Is it financially smart to finance a car?

Is it better to finance a car or pay cash

Paying cash for your car may be your best option if the interest rate you earn on your savings is lower than the after-tax cost of borrowing. However, keep in mind that while you do free up your monthly budget by eliminating a car payment, you may also have depleted your emergency savings to do so.

Cached

Is financing a car a good idea for credit

Even if you apply for a few car loans within a short time frame, it shouldn't affect your score significantly. Once you start making loan payments, your credit score should rebound. And by keeping up with your monthly loan payments, your credit score should increase in the long run.

Is it better to finance or pay in full

If you're not eligible for a low-interest credit card or loan, paying with cash helps you avoid sizable interest charges. You're not the best at sticking to a financial plan. Anyone who is prone to overspending, missing bill payments or paying only the monthly minimum may be better off sticking to cash.

Is it financially smart to pay off your car

The bottom line

Paying off a car loan early can save you money — provided the lender doesn't assess too large a prepayment penalty and you don't have other high-interest debt. Even a few extra payments can go a long way to reducing your costs.

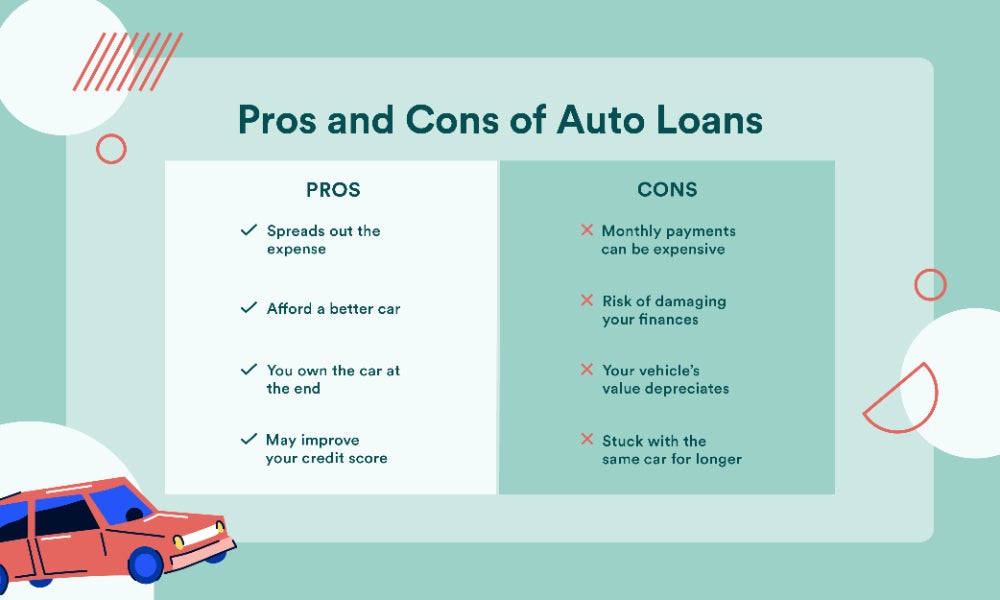

What are the disadvantages of financing a car

Now let's look at the disadvantages of traditional car financing: These are usually higher monthly payments. You have to have a down payment – either cash or a trade-in. You are buying a vehicle that depreciates the minute you drive it off the lot.

Why do dealerships want you to finance instead of cash

want you to finance through them for two main reasons: Dealerships can make money off the interest of a car loan you finance through them. Dealerships earn commission for acting as the middleman between you and another lender.

What is considered a high car payment

According to experts, a car payment is too high if the car payment is more than 30% of your total income. Remember, the car payment isn't your only car expense! Make sure to consider fuel and maintenance expenses. Make sure your car payment does not exceed 15%-20% of your total income.

How much should I spend on a car if I make $100000

How much car can I afford based on salary

| Annual salary (pre-tax) | Estimated monthly car payment should not exceed |

|---|---|

| $75,000 | $625 per month |

| $100,000 | $833 per month |

| $125,000 | $1,042 per month |

| $150,000 | $1,250 per month |

What happens if I pay an extra $100 a month on my car loan

Your car payment won't go down if you pay extra, but you'll pay the loan off faster. Paying extra can also save you money on interest depending on how soon you pay the loan off and how high your interest rate is.

Does paying off a car early look good

Many factors contribute to your credit score, including a history of payments and your mix of credit, such as loans and lines of credit. Paying off your auto loan early eliminates the auto loan from your mix of credit accounts, which can cause a slight decrease in your credit score.

Is it a bad idea to finance a car for 72 months

72-Month Car Loan Rates Are Typically High

To compensate for the added risk, they often charge higher annual percentage rate (APR) or interest rates. There's no benefit to paying more money in interest, and it's considered by some to be wasted money.

Can financing ruin your credit

Taking out a personal loan is not bad for your credit score in and of itself. However, it may affect your overall score for the short term and make it more difficult for you to obtain additional credit before that new loan is paid back.

What should you not do when financing a car

Here are five mistakes these industry veterans reveal and how you can avoid them.Letting the dealer mark up your interest rate.Negotiating your monthly payments.Buying overpriced extras.Extending the loan.Paying bogus fees.

Why you don’t pay cash for a car

And you bought a 30 000. Car obviously it's probably too much car but in this case that ratio is just too much and you're overextended. And you're using up way too much money that you need for other

How much should I spend on a car if I make $60000

How much should I spend on a car if I make $60,000 If your take-home pay is $60,000 per year, you should pay no more than $750 per month for a car, which totals 15% of your monthly take-home pay.

How much should my car payment be if I make 40000 a year

If you take a car loan of $40000 at an interest rate of 4.12% for a loan term of 72 months, then using an auto loan calculator, you can find that your monthly payment should be $628.

Can you afford a $30,000 car making $60,000 salary

Follow the 35% rule. Whether you're paying cash, leasing, or financing a car, your upper spending limit really shouldn't be a penny more than 35% of your gross annual income. That means if you make $36,000 a year, the car price shouldn't exceed $12,600. Make $60,000, and the car price should fall below $21,000.

What credit score is needed for a 50K car loan

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

Can you pay off a 72 month car loan early

Some lenders make it difficult to pay off car loans early because they'll receive less payment in interest. If your lender does allow early payoff, ask whether there's a prepayment penalty, since a penalty could reduce any interest savings you'd gain.

What is considered a high monthly car payment

Generally, however, a car payment is considered high if it exceeds 10-15% of a person's gross monthly income. This means that if a person earns $3,000 per month, a car payment that is greater than $300-$450 per month may be considered high.