Is it good to pay your statement balance full each month?

Is it OK to just pay statement balance

A credit card's statement balance is what you owe at the end of a billing cycle, while the current balance is how much you owe on your card at any given time. To avoid interest charges, pay your statement balance in full by the due date monthly – there's no need to pay your entire current balance in most cases.

Cached

Is it better to pay statement or full balance to build credit

Carrying a balance does not help your credit score, so it's always best to pay your balance in full each month. The impact of not paying in full each month depends on how large of a balance you're carrying compared to your credit limit.

Is paying statement balance early good

Paying early also cuts interest

Not only does that help ensure that you're spending within your means, but it also saves you on interest. If you always pay your full statement balance by the due date, you will maintain a credit card grace period and you will never be charged interest.

Cached

Is it bad to pay more than statement balance

There's nothing wrong with paying your current balance in full, even if it's higher than your statement balance, if you want to do so. But you should understand that paying your current balance won't save you any extra money in interest, unless you've previously lost your card's grace period.

Does statement balance mean I owe money

Your statement balance typically shows what you owe on your credit card at the end of your last billing cycle. Your current balance, however, will typically reflect the total amount that you owe at any given moment.

Which is the best strategy for paying your credit card bill

The best way to pay your credit card bill is by paying the statement balance on your credit bill by the due date each month. Doing so will allow you to avoid incurring any interest or fees. In case you weren't aware, you do not automatically pay interest simply by having a credit card.

