Is it good to pay credit card before statement date?

Should I pay credit before or after statement

Pay off all your credit cards a few days before each statement closes if you're applying for a loan soon. Paying off your cards early will decrease your overall utilization and boost your credit score for a few days.

What happens if you pay your credit card statement early

Increases your available credit

So, if you make payments to your card before your due date, you'll have a lower balance due (and higher available credit) at the close of your cycle. That means less credit card debt gets reported to the credit bureaus, which could help your credit score.

Cached

Does paying your credit card statement early affect your credit score

If you are looking to increase your score as soon as possible, making an early payment could help. If you paid off the entire balance of your credit card, you would reduce your ratio to 40%. According to the Consumer Financial Protection Bureau, it's recommended to keep your debt-to-credit ratio at no more than 30%.

Cached

Can I pay my credit card the same day I use it

Yes, if you pay your credit card early, you can use it again. You can use a credit card whenever there's enough credit available to complete a purchase.

Should I pay my statement right away

You should always pay your credit card bill by the due date, but there are some situations where it's better to pay sooner. For instance, if you make a large purchase or find yourself carrying a balance from the previous month, you may want to consider paying your bill early.

How many days before your statement should you pay your credit card

The best time to pay a credit card bill is a few days before the due date, which is listed on the monthly statement. Paying at least the minimum amount required by the due date keeps the account in good standing and is the key to building a good or excellent credit score.

Why does my credit score go down when I pay early

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

Can we pay credit card bill before billing

You can pay the bill on or before the due date at your convenience. However, paying the bill later will incur additional charges. What happens if I pay only the minimum amount due If you pay only the minimum amount due, your card issuer will start levying interest on the remaining amount.

How many days before due date should I pay my credit card

Paying credit card bills any day before the payment due date is always the best way to avoid penalties. Paying credit card bills any day before the payment due date is always the best. You'll avoid late fees and penalties. However, making payments even earlier can have even more benefits.

How early should I pay my statement balance

The best time to pay a credit card bill is a few days before the due date, which is listed on the monthly statement. Paying at least the minimum amount required by the due date keeps the account in good standing and is the key to building a good or excellent credit score.

How long before statement closing date should I pay

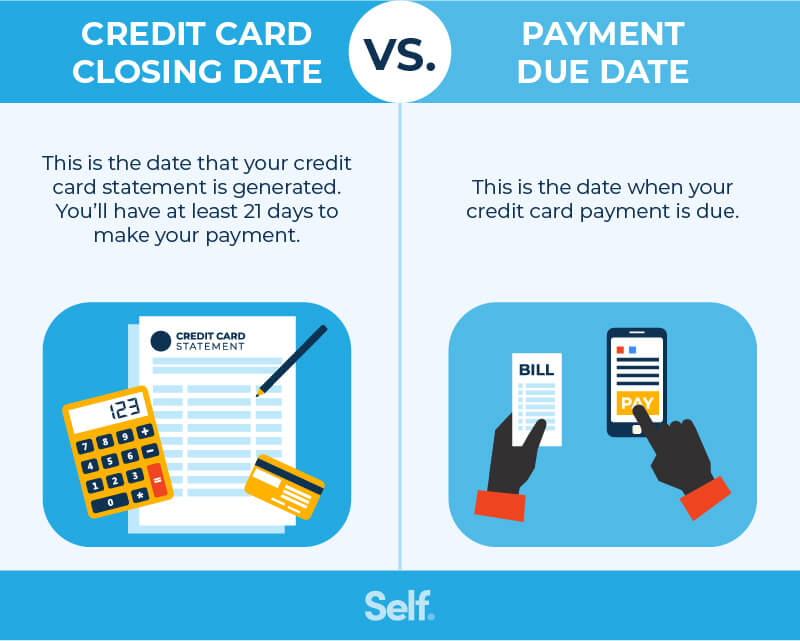

Your credit card payment is not due on the statement closing date. Instead, there is a delay of 21 to 30 days between the closing date and the payment due date. If you pay your credit card balance in full this month, a grace period may go into effect to help you avoid being charged interest during that time.

What is the 15 3 rule

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

What is the best time to pay credit card bill

The best time to pay your credit card bill is before it's late. You can avoid late payment fees when you make at least your minimum payment by the due date. And if you can pay your full balance before the due date, you can avoid accruing interest charges.

Is it better to pay bills early or on time

Not only will paying your bills on time help your credit score; it will also save you money. In addition to getting lower interest rates on your credit accounts, when you pay your bills on time you will not be charged a late fee or penalty, which can go as high as $35.

Should I pay before statement date or due date

To avoid paying interest and late fees, you'll need to pay your bill by the due date. But if you want to improve your credit score, the best time to make a payment is probably before your statement closing date, whenever your debt-to-credit ratio begins to climb too high.

What happens if you pay before closing date

Paying your credit card balance before the closing date can affect your statement balance and credit reporting. That's true whether you pay part of the balance or all of it. In this way, paying your credit card before or on the closing date is like making a purchase around the same time.

Why does the 15 3 credit hack work

The 15/3 hack can help struggling cardholders improve their credit because paying down part of a monthly balance—in a smaller increment—before the statement date reduces the reported amount owed. This means that credit utilization rate will be lower which can help boost the cardholder's credit score.

How do you avoid the 5 24 rule

How to bypass the Chase 5/24 rule If you've been approved for five cards in the past 24 months, you will not be approved for another Chase card thanks to the 5/24 rule. There have been reports of “Selected for you” and “Just for you” offers being exempt from the 5/24 rule.