Is it easy to get approved for Alphaeon?

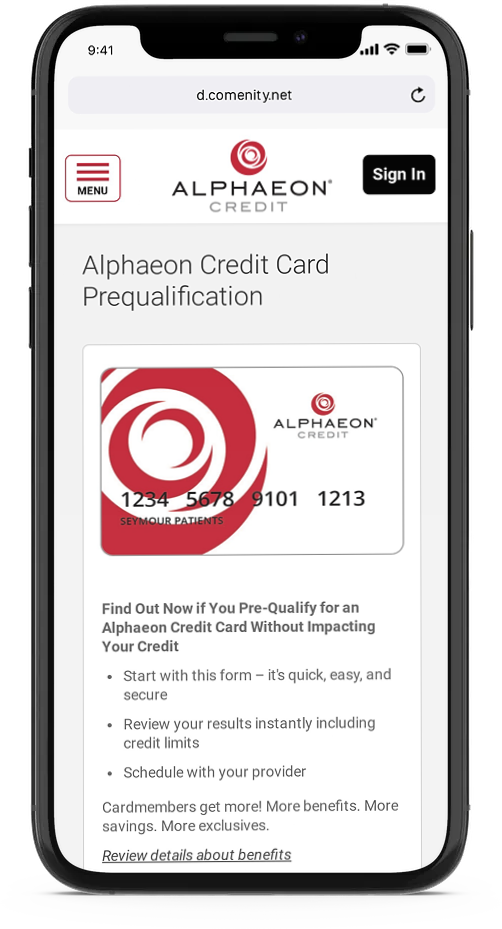

Does Alphaeon pre approval affect credit score

With Pre-Qual, patients can find out instantly if they may be approved and for how much with no impact to their credit!*

Cached

What bank does Alphaeon credit use

Comenity Capital Bank

ALPHAEON Credit Card Accounts are issued by Comenity Capital Bank.

Does CareCredit approve everyone

If you're considered high-risk, you may be denied credit entirely or you may be offered a loan with a very high interest rate. If you have good credit and present a low risk, the lender may decide that you should be approved and may offer you their most competitive rates.

Why is it so hard to get approved for CareCredit

Your credit score is too low. You don't have enough income. You have too much debt relative to your income. There are too many recent inquiries on your credit report.

What credit score do I need for Alphaeon

The credit score you need for the Alphaeon Credit Card is 640 or better. That means people with at least fair credit have a shot at getting approved for this card.

What is a good credit score for pre-approval

It's helpful to know where you stand before reaching out to a lender. A credit score of at least 620 is recommended to qualify for a mortgage, and a higher one will qualify you for better rates. Generally, a credit score of 740 or above will enable you to qualify for the best mortgage rates.

What credit score do you need for patient fi

To qualify for the $500 gift card the following criteria must be satisfied: 1) the minimum FICO score of the loan borrower for each of the five (5) loans approved must be 620 or above; and 2) PatientFi must be used as the “first look” financing option for all your patients during the promotional period that this offer …

What credit score needed for CareCredit

Apply Today!

The application process for CareCredit dental financing is completely confidential and takes less than ten minutes to complete. Many approved applicants have a minimum credit score of 540/560. You can also apply with a co-signer to improve the likelihood of being approved.

Can I get CareCredit with a 600 credit score

The credit score you need for the CareCredit Credit Card is 640 or better. That means people with at least fair credit have a shot at getting approved for this card.

Can you get CareCredit with a 580 score

For the best approval odds with CareCredit, you'll need a credit score of 620 or higher. However, some users report approval with scores around 600. If you're score is lower than 600 you'll have a hard time getting approval.

Why would you get denied after pre-approval

Buyers are denied after pre-approval because they increase their debt levels beyond the lender's debt-to-income ratio parameters. The debt-to-income ratio is a percentage of your income that goes towards debt. When you take on new debt without an increase in your income, you increase your debt-to-income ratio.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

Is CareCredit the same as Alphaeon

CareCredit and Alphaeon Credit

These two companies operate similarly. After applying for credit and getting approved, they'll pay your doctor or facility in full, up front, for your procedure. You then pay them back based on the terms of agreement. There are several options, including 6 or 12 months no interest.

What is the highest CareCredit limit

A CareCredit card has a maximum credit limit of $25,000. For charges of $200 or more, CareCredit offers "no-interest" promotional periods of six, 12, 18 and 24 months, depending on the provider.

Can I get CareCredit with a 500 credit score

For the best approval odds with CareCredit, you'll need a credit score of 620 or higher. However, some users report approval with scores around 600. If you're score is lower than 600 you'll have a hard time getting approval.

What is the highest credit limit for CareCredit

A CareCredit card has a maximum credit limit of $25,000. For charges of $200 or more, CareCredit offers "no-interest" promotional periods of six, 12, 18 and 24 months, depending on the provider.

How guaranteed is a pre-approval

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. This document is based on certain assumptions and it is not a guaranteed loan offer.

Can I still be denied after pre-approval

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval. If this happens, do not despair.

Can I afford a 300K house on a $70 K salary

Home buying with a $70K salary

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*.

How much does a couple need to make to buy a $200 K house

What income is required for a 200k mortgage To be approved for a $200,000 mortgage with a minimum down payment of 3.5 percent, you will need an approximate income of $62,000 annually.