Is Marcus a good account?

Is Marcus bank worth it

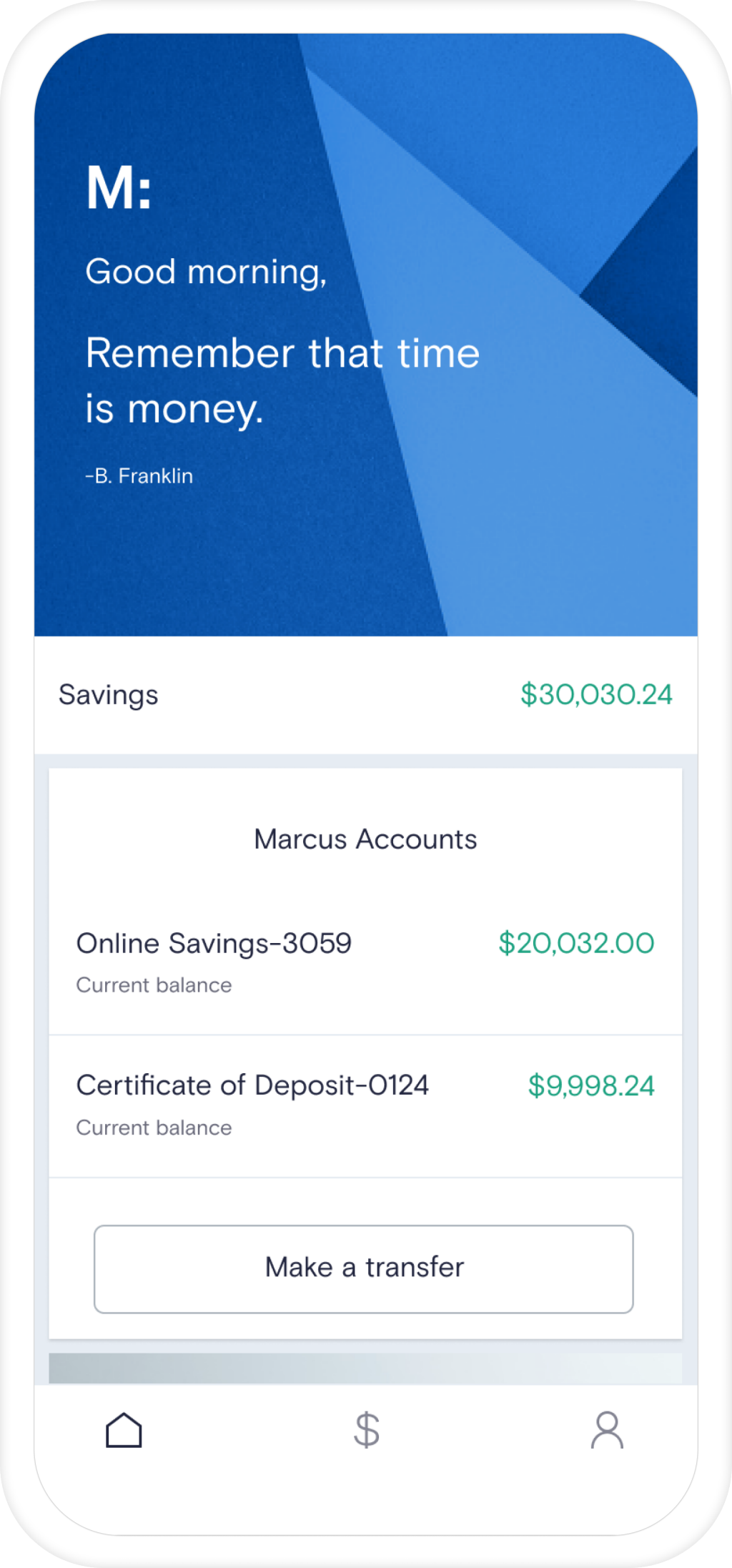

Marcus by Goldman Sachs Bank is best for customers comfortable with online banking looking to park their money in a high-yield savings account or a high-yield CD. However, since Marcus doesn't offer a money market or checking account, it isn't best for those looking to consolidate their banking under one roof.

Cached

Is Marcus bank trustworthy

Yes, Marcus is a legitimate set of banking products and services offered by Goldman Sachs. These services include savings accounts, certificates of deposit and personal loans. Marcus by Goldman Sachs accounts are insured by the FDIC, and its apps have high ratings from both Apple and Google users.

