit card company. Additionally, many credit cards offer fraud protection in case your card is stolen or used without permission.

What kind of bills should not go on autopay from your bank

Don't use automatic payments for bills where the total fluctuates each time: think utility bills and cable bills that could end up being a different total each month. You should also avoid paying certain bills with cash—including utility bills.

Is it safe to use bank account for autopay

Yes, autopay is a safe practice and carries no more inherent risks than other types of payment. However, because you are providing the company with your bank account info, some additional safety steps should be taken. Verify the company: Never provide your bank account information to a company you do not fully trust.