Is it hard to get approved for Amex business?

Is it hard to get an American Express Business Card

Summary. Getting the American Express® Business Gold Card isn't difficult if you have a credit score of at least 670, consistent income, and positive payment history with at least one other card.

Cached

What credit score do you need for American Express business card

There is not set credit score needed in order to be approved for the Amex Business Gold card, but we recommend that you have a personal credit score of at least 670, or a business credit score of at least 75, plus 2 years of good credit history.

Cached

Do you need good credit for American Express business card

But you will generally need to have very good or excellent credit to be approved. In particular, your consumer credit score will usually need to be 740 or higher to have a competitive application. Amex will perform a credit check with consumer and business credit bureaus when you apply for an Amex business card.

Cached

What credit score do you need for American Express Blue Business Card

690 or better

To qualify for The Blue Business® Plus Credit Card from American Express, you'll need good to excellent credit. That's generally defined as a score of 690 or better. Credit scores alone don't guanrantee approval, though.

Do Amex business cards have a credit limit

If you have a Consumer or Business Green, Gold or Platinum Card, your Card does not have a credit limit.

Does Amex business have a limit

The Amex Business Gold is a charge card. Unlike a more traditional credit card it doesn't have a preset credit limit. Instead, it offers the flexibility of a charge card by allowing you to purchase what you need with it as long as you pay off your balance each billing statement.

What is the minimum income for Amex business Platinum

Person Income/Business Income

We recommend that your annual income be at least $50,000 or higher before applying for the Amex Platinum.

What is the easiest Amex card to get

Which Amex card is the easiest to get The easiest Amex cards to get are ones with a lower minimum spending requirement for rewards, as well as a low annual fee or no annual fee. Examples include the Blue Cash Everyday Card from American Express and the American Express Cash Magnet Card.

How much income do you need for Amex business Platinum

What does your credit score need to be for the Amex Platinum card While there is no set score needed, we recommend you have a credit score of at least 670, 2 years of clean credit history, and an income of at least $50,000 per year to apply for the Amex Platinum card.

Does Amex build business credit

If you're looking to build your business credit, having one or more business credit cards could help you build it, but it depends on whether or not the creditor actually reports your activity to credit bureaus. American Express only reports only negative activity to Dun & Bradstreet (D&B).

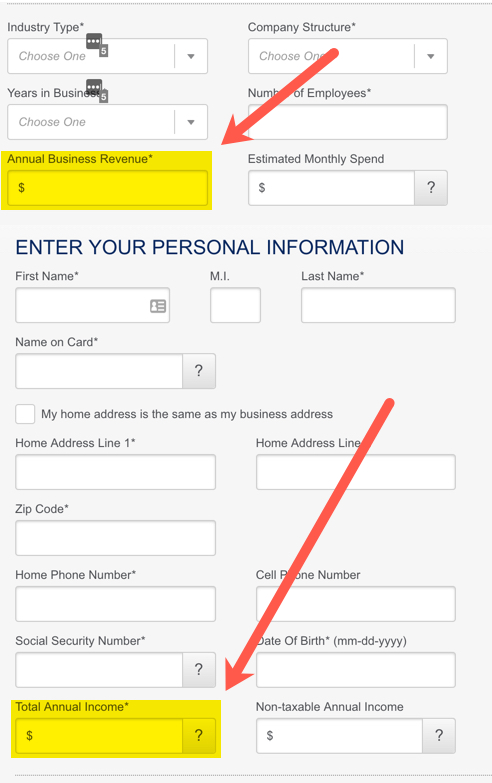

Does Amex verify income

While American Express probably won't ask to verify your income, it's not a good idea to lie about your income on an application. In fact, providing false information on a credit card application is against federal law. Therefore, you're much better off being honest when applying for an American Express credit card.

What is the hardest Amex card to get

the Centurion® Card from American Express

The hardest Amex card to get is the Centurion® Card from American Express. Also known as the “Black Card,” this Amex card is hard to get because it is available by invitation only, and potential candidates are rumored to need an annual income of at least $1 million.

What is the minimum income for Amex business

Person Income/Business Income

We recommend that your annual income be at least $50,000 or higher before applying for the Amex Platinum.

What is the recommended income for Amex

Salary Needed for Amex Platinum Credit Card

If you make nearly $100,000 a year and have good credit, you should have no issue getting approved. But, applicants with annual incomes as low as $40,000 have also been approved if they have a low debt-to-income ratio and pay their other credit cards in full every month.

What is the minimum income requirement for Amex

However, you must fulfill the minimum annual income criteria for the American Express® credit card you are applying for. In general, you require a minimum income of Rs. 4.5 lakh or above if you are salaried, and Rs. 6 Lakh or above if you are self employed.

What is the easiest Amex card to get approved for

Which Amex card is the easiest to get The easiest Amex cards to get are ones with a lower minimum spending requirement for rewards, as well as a low annual fee or no annual fee. Examples include the Blue Cash Everyday Card from American Express and the American Express Cash Magnet Card.

What is the richest Amex card

The American Express Centurion Card

The American Express Centurion Card, colloquially known as the Black Card, is a charge card issued by American Express. It is reserved for the company's wealthiest clients who meet certain net worth, credit quality, and spending requirements on its gateway card, the Platinum Card.

Will Amex verify my income

What you should know about the American Express income verification process: If Amex does request proof of income, you'll receive a reference number either by mail or email. This number will give you access to the American Express income verification portal.

What is the minimum income for Amex Business Platinum

Person Income/Business Income

We recommend that your annual income be at least $50,000 or higher before applying for the Amex Platinum.

What FICO score does Amex use

We believe everyone should know their credit score and have the tools to understand it better. That's why we're giving you VantageScore® 3.0 by TransUnion®, and the key factors that affect your score for free, even if you are not an American Express® Card Member.