Cached

What are the drawbacks of a Marcus savings account

You cannot deposit cash into a Marcus savings account. Marcus doesn't charge a fee if you link other bank accounts for incoming and outgoing transfers, but keep in mind that your other bank might. There is currently no limit to the number of withdrawals or transfers per statement cycle.

Is Marcus by Goldman Sachs in trouble

Goldman Sachs revealed a painful drop in quarterly profits Tuesday, slammed by a dealmaking slump and a major loss tied to the money-losing consumer bank Marcus.

What is the downside of Marcus by Goldman Sachs

Cons. No physical locations: Marcus is an online-only division of Goldman Sachs, therefore customers do not have access to any physical branches. No checking account options: Marcus does not offer any checking account options. For customers who want a wider range of product offerings, this could be a drawback.

Does opening a Marcus account affect credit score

Simply put, no, opening a savings account does not impact your credit score because you're not borrowing money.

Does Marcus run your credit

Marcus will run a hard credit check, verify your income information and may request additional documentation to support your application. Once approved, sign the necessary loan agreement and other documentation so you can receive your loan funds.

Does opening a Marcus savings account affect credit score

Opening a savings account does not impact your credit score because you aren't borrowing money and the activity in your savings account isn't reported to a credit agency.

Why did Marcus by Goldman fail

Goldman's consumer banking project, dubbed Marcus, was originally created to attract Main Street interest and take on competitors like JPMorgan Chase (JPM) but failed as the bank was plagued by higher interest rates, a shaky macro environment, and what previous reports have categorized as a negative culture with …

How much can you withdraw from Marcus

Unlike some other savings accounts, the Marcus account currently has no limits on the number of withdrawals you can make per month. It also allows up to $125,000 transfers per month online (with same-day transfers up to $100,000) and unlimited transfers when you call.

How often does Marcus pay interest

compounded daily

How often does Marcus pay interest Interest is compounded daily and credited monthly to your account. Interest is calculated using the daily balance method. This method applies a daily periodic rate to the principal and interest that has accrued in the Account each day.

How hard is it to get a loan from Marcus

Relatively high eligibility requirements

To qualify for a loan with Marcus at the most-competitive rates, you'll probably need to be seen as very creditworthy by the lender. In fact, 95% of people approved for a Marcus loan have FICO® credit scores of at least 660, according to Goldman Sachs' 2023 annual report.

How long does it take to get money out of Marcus

Loan disbursement can take several days: While some lenders offer loan disbursements in as little as one day, it can take up to three business days to receive your funds from Marcus. If you have an emergency expense and need money right away, you may need to work with another lender.

What credit score do you need for Marcus pay

Marcus doesn't disclose many borrower requirements, but here are a few must-haves to qualify: Minimum credit score: 740. Must show ability to repay the loan, through income from employment, self-employment or other sources. Must provide a Social Security number and Individual Tax ID number.

How much money can you put in a Marcus account

Customer Deposit Limits

Each deposit account owner is limited to a maximum balance of $3,000,000 across all deposit accounts. Online Savings Accounts and CDs are limited to a maximum balance of $1,000,000 per account.

How much can I put in a Marcus account

You can read more about moving your money in our terms and conditions. How much can I pay into my account The maximum amount you can save in any Marcus account is £250,000. If your balance is close to the pay in limit of £250,000, you may accrue interest that pushes your account balance over the maximum pay in limit.

Why does Goldman Sachs have a bad reputation

Personnel "revolving-door" with US government. During 2008 Goldman Sachs received criticism for an apparent revolving door relationship, in which its employees and consultants have moved in and out of high level U.S. Government positions, creating the potential for conflicts of interest.

Is there a penalty for withdrawing from Marcus savings account

If you want to withdraw a portion (or all) of the principal amount, you'll face early withdrawal penalties. For terms less than 12 months the penalty is 90 days' simple interest, terms of 12 months to five years cost 270 days of interest and terms longer than five years penalize 365 days of simple interest earned.

How much interest does $10000 earn in a year

Currently, money market funds pay between 4.47% and 4.87% in interest. With that, you can earn between $447 to $487 in interest on $10,000 each year. Certificates of deposit (CDs). CDs are offered by financial institutions for set periods of time.

What credit score is needed for Marcus loan

Marcus doesn't disclose many borrower requirements, but here are a few must-haves to qualify: Minimum credit score: 740. Must show ability to repay the loan, through income from employment, self-employment or other sources. Must provide a Social Security number and Individual Tax ID number.