Is my account number the same as my ACH?

Does ACH mean account number

The acronym ACH stands for Automated Clearing House , and like ABA routing numbers, ACH routing numbers are nine-digit numbers unique to their respective financial institutions. Unlike ABA routing numbers, ACH routing numbers are used for electronic transactions between financial institutions.

Cached

How do I find my ACH number

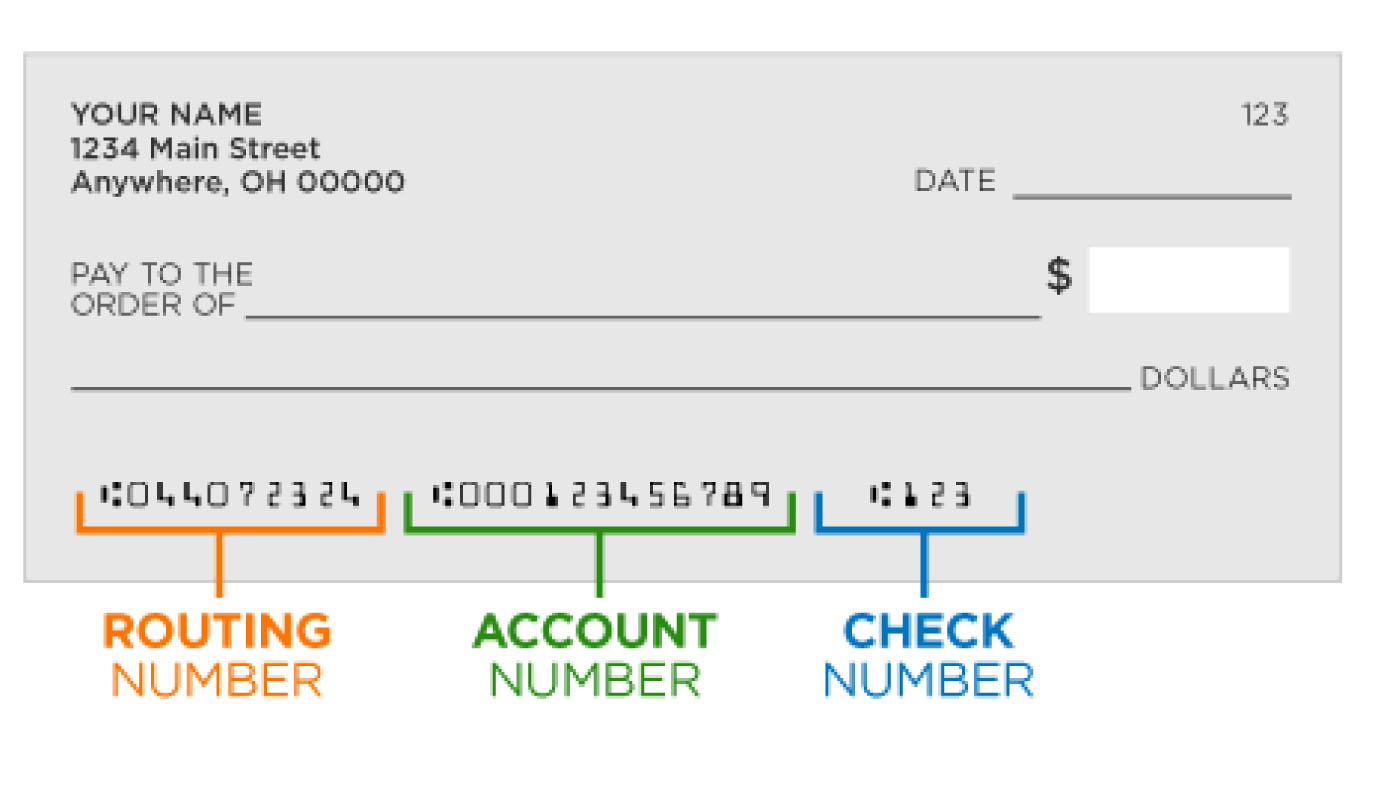

To find your ACH routing number, first check your checkbook. It may be the nine-digit number to the left of your account number. ACH is an electronic money transfer system that lets individuals receive or send payments via the Federal ACH network of banks in the United States.

