Is PayPal considered a payment processor?

Is PayPal a payment processing company

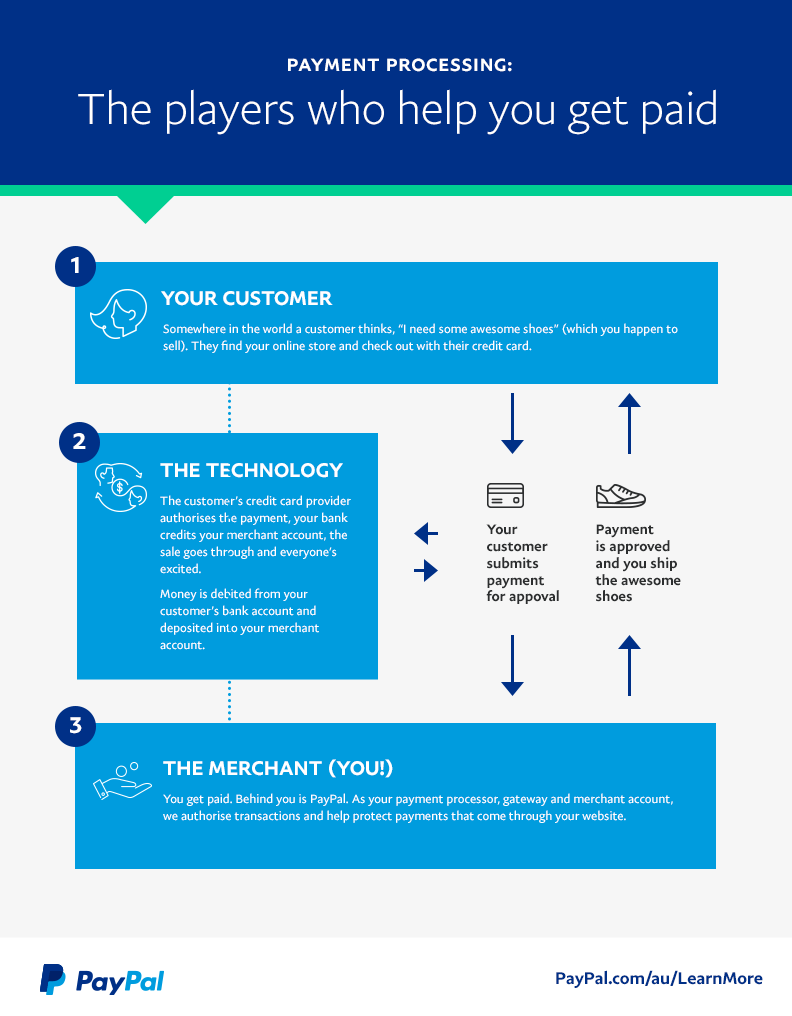

We offer an online payment service that enables you to accept bank or credit card payments for the items you sell. When a customer pays for his or her purchases, we process the payment and transfer the funds to your PayPal account.

What payment processor does PayPal use

Payflow Gateway

Payflow Gateway is PayPal's secure and open payment gateway. Using the Payflow Gateway APIs, merchants can process debit and credit card payments, PayPal, PayPal Credit®, authorizations, captures, and credit voids. PayPal Payments Pro internally utilizes Payflow Gateway and its API, providing the same features.

Is PayPal a merchant card processor

PayPal is also different because, while it offers credit card processing services and can function similarly to a merchant account, it is more expensive than most major credit card processors.

Cached

Is PayPal a third-party payment processor

Third-party payment processor examples include companies like PayPal, Stripe, Square, and GoCardless.

What is considered payment processing

Payment processing allows businesses to accept debit or credit card transactions online or in person. With ecommerce and digital transactions increasing, payment processing has become a necessity.

What are payment processing companies

A payment processing company serves as the conduit between a customer and a merchant. It handles the financial backhaul required to get money from a customer's payment source (like a credit card or digital wallet) into a merchant's business checking account.

Is venmo a payment processor

Venmo offers various benefits for businesses, including speedy processing and transaction security.

Who are payment processors

A payment processor is a company that manages the credit card transaction process, acting as a kind of mediator between the bank and the merchant. Put simply, the payment processor communicates information from your customer's card to your bank and the customer's bank.

Is Zelle a payment processor

Mobile payment processors like Zelle transfer money from one person's or business's bank account to another within minutes. Transferring money instantly with little to no fees can be a game-changer for small businesses.

Is Venmo a payment processor

Venmo offers various benefits for businesses, including speedy processing and transaction security.

How many payment processors are there

As of 2023, there are close to 1300 Visa registered independent sale organizations that essentially sell credit card processing to merchants and business owners.

What are the types of payment processor

A payment processor is a system that enables financial transactions, commonly employed by a merchant, to handle transactions with customers from various channels such as credit cards and debit cards or bank accounts. They are usually broken down into two types: front-end and back-end.

What is the difference between PayPal and Zelle

The main difference between Zelle and Paypal is that Zelle is an entirely free service and does not charge fees for sending or receiving money while PayPal has a very complicated fee structure with many variables. Zelle and PayPal go head to head in this comparison of both money transfer services.

What is meant by payment processor

A payment processor manages the credit card transaction process by acting as the mediator between the merchant and the financial institutions involved. A processor can authorize credit card transactions and works to ensure merchants get paid on time by facilitating the transfer of funds.

Why do people use Zelle instead of PayPal

One limitation of PayPal, Venmo and Cash App is that users must all be using the same service. Zelle's appeal is that anyone with a bank account at a participating financial institution can send money.

Is PayPal safer than Zelle

However, while Zelle may appear more secure, applications like Venmo and PayPal are just as secure. All of them use data encryption to protect users against unauthorized transactions and store users' data on servers in secure locations.

What is downside of using Zelle

Just as with any app, Zelle has disadvantages. They include: Inability to cancel a payment after it's been sent if the recipient is enrolled in Zelle. No availability of a Zelle-branded debit or credit card. Zelle account can't be linked to a credit card.

Is Zelle or PayPal safer

However, while Zelle may appear more secure, applications like Venmo and PayPal are just as secure. All of them use data encryption to protect users against unauthorized transactions and store users' data on servers in secure locations.

Which is safer PayPal or Venmo

Venmo uses encryption to protect your account information. You can also work with Venmo to set up multi-factor authentication or create a PIN for your account. PayPal offers similar security protections as Venmo, but it also provides a more robust set of security features for businesses.

What’s safer Zelle or Venmo

Unlike Zelle, Funds Stored in Venmo Are Not FDIC-Insured

Zelle transfers money directly to and from FDIC-insured bank accounts, so you know the funds you send or receive are protected up to $250,000 per account.