Is land an asset or liability?

Is land an asset or liabilities or equity

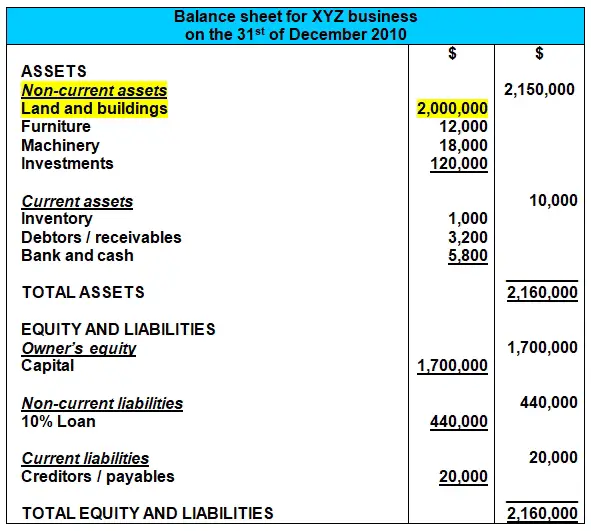

Land is an example of an asset that an individual or a firm can own. Therefore, land is recorded in the balance sheet and classified as a fixed asset.

Cached

Can land be a liabilities

Instead, land is classified as a long-term asset, and so is categorized within the fixed assets classification on the balance sheet. The balance sheet is one of the financial statements, and summarizes an organization's assets, liabilities, and shareholders' equity as of a specific point in time.

Cached

Are lands an asset

Since land is an asset that is a long-term investment, which provides value for more than a year and is generally not liquidated within a year of its purchase, it should be categorized as a fixed asset on a business's balance sheet.

What type of account is land

A long-term asset account that reports the cost of real property exclusive of the cost of any constructed assets on the property. Land usually appears as the first item under the balance sheet heading of Property, Plant and Equipment.

What are 5 examples of liabilities

Examples of liabilities are -Bank debt.Mortgage debt.Money owed to suppliers (accounts payable)Wages owed.Taxes owed.

How do you account for land

When you sell land, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount of land from the general ledger. Unless the buyer pays you exactly what you paid for the land, there will also be a gain or loss on sale of the land.

Is land a good asset to own

The land is always a profitable investment as you can make money off it quickly. You can either sell your land, use it to grow crops, use the land as boat storage, or lease it out. The highest and best use of land is an imperative factor that determines the value of your land.

Is land a good asset

The land is always a profitable investment as you can make money off it quickly. You can either sell your land, use it to grow crops, use the land as boat storage, or lease it out. The highest and best use of land is an imperative factor that determines the value of your land.

How is land recorded on a balance sheet

Land, buildings, and equipment are reported on a company's balance sheet at net book value, which is cost less any of that figure that has been assigned to expense. Over time, the expensed amount is maintained in a contra asset account known as accumulated depreciation.

What are 10 examples of assets

What are the Main Types of AssetsCash and cash equivalents.Accounts Receivable.Inventory.Investments.PPE (Property, Plant, and Equipment)Vehicles.Furniture.Patents (intangible asset)

Is a house an asset or liability

Given the financial definitions of asset and liability, a home still falls into the asset category. Therefore, it's always important to think of your home and your mortgage as two separate entities (an asset and a liability, respectively). Finally, your house is your home.

Is land an asset or expense

Land is classified as a long-term asset on a business's balance sheet, because it typically isn't expected to be converted to cash within the span of a year. Land is considered to be the asset with the longest life span.

Where does land go on a balance sheet

Land is always reported at historical cost on the balance sheet and would remain at historical cost since land is not depreciated. In addition, there is no fair value adjustment unless the land is sold or is part of a transaction.

Is there a downside to buying land

Land can be expensive to trade into and out of. There's real estate agent commissions, surveys, title insurance premiums, transaction taxes, etc. and all of these costs (those that you pay when you buy land and those that you pay when you sell it) reduce your profit.

Why is land not an asset

Land is a long-term asset, not a current asset, because it's expected to be used by the business for more than one year. Current assets are a business's most liquid assets and are expected to be converted to cash within one year or less.

Is it smart to buy land

The land is always a profitable investment as you can make money off it quickly. You can either sell your land, use it to grow crops, use the land as boat storage, or lease it out. The highest and best use of land is an imperative factor that determines the value of your land.

Where is land recorded in accounting

When a company purchases land, it is recorded as an asset on the company's balance sheet at its cost. The cost of the land includes any fees or expenses associated with the purchase, such as closing costs and legal fees. The land is then held as an asset until it is sold or otherwise disposed of.

What is your strongest asset

We've heard it before, “Attitude is everything.” It's true. Your attitude is your greatest asset and can make up for gaps in your expertise, skills, and knowledge while growing in those areas. Make sure that you're intentional in keeping your attitude strong and contagious in a good way.

Is your car an asset

In accounting terms, your car is a depreciating asset. This means your vehicle may have value right now and you could sell it. However, while you own the car, that value usually goes down over time.

How do you record land on a balance sheet

Land is always reported at historical cost on the balance sheet and would remain at historical cost since land is not depreciated. In addition, there is no fair value adjustment unless the land is sold or is part of a transaction.