Is it hard to get into Robinhood?

Is Robinhood a good place for beginners

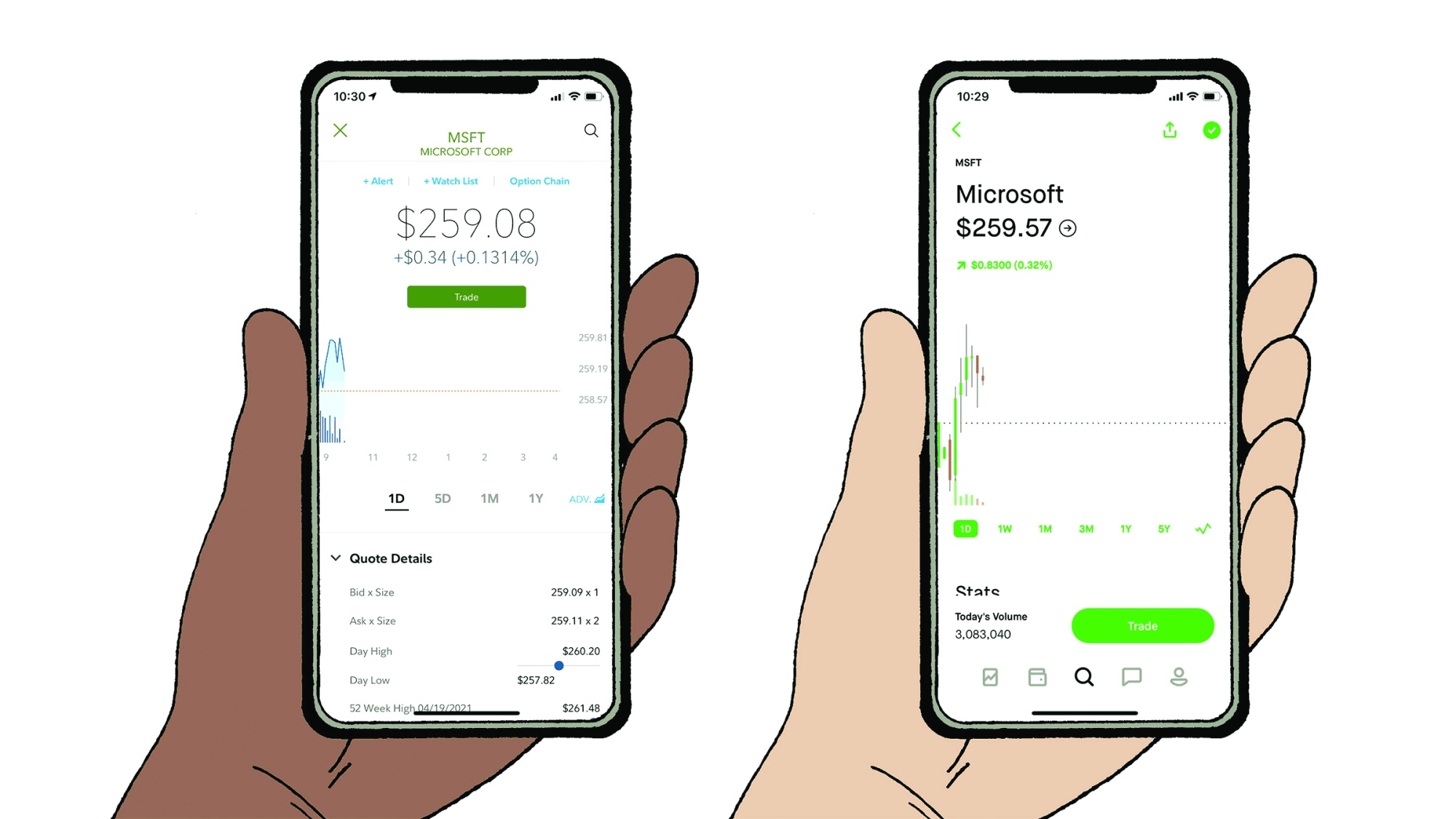

Is Robinhood a good broker for beginners Robinhood is a good fit for beginner investors, and the company made our list of the best brokers for beginners. The app offers a streamlined, approachable and easy-to-navigate trading platform, plus extremely low costs, which beginner investors tend to prioritize.

Cached

How long does it take to get approved for Robinhood

If we request a document to verify your identity, we'll include instructions for uploading your documents securely. Please give us five to seven days to review the materials and open your account.

