Is it smart to have multiple banks?

Is there any downside to having multiple banks

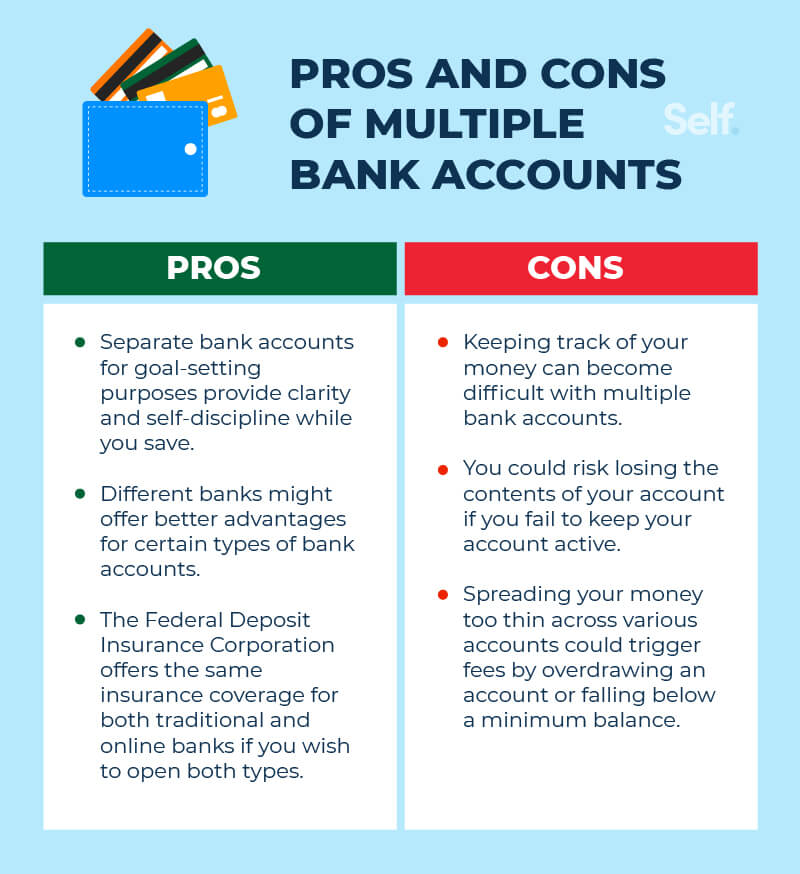

Cons. Multiple accounts can be more challenging to keep up with when tracking deposits or withdrawals. You may run the risk of incurring overdraft or other fees if you're not tracking each account closely. Monthly maintenance fees can easily add up for multiple checking accounts.

Is it good to have multiple banks

Having multiple accounts — at the same bank or different banks — can be useful for managing different savings goals, and there's little harm in doing so, since it doesn't impact your credit.

Cached

Is 3 banks too many

Some experts suggest you should have four bank accounts — two checking and two savings. You'll use one checking account to pay bills and the other for spending money.

Do millionaires use multiple banks

As such, millionaires will often hold different bank accounts that do not contain cash. Instead, it will have other types of assets, such as mutual funds, which are riskier but offer the possibility of bigger rewards.

Is it bad to have 4 banks

Having multiple bank accounts can be beneficial, but how many you decide to have depends on your situation and goals. At the very minimum, it's a good idea to have at least one checking and one savings account. Beyond that, consider your money management goals.

How many banks should I bank with

In general, having three to five bank accounts can be helpful for managing your money. For instance, if you're married, you may share a joint checking and a joint savings account with your spouse. You and your spouse may also decide to have individual checking and savings accounts, as well.

Can banks see your other bank accounts

Can bank employees see your accounts Bank tellers can see your checking and savings accounts as well as money paid toward loans. They can also move money around your different accounts at your request.

Is it bad to have 4 bank accounts

Having multiple bank accounts can be beneficial, but how many you decide to have depends on your situation and goals. At the very minimum, it's a good idea to have at least one checking and one savings account. Beyond that, consider your money management goals.

Does having 3 bank accounts hurt your credit

If you happen to have many bank accounts, you might worry if they will have any negative effect on your credit score. Quick answer: Credit scores are not affected by the number of bank accounts in your name.

What percentage of people have $1000 in the bank

The numbers are consistently around 60%, meaning only 40% of Americans have enough savings to cover an unexpected expense without going into debt. As of January 2023, the report shows that 57% of Americans have less than $1,000 in savings.

What bank do wealthy people use

Bank of America, Citibank, Union Bank, and HSBC, among others, have created accounts that come with special perquisites for the ultrarich, such as personal bankers, waived fees, and the option of placing trades. The ultrarich are considered to be those with more than $30 million in assets.

Is it safe to have more than $250000 in a bank account

Some examples of FDIC ownership categories, include single accounts, certain retirement accounts, employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. Q: Can I have more than $250,000 of deposit insurance coverage at one FDIC-insured bank A: Yes.

How many banks should one person have

In general, having three to five bank accounts can be helpful for managing your money. For instance, if you're married, you may share a joint checking and a joint savings account with your spouse. You and your spouse may also decide to have individual checking and savings accounts, as well.

Is it OK to have 4 bank accounts

Yes, it is good to keep money in multiple bank accounts as it has various benefits. If you make transactions like direct benefit transfer from government, pension account, tax payment and refunds, etc. from separate bank accounts, it will help you track your transactions easily.

How many banks does the average person have

2. The average person in the US has approximately 5.3 bank accounts. In 2023, an FDIC survey of 33,000 individuals found that 95.4% of American households were “banked,” meaning that they owned at least one or more bank accounts. This is the highest share on record, leaving the “unbanked” total at 4.6%.

Do banks know how much you make

If you've ever applied for a loan, you know that banks and credit unions collect a lot of personal financial information from you, such as your income and credit history.

Why do banks keep denying me

Reasons You Can Be Denied a Checking Account

Excessive overdrafts or nonsufficient funds incidents. Unpaid fees or negative account balances, whether from an active or closed account. Suspected fraud or identity theft. Applying for too many bank accounts over a short period of time.

How many bank accounts is too many

There is no limit to the number of checking accounts that you can have. But it's a good idea to limit the number of accounts to an amount that you can reasonably and sustainably manage. Too many checking accounts can make it harder to track deposits and withdrawals.

What is the 3 bank account rule

The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings. If you've ever made a mortgage or rent payment without realizing your credit card payment was hitting your account that day, you may benefit from keeping your needs and wants in separate checking accounts.

How many Americans have $100,000 in bank

Most Americans are not saving enough for retirement. According to the survey, only 14% of Americans have $100,000 or more saved in their retirement accounts. In fact, about 78% of Americans have $50,000 or less saved for retirement.