Is it smart to keep money in Robinhood?

Is it safe to leave money on Robinhood

Is Robinhood Safe to Use YES–Robinhood is absolutely safe. Your funds on Robinhood are protected up to $500,000 for securities and $250,000 for cash claims because they are a member of the SIPC (Securities Investor Protection Corporation).

Cached

Do I actually own stock on Robinhood

Do you actually own the stock on Robinhood Investors do own the shares of stocks and ETFs purchased on the Robinhood platform. This is the same type of stock ownership you get when you purchase stocks through most other brokerage companies.

Cached

Is my money safe if Robinhood goes out of business

Since Robinhood is a member of SIPC, you are covered for up to $500,000 worth of securities, including $250,000 which can cover cash. So, if Robinhood somehow went out of business and lost customer assets, the SIPC would step in. Your assets would be safe regardless of what happens to the brokerage.

What is the average account balance on Robinhood

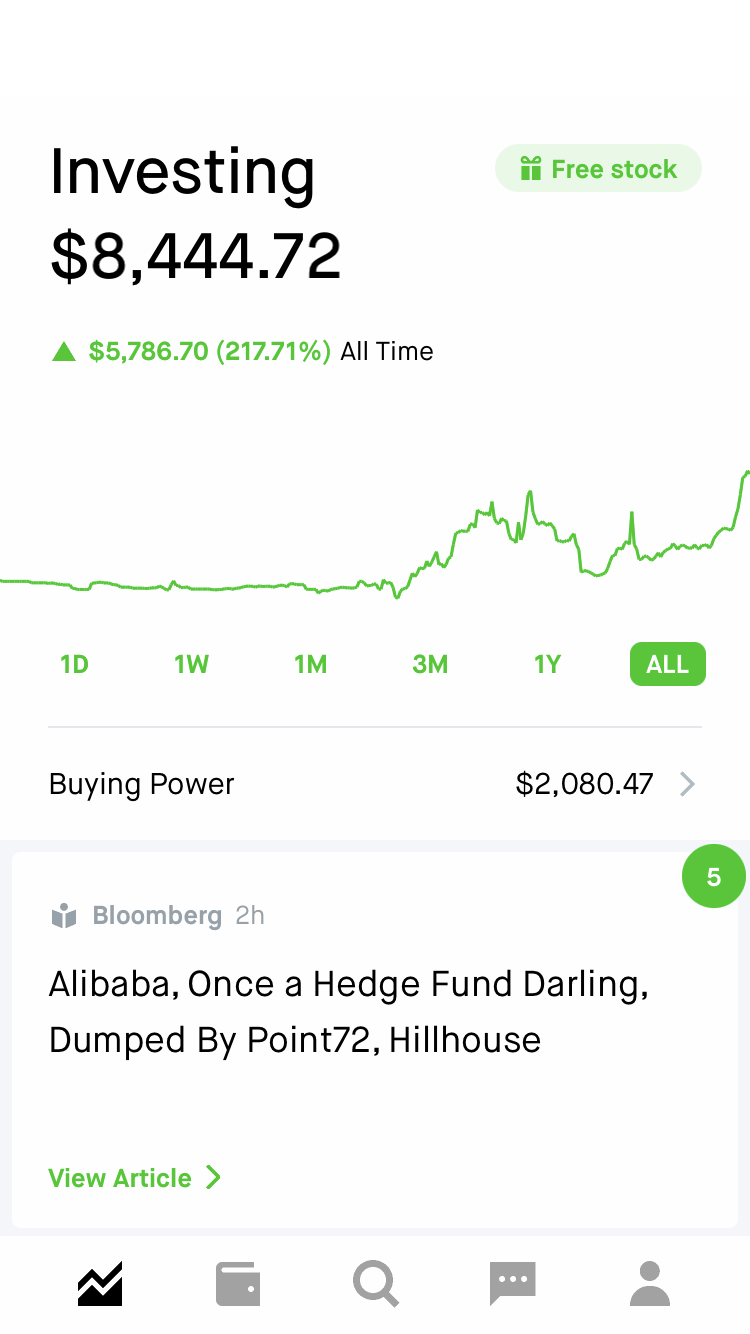

Robinhood Yearly Average Account Size

| Robinhood Average Account Size 2023 | $2,371 |

|---|---|

| Robinhood Average Account Size 2023 | $2,771 |

| Robinhood Average Account Size 2023 | $5,038 |

| Robinhood Average Account Size 2023 | $4,317 |

| Robinhood Average Account Size 2023 | $2,695 |

Do you get taxed if you leave your money in Robinhood

The length you hold the investment determines the taxes owed. A common misconception is that you can trade as much as you like, and if you don't withdraw money, you owe no taxes. While this holds true in retirement accounts, it does not with taxable (non-retirement) investment accounts.