Cached

How much money do you need to start Robinhood

On Robinhood, investors can buy fractional shares of stocks and exchange-traded funds (ETFs) with as little as $1. Stocks worth over $1.00 per share, and which have a market capitalization of more than $25 million, are eligible for fractional shares on Robinhood.

Can you really make money using Robinhood

You can make money on Robinhood by holding stocks that will pay dividends. You can then reinvest the dividends to earn compound interest. Besides this, you can earn money by asset appreciation. This means you sell something for a higher price than you purchased it for.

Cached

How much does Robinhood charge to cash out

There's no fee for bank transfers. However, instant withdrawals to a debit card or bank account can incur a 1.5% fee.

How much does Robinhood charge to sell

Trading activity fee

This fee is rounded up to the nearest penny, which will be no greater than $7.27 per trade. Keep in mind, you may be charged more than the $7.27 fee because the fee limit is based on the execution of your order, which can occur with multiple trades.

What is required to open a Robinhood account

Be 18 years or older. Have a valid Social Security Number (not a Taxpayer Identification Number) Have a legal U.S. residential address within the 50 states or Puerto Rico (exceptions may apply for active U.S. military personnel stationed abroad) Be a U.S. citizen, U.S. permanent resident, or have a valid U.S. visa*

How fast can you get money from Robinhood

Although you get instant access to your money, the bank withdrawal could happen within 5 business days after you initiate the transfer. To prevent a possible reversal, make sure you have the necessary funds in your bank account for 5 business days after you initiate the bank transfer.

How much is Robinhood monthly fee

Investing with a Robinhood brokerage account is commission free. We don't charge you fees to open your account, to maintain your account, or to transfer funds to your account.

Does Robinhood report to IRS

Robinhood reports every transaction to the IRS, so they'll know everything related to your Robinhood taxes. If you fail to report your Robinhood tax information, the IRS might assume that all of the proceeds from the transactions are gains and tax you on that total amount.

What are the cons of Robinhood

Cons Explained

Limited research and educational content: Research and educational material at Robinhood don't measure up to competitor standards, making it difficult for traders to get the most out of the platform. There are no stock or ETF screeners available at all, and other research tools are rudimentary at best.

How to turn $1,000 into $10,000 in a week

The Best Ways To Turn $1,000 Into $10,000Retail Arbitrage. Have you ever bought something and then resold it for a profitInvest In Real Estate.Invest In Stocks & ETFs.Start A Side Hustle.Start An Online Business.Invest In Small Businesses.Invest In Alternative Assets.Learn A New Skill.

Do you pay taxes when you withdraw from Robinhood

We'll also begin 24% backup tax withholding on your Robinhood Securities account. That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding.

Why can’t i withdraw money from Robinhood

You may not be able to withdraw money while your account is restricted. Robinhood sometimes restricts users' accounts. That can happen if the user has a negative balance, had a bank account transaction reversed, if the user is suspected of fraud, or for a few other reasons.

Is Robinhood a good or bad thing

Robinhood provides a bare-bones trading experience, making it a poor choice for investors seeking the best trading platform. Also, Robinhood's stock research tools are lacking when compared to $0 commission brokers such as E*TRADE, Charles Schwab, and Fidelity.

How much does Robinhood tax when you withdraw

We'll also begin 24% backup tax withholding on your Robinhood Securities account. That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding.

How much does the average Robinhood account have

Robinhood Yearly Average Account Size

| Robinhood Average Account Size 2023 | $2,371 |

|---|---|

| Robinhood Average Account Size 2023 | $2,771 |

| Robinhood Average Account Size 2023 | $5,038 |

| Robinhood Average Account Size 2023 | $4,317 |

| Robinhood Average Account Size 2023 | $2,695 |

How do I buy stock on Robinhood

Go to the stock's detail page. You'll see the stock's historical performance, analyst ratings, company earnings, and other helpful information to consider when buying or selling a stock. Select Trade → Buy or just Buy if you don't currently own the stock.

What is the fastest way to get money from Robinhood

The Instant transfers option offers you a faster way to move money. In comparison to the free option that takes 4-5 business days to complete, an instant transfer typically takes 10 minutes (sometimes longer depending on your bank).

Why can’t i cash out on Robinhood

You may not be able to withdraw money while your account is restricted. Robinhood sometimes restricts users' accounts. That can happen if the user has a negative balance, had a bank account transaction reversed, if the user is suspected of fraud, or for a few other reasons.