Cached

Does ACH use routing and account number

An ACH routing number is a 9-digit, unique numeric ID assigned to each banking institution in the US. It's needed for banks to identify where payments should be taken from and sent to. The routing number is used in conjunction with an account number to send or receive an ACH payment.

Cached

Is the ACH number the account number for direct deposit

Do I use my ACH number for direct deposit Yes, you need to provide your employer with your ACH number as well as your bank account number to set up direct deposit.

What is the difference between ACH and checking account

The main differences between ACH vs check payments are cost, security, and speed of delivery. ACH transfers are electronic whereas checks are physical documents that are manually sent – making ACH transfers a safer and more efficient payment method.

Is the ACH number different than the routing number

ACH routing numbers are different from ABA routing numbers since they're used specifically for electronic transactions. The first two digits of ACH routing numbers typically range from 61 to 72, whereas the first two digits of ABA routing numbers range between 00 and 12.

What is a 10 digit ACH number

An ACH company ID is a 10-digit unique identifier used for identifying entities, called originators, collecting payments via ACH debit. Similar to a mailing address, an ACH company ID helps ensure an ACH debit is delivered to the correct account holder. All communications with Nacha will use this ID.

What info do you need to send money via ACH

ACH Payment Requirements:The name of the financial institution receiving the funds (bank or credit union)The type of account at that bank (checking vs. savings)The ABA routing number of the financial institution.The recipient's account number.

Is ACH and direct deposit the same

Is ACH Direct Deposit Direct deposits are a type of ACH payment – so yes, ACH is a direct deposit, but there are also other types of ACH payments. On the other hand, all direct deposits are ACH transfers.

Can you use a checking account for ACH

ACH payments apply to checking and savings accounts and include direct deposits and recurring payments. The National Automated Clearing House Association, or Nacha, oversees and governs the ACH network.

Is a direct deposit the same as a ACH payment

ACH transfers are electronic, bank-to-bank money transfers processed through the Automated Clearing House Network. Direct deposits are transfers into an account, such as payroll, benefits, and tax refund deposits.

What is another name for ACH routing number

American Clearing House

They are commonly referred to as ABA routing numbers or American Clearing House (ACH) routing numbers, and can be found on personal checks, bank websites or the ABA's online database.

Is a bank transfer the same as an ACH

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Are account numbers 9 or 10 digits

Bank account numbers typically consist of eight to 12 digits, but some account numbers could even contain up to 17 digits. You can find your account number on your checks or by accessing your account on your financial institution's website or by contacting the bank directly.

Is ACH considered a wire transfer

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Can ACH be used for direct deposit

A “direct deposit” is a type of payment made via the ACH network. It's an informal name for common ACH deposits where individuals receive payments directly into their bank accounts. The ACH-based payouts popularly referred to as direct deposits include: Salary and wages.

What information is required for an ACH transfer

ACH Payment Requirements:The name of the financial institution receiving the funds (bank or credit union)The type of account at that bank (checking vs. savings)The ABA routing number of the financial institution.The recipient's account number.

What is my account number

Look at a check. Your account number (usually 10 digits) is specific to your personal account. It's the second set of numbers printed on the bottom of your checks, just to the right of the bank routing number.

What is the difference between a routing number and an account number

Routing vs Account Number

A routing number is nine digits that identify the financial institution that holds your account, while an account number is the unique 9 to 12 digit number that identifies your specific account within that financial institution.

What is another name for ACH transfer

EFT transfer

In simplest of terms, EFT's are any transfer of funds from one account to another that occurs electronically. EFTs include both ACH and Wire Transfer services. ACH transfers are sometimes referred to as an EFT transfer, because EFT is a term that covers several different types of financial transactions.