Is PayPal Credit pay monthly?

How often are PayPal Credit payments due

Your due date is at least 23 days after the close of each billing cycle. We will not charge you any interest on non-promotional transactions if you pay your entire balance by the due date each month. We will begin charging interest on promotional purchases on the purchase date.

Cached

Is PayPal pay in 4 every month

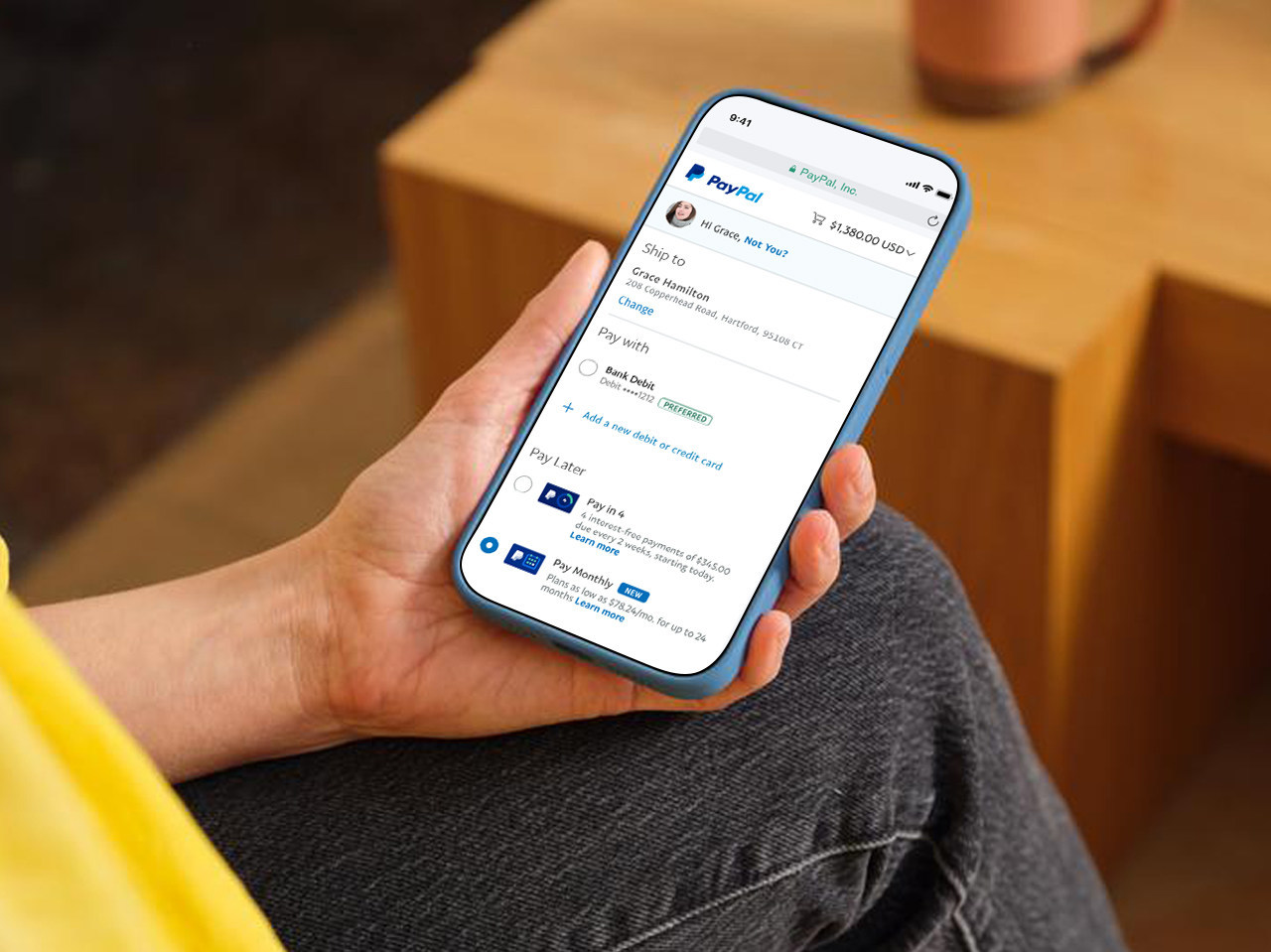

You can shop online with Pay in 4 of Pay Monthly just about everywhere PayPal is accepted. Some exclusions apply. Pay in 4 and Pay Monthly are not available in stores.