What are the negatives of Robinhood

What are the disadvantages of using Robinhood The main downside of Robinhood is that the investment selection is limited for hands-off, passive investors: The broker offers no mutual funds or index funds, which financial advisors typically suggest using as the basis of a diversified portfolio.

Can you make profit off Robinhood

You can make money on Robinhood by holding stocks that will pay dividends. You can then reinvest the dividends to earn compound interest. Besides this, you can earn money by asset appreciation. This means you sell something for a higher price than you purchased it for.

How does Robinhood make money off me

That is, Robinhood routes its users' orders through a market maker who actually makes the trades and compensates Robinhood for the business at a rate of a fraction of a cent per share. Robinhood also makes money by investing users' cash deposits at a higher interest rate.

Is there any downside to using Robinhood

What are the disadvantages of using Robinhood The main downside of Robinhood is that the investment selection is limited for hands-off, passive investors: The broker offers no mutual funds or index funds, which financial advisors typically suggest using as the basis of a diversified portfolio.

Can I leave Robinhood and keep my stocks

You can transfer all your eligible securities in a full ACATS transfer, or only some in a partial ACATS transfer. After you complete a full ACATS transfer, we'll put your account on hold. We charge a $100 fee for a partial or full ACATS out of Robinhood.

Can I use Robinhood as a savings account

You may know Robinhood as a financial services company that makes it easy to invest. The Robinhood Cash Management Account is its hybrid savings and checking account. It pays a relatively high interest rate like a high-yield savings account, but it comes with a debit card like a checking account.

How much is Robinhood monthly fee

Investing with a Robinhood brokerage account is commission free. We don't charge you fees to open your account, to maintain your account, or to transfer funds to your account.

Do I leave my money in stocks

When the stock market is in free fall, holding cash helps you avoid further losses. Even if the stock market doesn't drop on a particular day, there is always the potential that it could have fallen—or will tomorrow. This possibility is known as systematic risk, and it can be completely avoided by holding cash.

How much taxes you pay on Robinhood

We'll also begin 24% backup tax withholding on your Robinhood Securities account. That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding.

How do I get out of Robinhood

Close my accountSelect Account (person) → Settings.Select Account Information → Deactivate Account.Follow the steps to close all your brokerage positions and withdraw your outstanding balance.After your balance is $0 and your positions are closed, you can confirm your deactivation request.

Is Fidelity better than Robinhood

Robinhood is good for simple trades, while Fidelity's mobile offering is more comprehensive and a better platform when it comes to the complete mobile trade experience.

What are the cons of Robinhood

What are the disadvantages of using Robinhood The main downside of Robinhood is that the investment selection is limited for hands-off, passive investors: The broker offers no mutual funds or index funds, which financial advisors typically suggest using as the basis of a diversified portfolio.

How to turn $1,000 into $10,000 in a week

The Best Ways To Turn $1,000 Into $10,000Retail Arbitrage. Have you ever bought something and then resold it for a profitInvest In Real Estate.Invest In Stocks & ETFs.Start A Side Hustle.Start An Online Business.Invest In Small Businesses.Invest In Alternative Assets.Learn A New Skill.

Is using Robinhood a good idea

Robinhood provides a bare-bones trading experience, making it a poor choice for investors seeking the best trading platform. Also, Robinhood's stock research tools are lacking when compared to $0 commission brokers such as E*TRADE, Charles Schwab, and Fidelity.

Why not to invest in Robinhood

Robinhood provides a bare-bones trading experience, making it a poor choice for investors seeking the best trading platform. Also, Robinhood's stock research tools are lacking when compared to $0 commission brokers such as E*TRADE, Charles Schwab, and Fidelity.