Is one derogatory account affect your score?

How much does one derogatory account affect your score

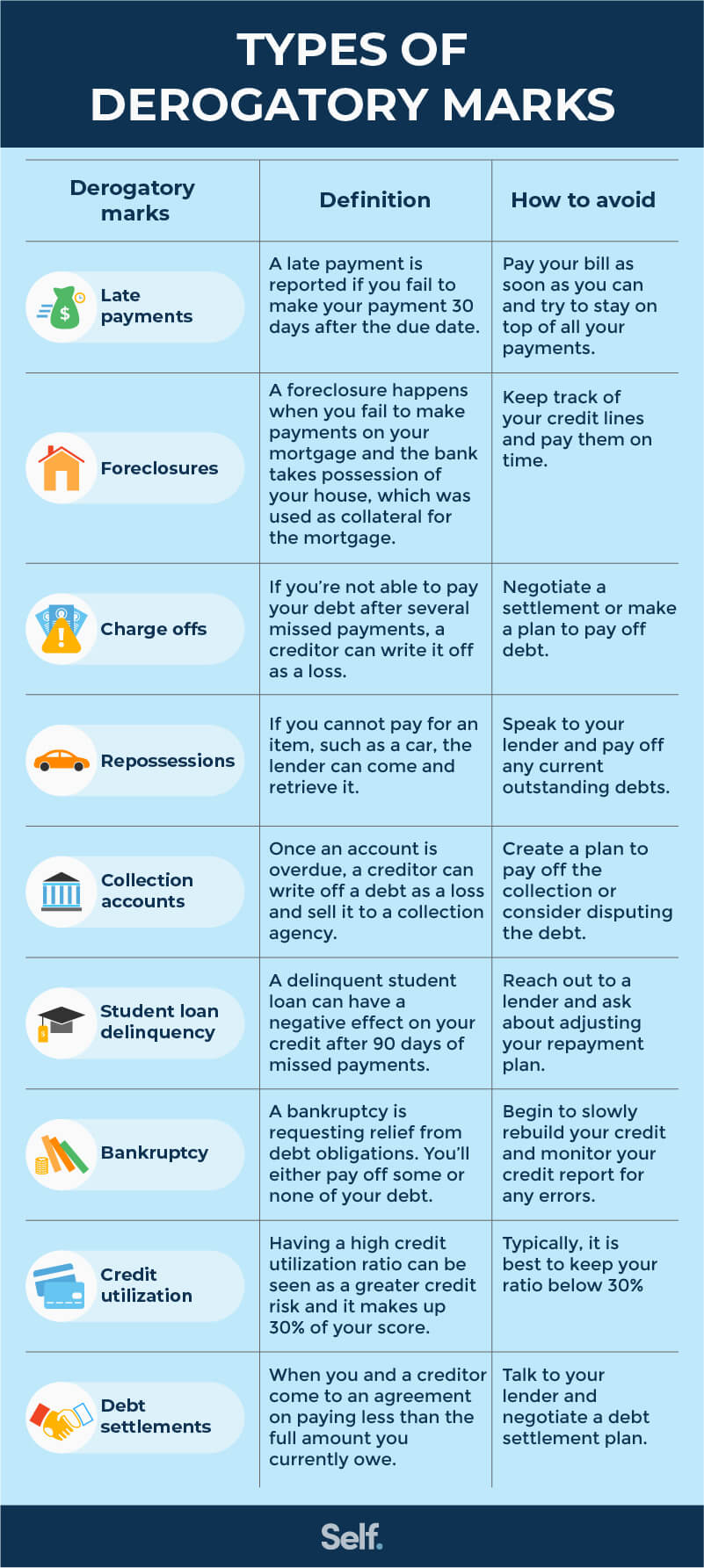

Late payments

It can appear on your report as a derogatory remark and has the potential to lower your credit score by 100 points or more.

Cached

Is one derogatory mark bad

Most derogatory marks stay on your credit reports for about seven years, and one type may linger for up to 10 years. The damage to your credit score means you may not qualify for new credit or may pay more in interest on loans or credit cards.

Cached

Do derogatory marks affect credit score

These derogatory marks generally stay on your credit reports for up to 7 or 10 years (sometimes even longer) and damage your scores. If you have a lower score coupled with a derogatory mark, you may have a hard time getting approved for credit or may get less-than-ideal credit terms.

Cached

Can a derogatory mark be removed

Once seven years has passed from the date of delinquency, check your credit report to be sure the derogatory mark has been removed. If it hasn't, you can file a dispute with the relevant credit bureau to have the error removed.

Cached

Should I pay off derogatory marks

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

Should I pay a closed derogatory account

It can be beneficial to pay off derogatory credit items that remain on your credit report. Your credit score may not go up right away after paying off a negative item. However, most lenders won't approve a mortgage application if you have unpaid derogatory items on your credit report.

Can you buy a house with a derogatory mark

Homebuyers can buy a house and qualify for a mortgage with derogatory credit. Borrowers do not need perfect credit to qualify for a home mortgage. You can have derogatory credit tradelines and qualify for FHA, VA, USDA, Conventional, Jumbo, and non-QM loans.

Will my credit score improve if I pay off a derogatory account

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law's editorial disclosure for more information.

Will my credit score go up if I pay off closed accounts

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

How do you get rid of derogatory marks

Following are the strategies on how to remove derogatory items from your credit reportCheck For Inaccuracies.Submit A Dispute To The Credit Bureau.Send A Pay For Delete Offer To Your Creditor.Make A Goodwill Request For Deletion.Wait Out The Credit Reporting Time Limit.

Should I pay derogatory marks

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

Should I pay off my derogatory accounts

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

How many points will my credit score go up when a derogatory is removed

Generally, the boost to scores can range from 50 to 100 points or more. However, this does not happen overnight and may take a few months to reflect. To further improve scores over time, it is important to keep up with smart credit habits such as making payments on time and having a low credit utilization ratio.

Can you buy a house with derogatory marks

Homebuyers can buy a house and qualify for a mortgage with derogatory credit. Borrowers do not need perfect credit to qualify for a home mortgage. You can have derogatory credit tradelines and qualify for FHA, VA, USDA, Conventional, Jumbo, and non-QM loans.