Is manufacturing a credit or debit?

Is manufacturing cost a debit or credit

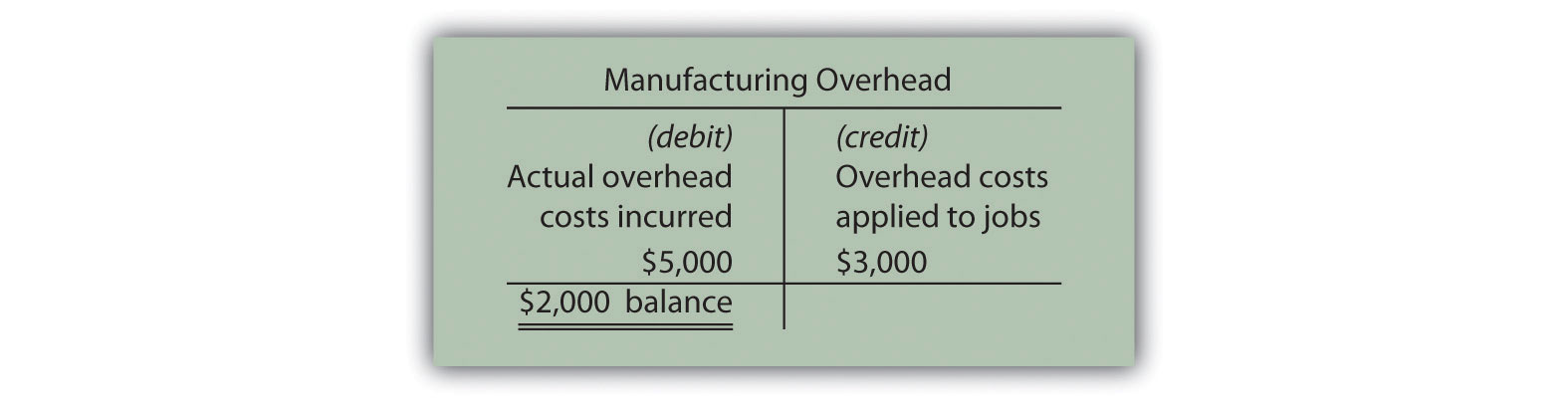

Recall that manufacturing overhead costs include all production costs other than direct labor and direct materials. The actual manufacturing overhead costs incurred in a period are recorded as debits in the manufacturing overhead account.

CachedSimilar

Is manufacturing overhead a credit

Manufacturing Overhead Account

The overhead account is debited for the actual overhead costs as incurred. The overhead account is credited for the overhead costs applied to production in the work-in-process account.

Is manufacturing overhead a debit

Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated.

Cached

When manufacturing overhead has a debit balance

If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied.

Is manufacturing an expense

Manufacturing costs are the expenses directly related to building the product. Both production costs and manufacturing costs must be included in the calculation of the per-item cost of doing business.

What is manufacturing in accounting

Manufacturing accounting is a group of inventory and production management processes used for monitoring and controlling the costs involved with manufacturing products. The process mostly revolves around cost accounting practices and conducting inventory valuation and production costing.

Does manufacturing overhead increase with a debit or credit

Debit

Factory Payroll and Factory Overhead are temporary accounts that act like assets/expenses meaning Debit will increase and Credit will decrease.

How do you Journalize manufacturing overhead

Answer: To allocate manufacturing overhead, Work-in-Process Inventory is debited and Manufacturing Overhead is credited. Work-in-Process Inventory is treated as an current asset, and increase the assets of the company and Manufacturing Overhead is decreased, which increases equity of the company.

How do you account for manufacturing overhead

First, you have to identify the manufacturing expenses in your business. Once you do, add them all up or multiply the overhead cost per unit by the number of units you manufacture. To get a percentage, divide by your monthly sales and multiply that number by 100.

What type of account is manufacturing

What is Manufacturing Account The manufacturing account gives information on all the expenses and costs incurred in the preparation of the goods to be sold. This includes the expenses that are met in the path of preparing the goods but not the finished goods.

Is manufacturing an asset

The inventory of a manufacturing company is listed in the current asset section of the balance sheet, because it is likely to be consumed or sold over a 12-month period. There are three basic types of inventory: raw materials, work in process and finished goods.

Is Overapplied debit or credit

When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the overapplication. Doing so results in the actual amount of overhead incurred being charged through the cost of goods sold.

What is a credit balance in the manufacturing overhead control account

A credit balance at the end of the period in the manufacturing overhead account indicates that the overhead is overapplied. When the applied overhead is more than the actual overhead, the overhead is said to be overapplied. The manufacturing overhead account is usually credited when the overhead is applied.

What is the journal entry for manufacturing overhead

To allocate manufacturing overhead, Work-in-Process Inventory is debited and Manufacturing Overhead is credited. Work-in-Process Inventory is treated as an current asset, and increase the assets of the company and Manufacturing Overhead is decreased, which increases equity of the company.

Is manufacturing overhead on the balance sheet

According to generally accepted accounting principles (GAAP), the manufacturing overhead appears on the balance sheet as the cost of a finished product in and inventory and work-in-progress inventory as well as the cost of the goods income statement.

How do you account for manufacturing

A simple formula for calculating Total manufacturing Cost is:TMC = (Direct materials + Direct labor + Direct misc.)Total Manufacturing Cost = Prime cost + Manufacturing overhead.COGM = Beginning WIP + Total Manufacturing Cost – Ending WIP.

What category is manufacturing

About the Manufacturing sector. The manufacturing sector is part of the goods-producing industries supersector group. The Manufacturing sector comprises establishments engaged in the mechanical, physical, or chemical transformation of materials, substances, or components into new products.

What goes under debit and credit

Debits record incoming money, whereas credits record outgoing money. When using the double-entry system, it's important to assign transactions to different accounts: assets, expenses, liabilities, equity and/or revenue.

Where are manufacturing costs recorded

Manufacturing costs are the costs incurred during the production of a product. These costs include the costs of direct material, direct labor, and manufacturing overhead. The costs are typically presented in the income statement as separate line items. An entity incurs these costs during the production process.

What is manufacturing balance sheet

What is a Balance Sheet The balance sheet of a manufacturing company comprises the number of assets it owns, along with the capital and liabilities, equity of the owners, etc., at a given point of time, which is generally the year or month-end.