Is it better to pay with debit card or Apple Pay?

Is it safer to use Apple Pay or debit card

Apple Pay is designed with your security and privacy in mind, making it a simpler and more secure way to pay than using your physical credit, debit, and prepaid cards. Apple Pay uses security features built-in to the hardware and software of your device to help protect your transactions.

CachedSimilar

What is the downside of Apple Pay

Apple Pay requires you to disclose various personal information. Apart from the standard data like your name and address, the company will also access your transaction history—which could amount to a lot if you use it frequently.

Cached

Do you pay more if you use Apple Pay

Apple does not charge any fees when you use Apple Pay — in shops, online or in apps.

What is the best way to pay with iPhone

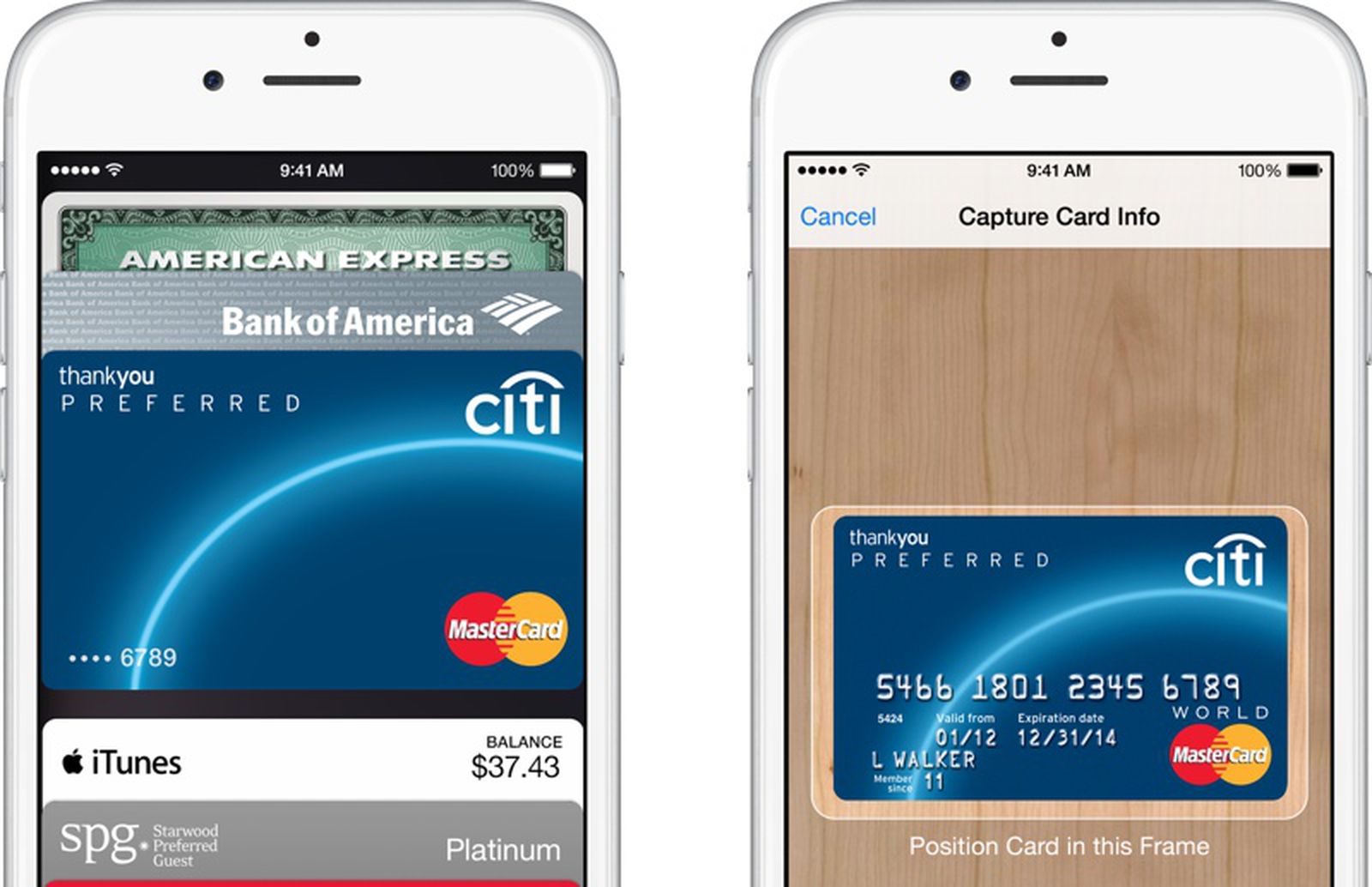

It's easy secure. And private to get started be sure to sign in with your Apple ID on any device you want to use with Apple pay on your iPhone open the wallet app and tap the plus sign in the upper