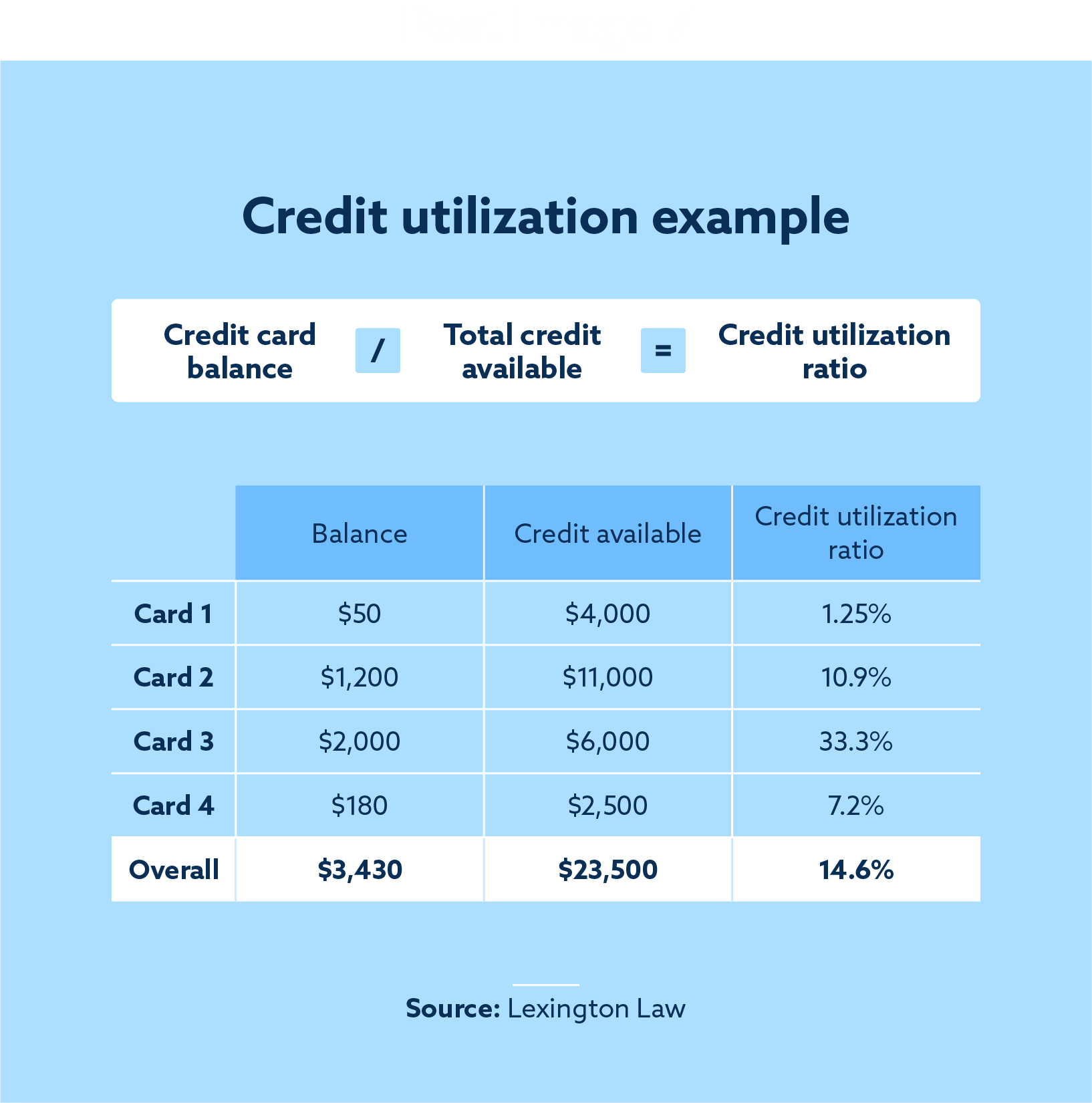

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

How many days before should I pay my statement balance

The best time to pay a credit card bill is a few days before the due date, which is listed on the monthly statement. Paying at least the minimum amount required by the due date keeps the account in good standing and is the key to building a good or excellent credit score.

How much should you pay on your credit card each month

The Bottom Line

Here's a rule of thumb for deciding your credit card payments: pay the full balance or as much of the balance as you can afford. If you're trying to pay off several credit cards, pay as much as you can toward one credit card and the minimum on all the others.

What happens if you pay more than your minimum each month

You'll incur less interest

Every dollar you pay over the minimum reduces your actual debt, which reduces the amount of interest charged. So even if you can't pay off your balance in full, it's to your benefit to pay more than the minimum.

Should I pay statement balance or minimum balance

Experts recommend you pay the statement balance in full every month, but there are times when that may not be possible. In those cases, it's important to make at least the minimum payment so your account stays current and you don't incur any late fees or penalty APRs.

What is the difference between paying total balance and statement balance

Remaining Statement Balance is your 'New Balance' adjusted for payments, returned payments, applicable credits and amounts under dispute since your last statement closing date. Total Balance is the full balance on your account, including transactions since your last closing date. It also includes amounts under dispute.

What is the smartest way to pay your credit card

The best way to pay your credit card bill is by paying the statement balance on your credit bill by the due date each month. Doing so will allow you to avoid incurring any interest or fees. In case you weren't aware, you do not automatically pay interest simply by having a credit card.

What’s a bad strategy to pay off your credit card

If you pay off your cards with a new financing, but run up a balance on the original accounts again, you could set yourself up for severe financial and credit problems later. Also, if you plan to apply for new financing, it's best if your credit score is either good or excellent.

How much should I pay on my credit card each month

The key is to keep your balance at or below 30 percent of your credit limit to help improve and maintain a good credit score, which means having no balance at all is even more helpful. Always try to pay off your credit card in full when possible.

How much should you spend on a $500 credit limit

It's commonly said that you should aim to use less than 30% of your available credit, and that's a good rule to follow.

What’s the minimum payment on a $5000 credit card

The minimum payment on a $5,000 credit card balance is at least $50, plus any fees, interest, and past-due amounts, if applicable. If you were late making a payment for the previous billing period, the credit card company may also add a late fee on top of your standard minimum payment.

What is the minimum payment on a $1000 credit card

Method 1: Percent of the Balance + Finance Charge

1 So, for example, 1% of your balance plus the interest that has accrued. Let's say your balance is $1,000 and your annual percentage rate (APR) is 24%. Your minimum payment would be 1%—$10—plus your monthly finance charge—$20—for a total minimum payment of $30.

Is it better to pay minimum payments or in full

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

What is the best strategy for paying your credit card bill

The best way to pay your credit card bill is by paying the statement balance on your credit bill by the due date each month. Doing so will allow you to avoid incurring any interest or fees. In case you weren't aware, you do not automatically pay interest simply by having a credit card.