Is payroll account a credit card?

Is a payroll card a credit card

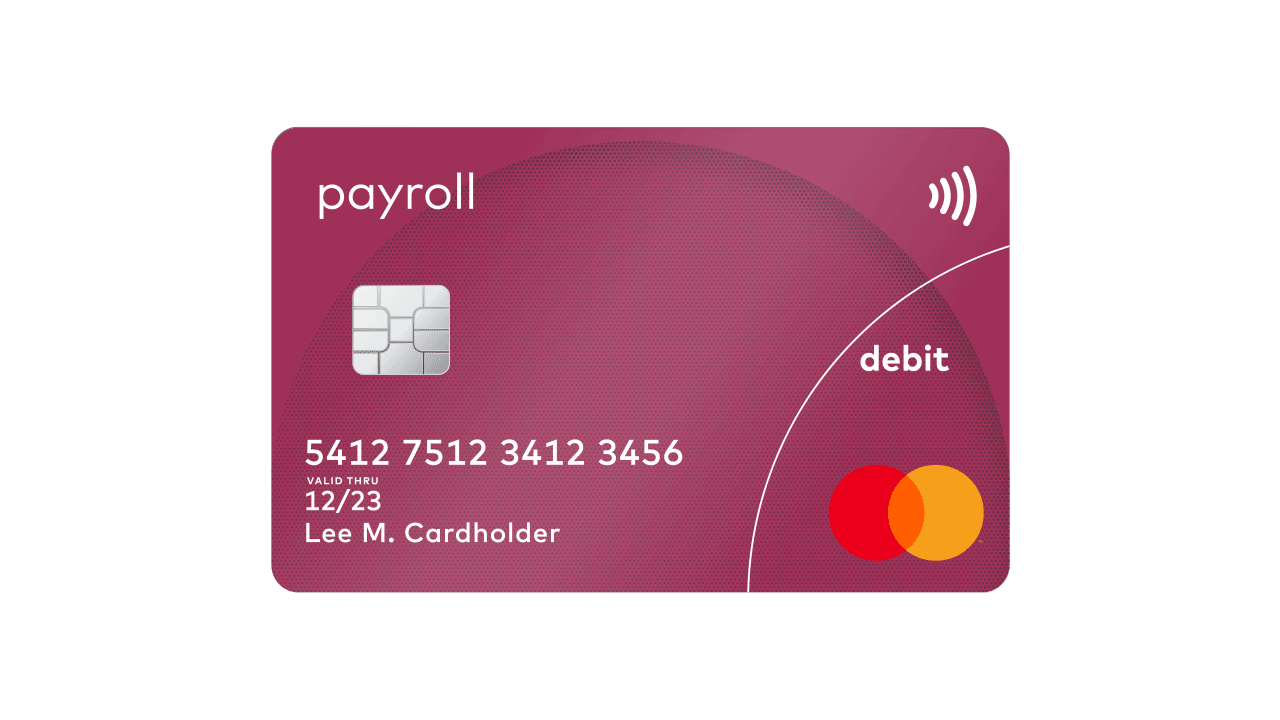

A payroll card is a type of prepaid debit card for your employees. On payday, your organization would deposit an employee's wages on their card. The employee can then use the card to make cash withdrawals from ATMs and to make purchases, just like a debit card from a bank account.

Cached

What type of account is payroll

A payroll account is a type of checking account that businesses can use solely to pay employee wages. It can make the separation of business funds clear, and ensure there's always money in the business to pay employees.

Cached

What is the difference between a payroll card and a debit card

A payroll card works exactly like a debit card, but it's not linked to a bank account. Every payday, the funds owed to the employee are automatically added to the card for the employee to use.

Cached

What is the payroll card

A payroll card is a prepaid card arranged by an employer for the purpose of paying its employees' wages or salary. An employer arranges with a bank or other financial institution to pay its employees with a payroll card.

Cached

Can you take money out of a payroll card

You also can use your payroll card to access cash at ATMs. Some payroll cards offer one or more free in-network ATM withdrawals per pay period. You can locate in-network ATMs online, at the same website where you log in to your card account, or ask your employer for a list.

Where can I use my payroll card

If an employee doesn't have a bank account, a payroll card functions as a debit card. With these cards, they avoid carrying large sums of money. They can use it in any place that accepts debit card payments like grocery stores, gas stations, and other retail outlets. They can also use their card to shop online.

Is payroll account a debit or credit

debit

Record gross wages as an expense (debit column). Record money owed in taxes, net pay and any other payroll deductions as liabilities (credit column).

Is payroll a debit or credit

Debit the wages, salaries, and company payroll taxes you paid. This will increase your expenses for the period. When you record payroll, you generally debit Gross Wage Expense and credit all of the liability accounts.

Can you put money on a payroll card

Employees can also add funds to their payroll cards; they aren't limited to only having payroll funds added by their employer.

Can you use your payroll card as a debit card

A payroll card is a "stored value debit card", which is "reloaded" every pay day or at other times through an ACH direct deposit transaction. It is not a credit card, and you may not spend or withdraw more than the amount available on the card. It does not extend credit to individuals, it works like a debit card.

Can I use my payroll account to pay

A payroll account is a separate bank account for your business that is strictly used for payroll. Instead of lumping all your business expenses into one account, you will pay employee wages with your payroll bank account. The money going into the payroll account will only be used for payroll.

Can I use my payroll account to receive money

The money going into the payroll account will only be used for payroll. For example, you won't write checks to vendors from your payroll account. You would make checks out from your main business bank account. Companies can choose to separate business income and expenses by account.

Is payroll account considered cash

The cash in bank set aside for payroll is included in cash because it is for the payment of current liability.

Is payroll account a bank account

A payroll account is a bank account that is set aside for the purpose of managing all disbursements that are associated with the payroll of an employer.

What is a payroll account used for

A payroll account is a separate bank account for your business that is strictly used for payroll. Instead of lumping all your business expenses into one account, you will pay employee wages with your payroll bank account. The money going into the payroll account will only be used for payroll.