Does Apple Pay protect against card skimmers

Yes, as Apple Pay is a contactless form of payment, it is protected from card skimmers. Card skimming works by skimming the information stored on a card's magnetic strip. Because there is no magnetic strip used with Apple Pay, it is protected from skimming.

Does Apple Pay refund money if scammed

Apple does not offer refunds if you are scammed using apple pay. However, users' bank and card companies may be able to refund the money that was stolen from the users. Be sure to contact them as soon as possible.

What are the pros and cons of Apple cash pay

Apple Cash is fast and convenient to send payments – however, it can only be used by Apple device users, and it's only available in the US. That means it's not a solution if the person you're sending money to prefers Android, or if you're making an international transfer.

Does Apple Pay charge lower fees

Apple Pay uses the customer's credit card there are no additional fees beyond what the credit card issuers already charge those merchants for accepting the cards.

Does Apple Pay keep a percentage

Transferring money to your debit card or bank account

For Instant Transfer, a 1.5 percent fee (with a minimum fee of $0.25 and a maximum fee of $15) is deducted from the amount of each transfer. With Instant Transfer, limits don't include fees.

What is the best way to pay with your phone

Google Pay works on any Android 5.0 smartphone (or newer) with Near-Field Communication (NFC), and several Wear OS smartwatches including Huawei Watch 2, Fossil and TicWatch models. Samsung Pay works on the Samsung Galaxy s6 and more recent models, the Galaxy A series of smartphones and Samsung Galaxy watches.

Is it better to buy iPhone in full or pay monthly

If you can be content using the same phone for two years or longer, your better off just buying your phones outright. Overtime, lease payments could add up to far more than you would pay for the phone upfront assuming you don't trade your phone in every year or two.

Can someone use Apple Pay if they steal my iPhone

If your iPhone or iPad is lost or stolen

You can go to iCloud.com/find or use the Find My iPhone app to suspend or permanently remove the ability to pay from that device with Apple Pay.

Can someone steal your info through Apple Pay

Yes, it's possible to be scammed via Apple Pay. If a hacker is able to gain access to your personal details, they may be able to access your account and make fraudulent payments.

Can your Apple wallet get hacked

Yes, it's possible to be scammed via Apple Pay. If a hacker is able to gain access to your personal details, they may be able to access your account and make fraudulent payments.

Does Apple Pay protect against skimmers

Since you cannot use Apple Pay through a regular card reader, there's no risk that someone will skim the card in the process. In terms of skimming, the risk is eliminated for Apple Pay users.

What is so special about Apple Pay

Apple Pay is safer than using a physical credit, debit or prepaid card. Face ID, Touch ID or your passcode are required for purchases on your iPhone, Apple Watch, Mac or iPad. Your card number and identity aren't shared with merchants, and your actual card numbers aren't stored on your device or on Apple servers.

Why use Apple Pay vs credit card

Since you don't need a physical debit/credit card, there's a reduced risk of someone stealing your card(s) or their information. In fact, Apple Pay doesn't use your card number to make a purchase; rather, it uses a token called a “device account number” to complete the transaction.

How much does Apple Pay charge per transaction

For Instant Transfer, a 1.5 percent fee (with a minimum fee of $0.25 and a maximum fee of $15) is deducted from the amount of each transfer. With Instant Transfer, limits don't include fees.

Is it better to pay iPhone in full or monthly

Paying off early does not really save you anything, since the loan is at 0% interest. You don't have to trade the phone at 12 months, you can keep it and pay the entire 24. Either way, you are paying the same for the phone if you purchased it all at once, or make the 24 month payments.

Is paying by phone safer than debit card

Cards feature an identifying magnetic stripe, and information can be stolen from it rather easily if criminals tamper with a card reader by adding a skimmer. A digital wallet — such as Apple Pay — is even more secure than a chip card because it doesn't use your actual card number for the transaction.