Is PayPal Credit always 4 months interest free

While no interest is charged, any balance subject to a 0% for 4 months offer will be included in the calculation of your minimum repayment amount. Any remaining balance due after the 4-month promotional period will be charged at 21.9% p.a. (variable).

Is PayPal pay in 3 every month

Pay in 3 is an interest-free loan that lets you split your basket into 3 payments, with the first due at time of purchase and subsequent payments due every month on the same date.

How does 4 month PayPal Credit work

While no interest is charged, any balance subject to a 0% for 4 months offer will be included in the calculation of your minimum repayment amount. Any remaining balance due after the 4-month promotional period will be charged at 21.9% p.a. (variable).

How many months is PayPal pay in 4

What Is PayPal Pay In 4 PayPal Pay in 4 lets you split up payments on your purchases at eligible online retailers into four equal payments. You'll make the first payment upfront and pay the remaining ones every two weeks for a total repayment period of six weeks.

How does 0% for 4 months PayPal work

While no interest is charged, any balance subject to a 0% for 4 months offer will be included in the calculation of your minimum repayment amount. Any remaining balance due after the 4-month promotional period will be charged at 21.9% p.a. (variable).

What happens if you don’t pay off PayPal Credit in 6 months

Interest will be charged to your account from the purchase date if the balance is not paid in full within 6 months.

Is PayPal pay in 3 bad for credit score

Pay in 3 eligibility is subject to status and approval. UK residents only. Pay in 3 is a form of credit, may not be suitable for everyone and use may affect your credit score. See product terms for more details.

Why am I not getting pay in 3 with PayPal

There are a number of reasons we may not have been able to complete your scheduled payment. For example, if the debit card used to sign up to your Pay in 3 plan has expired or if there were insufficient funds available in your bank account balance. If you need further assistance, contact us here.

How does paying with PayPal Credit work

How does PayPal Credit work PayPal Credit is like a credit card, without the plastic. It's a credit limit that's attached to your PayPal account which you can use to spread the cost of your online purchases. There is no annual fee for a PayPal Credit account.

What happens if I can’t pay my PayPal Credit

If you refuse or cannot make payments with PayPal then will likely sell your debt or refer to you to a debt collector who will continue to contact you until your debt is paid. Your credit score will also be affected.

How does PayPal Credit 4 months work

While no interest is charged, any balance subject to a 0% for 4 months offer will be included in the calculation of your minimum repayment amount. Any remaining balance due after the 4-month promotional period will be charged at 21.9% p.a.

Does PayPal Pay in 4 hurt my credit score

Does Pay in 4 Affect Your Credit Score PayPal may perform a soft check on your credit when you apply for Pay in 4, but this will not affect your score. A soft credit check gives the lender the ability to review your credit report and determine creditworthiness.

Does PayPal still do 4 months no interest

No interest will be charged on the purchase if you pay it off in full within 6 months. If you do not, interest will be charged on the purchase from the purchase date at the Purchase APR applicable to your account.

Does PayPal pay monthly affect credit score

When your PayPal Pay Monthly loan is approved and used, it may be reported to the credit reporting agencies within 30-60 days of the loan date. Your payment history and loan status, including if payments are missed or delinquent, may be reported.

Does paying PayPal Credit improve credit score

Can PayPal Credit help you build credit Yes, responsible use of PayPal Credit can help you build credit. PayPal Credit reports to credit bureaus, so timely payments and responsible use can increase your credit score and help you establish a favourable credit profile.

How often is PayPal pay in 3

two payments every month

Pay in 3: Easy as 1-2-3…

1Check out with PayPal 2Choose “Pay in 3” and complete your purchase. 3Make the first payment now, the rest in two payments every month on the same date.

Is it a good idea to use PayPal Credit

Is PayPal Credit good PayPal Credit is a good option for people who have good credit and who shop online a lot. Because it doesn't give you a credit card number, it won't replace your credit card, but it provides additional benefits, like security and financing, for shopping online.

How does PayPal Credit 4 month interest free work

Four-month interest-free offer

You must meet minimum repayments: 2% of the outstanding balance, or £5, whichever is higher (on top of your monthly instalments), or risk £12 late payment fees. And you'll want to pay off your entire balance before the four months end.