Is negative good on credit card?

Why do I have a negative balance on my Discover credit card

(Remember, a negative balance on a credit card means that you've paid more than the amount of credit issued to you, so you actually have MORE money available to spend on your account.)

What does a negative balance mean on a bill

A negative balance indicates that your bill was overpaid and that you may be eligible for a refund.

Cached

Can I overpay my credit card to increase limit

An overpayment will not help boost your credit limit, not even temporarily. Your credit limit remains the same – you'll just have a negative balance that will be applied toward your next statement. Details like credit score and income are usually factored into a credit limit increase.

What does a positive credit card balance mean

A positive balance on your credit card, also called a credit balance, is an overpayment or refund on your card. It's an amount that belongs to you, so it's the opposite of an amount you owe.

Can I overpay my credit card

There are no penalties if you've accidentally paid more than you owe, and there are laws in place that require issuers to refund your overpayment. Funto Omojola started writing for NerdWallet in 2023.

Is it bad to have a negative balance on debit card

You may incur overdraft fees

Banks are entitled to charge an overdraft fee for each transaction that results in a negative balance. These can add up quickly, especially if you're using your debit card for multiple small transactions in a short span of time.

Is it bad if my credit card balance is negative

Having a negative balance on a credit card isn't a bad thing, but it has some points to consider: Negative balances don't affect credit. Most credit models typically consider negative balances equivalent to a $0 balance. This means a negative balance won't hurt a credit score.

Does a negative balance mean you owe money

You'll have a negative balance if your credit card issuer owes you money. It will be marked with a minus sign in front of the number listed for your current balance. You could see a negative balance if you accidentally overpaid your bill. You could also see one if you got a refund for a returned purchase.

What happens if you put too much money on your credit card

The Bottom Line

And the credit card issuer is required to return the overpayment, so you won't be out the money, either. This can be accomplished either with a check or deposit to your bank account, or through using the overpayment to cover new charges.

What happens if I pay my credit card early

Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.

Is it OK to overpay credit card

The Bottom Line. It can be annoying to accidentally overpay a credit card bill, but it won't affect your credit. And the credit card issuer is required to return the overpayment, so you won't be out the money, either.

What happens if I overpay my credit card balance

Whether you've made too large a payment or had a refund come through for a recent return, an overpayment results in a negative balance on your credit card. Suddenly, your credit card issuer owes you money instead of the other way around.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

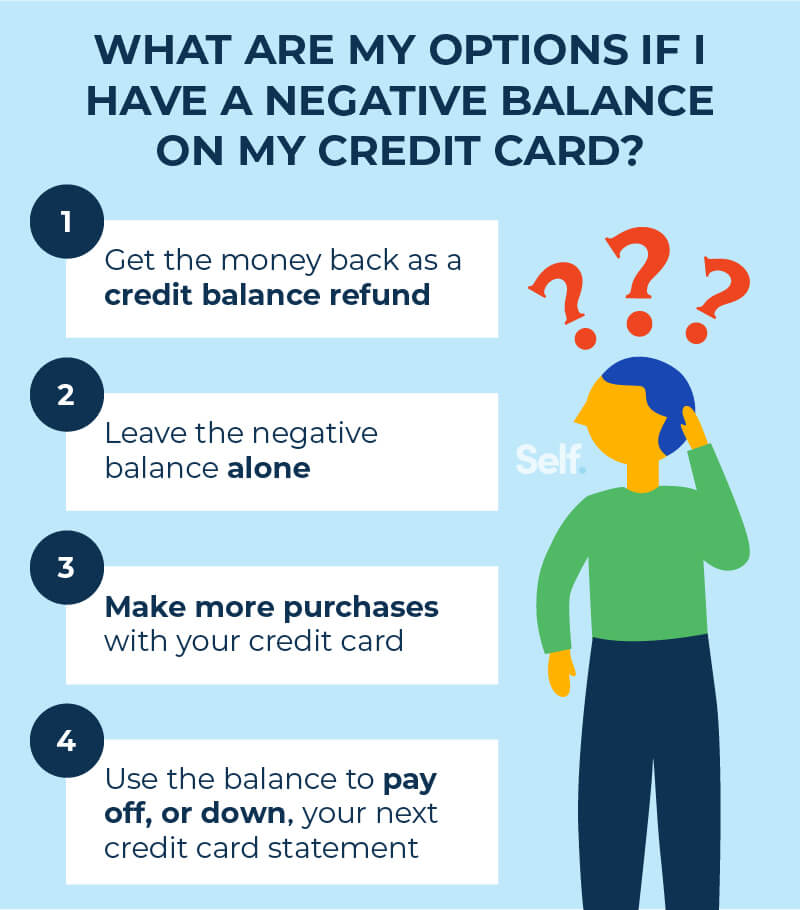

How do I get rid of negative balance on my credit card

If you have a negative balance on your credit card account, the simplest way to bring your balance back to $0 is to make new purchases. For instance, if you have a -$50 balance, you can simply apply it to future purchases.

Does negative debit affect credit score

Your credit report only includes money you owe or have owed. An overdraft won't affect your credit score as long as you take care of the problem quickly. If you don't repay an overdraft and it goes to collections, it can negatively affect your credit score.

Is negative balance of payments bad

In the short-term, a balance of payments deficit isn't necessarily bad or good. It does mean that, in real terms, there is more importation than exportation occurring until the value of money adjusts.

How much money should be left on your credit card

A good rule of thumb is to keep your credit utilization under 30 percent. This means that if you have $10,000 in available credit, you don't ever want your balances to go over $3,000. If your balance exceeds the 30 percent ratio, try to pay it off as soon as possible; otherwise, your credit score may suffer.

Is $1,000 on a credit card bad

A $1,000 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

Is it OK to pay credit card before statement

Paying your credit card balance before your billing cycle ends can have a positive impact on your finances. It'll prevent you from missing a payment, help you avoid expensive interest charges, increase your credit limit and improve your credit score faster.

Is it bad to pay off credit card before statement

If you can afford to pay your balance in full every month, doing so before your monthly statement closing date has the benefit of ensuring that no outstanding card balance is reported to the credit bureaus—which can boost your credit scores.