Is land a asset or liabilities?

Is land an asset or equity or liabilities

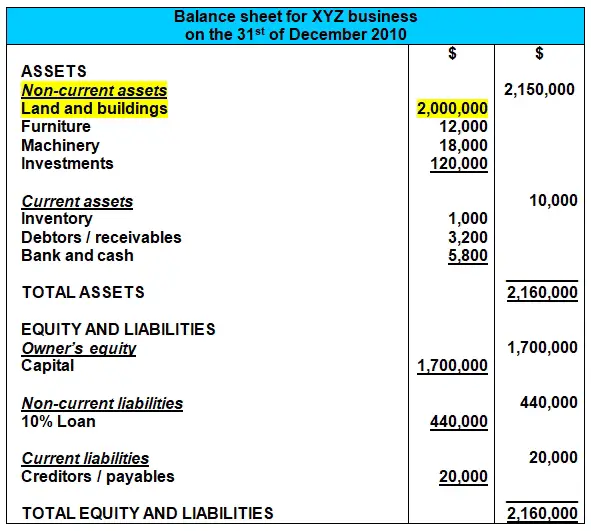

Since land is an asset that is a long-term investment, which provides value for more than a year and is generally not liquidated within a year of its purchase, it should be categorized as a fixed asset on a business's balance sheet.

Can land be a liabilities

Instead, land is classified as a long-term asset, and so is categorized within the fixed assets classification on the balance sheet. The balance sheet is one of the financial statements, and summarizes an organization's assets, liabilities, and shareholders' equity as of a specific point in time.

Cached

What are 5 examples of liabilities

Examples of liabilities are -Bank debt.Mortgage debt.Money owed to suppliers (accounts payable)Wages owed.Taxes owed.

What type of account is land

A long-term asset account that reports the cost of real property exclusive of the cost of any constructed assets on the property. Land usually appears as the first item under the balance sheet heading of Property, Plant and Equipment.

How do you account for land

When you sell land, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount of land from the general ledger. Unless the buyer pays you exactly what you paid for the land, there will also be a gain or loss on sale of the land.

Are houses an asset

Given the financial definitions of asset and liability, a home still falls into the asset category. Therefore, it's always important to think of your home and your mortgage as two separate entities (an asset and a liability, respectively).

Is land a good asset to own

The land is always a profitable investment as you can make money off it quickly. You can either sell your land, use it to grow crops, use the land as boat storage, or lease it out. The highest and best use of land is an imperative factor that determines the value of your land.

What are 10 examples of assets

What are the Main Types of AssetsCash and cash equivalents.Accounts Receivable.Inventory.Investments.PPE (Property, Plant, and Equipment)Vehicles.Furniture.Patents (intangible asset)

Is a house an asset or liability

Given the financial definitions of asset and liability, a home still falls into the asset category. Therefore, it's always important to think of your home and your mortgage as two separate entities (an asset and a liability, respectively). Finally, your house is your home.

How is land recorded on a balance sheet

Land, buildings, and equipment are reported on a company's balance sheet at net book value, which is cost less any of that figure that has been assigned to expense. Over time, the expensed amount is maintained in a contra asset account known as accumulated depreciation.

Is owning land an asset

Is Land a Current Asset or Long-Term Asset Land is classified as a long-term asset on a business's balance sheet, because it typically isn't expected to be converted to cash within the span of a year. Land is considered to be the asset with the longest life span.

Where does land go on a balance sheet

Land is always reported at historical cost on the balance sheet and would remain at historical cost since land is not depreciated. In addition, there is no fair value adjustment unless the land is sold or is part of a transaction.

What is not an asset

While an asset is something with economic value that's owned or controlled by a person or company, a liability is something that is owed by a person or company. A liability could be a loan, taxes payable, or accounts payable.

Is your car an asset

In accounting terms, your car is a depreciating asset. This means your vehicle may have value right now and you could sell it. However, while you own the car, that value usually goes down over time.

Is it smart to buy land and build later

Perhaps there's a perfect property that comes up for sale and you don't want to lose it, so buying the land now and building later makes sense. From a financial perspective, it may be much more feasible to split up the investments and have time to rebuild your savings before being ready to build.

Is there a downside to buying land

Land can be expensive to trade into and out of. There's real estate agent commissions, surveys, title insurance premiums, transaction taxes, etc. and all of these costs (those that you pay when you buy land and those that you pay when you sell it) reduce your profit.

What are your 3 greatest assets

Your 3 greatest assets are not what you sell, it's not your customers, it's not your territory. Your three greatest assets are your time, your mind, and your network. Each day your objective is to protect your time, grow your mind, and nurture your network.

What are 6 best assets

Being able to adapt when an extra hand is needed or when a transition happens is a great soft skill.Teamwork. Working with others, especially being able to respect others' different opinions, is an important component of teamwork.Empathy.Patience.Time Management Skills.Interpersonal Skills.

Is 401k considered an asset

Retirement account: Retirement accounts include 401(k) plans, 403(b) plans, IRAs and pension plans, to name a few. These are important asset accounts to grow, and they're held in a financial institution. There may be penalties for removing funds from these accounts before a certain time.

Where is land recorded in accounting

balance sheet

Land, buildings, and equipment are reported on a company's balance sheet at net book value, which is cost less any of that figure that has been assigned to expense. Over time, the expensed amount is maintained in a contra asset account known as accumulated depreciation.