Is purchased equipment an expense?

Is equipment purchase an asset or expense

Equipment is a fixed asset, or a non-current asset. This means it's not going to be sold within the next accounting year and cannot be liquidized easily. While it's good to have current assets that give your business ready access to cash, acquiring long-term assets can also be a good thing.

What type of account is purchased equipment

fixed asset

Generally, equipment and property fall under the “fixed asset” category. Fixed assets are long-term (i.e., more than one year) assets you use in your operations to generate income.

Cached

How do you account for equipment purchases

The purchase of property, plant, or equipment results in a debit to the asset section of the balance sheet. The credit is based on what form of payment you use as the customer. If you use cash, then you would credit cash.

Cached

Is purchased equipment a liability

Is equipment considered an asset or liability Equipment can be considered both a liability and an asset. For example, if you have a loan on your equipment, it is a liability.

What expense is equipment

Any item that costs over $200 or $300 is often considered as equipment by default. Equipment is classified as a long-term asset and usually refers to items that will last and be used longer than a year. Equipment in a business is often referred to as tangible property.

What is not considered an expense account

Payments to Yourself.

You most likely just withdraw money from your business on a semi-regular basis or even just when you need it. These withdrawals are not considered expenses as they are not paying for something related to the business, but instead are a reduction in your Equity in the business.

What type of account is equipment expense

Equipment is a noncurrent or long-term asset account which reports the cost of the equipment. Equipment will be depreciated over its useful life by debiting the income statement account Depreciation Expense and crediting the balance sheet account Accumulated Depreciation (a contra asset account).

How do I categorize equipment purchases in QuickBooks

How to Record a Fixed Asset Purchase in QuickBooks OnlineOpen the Fixed Asset Item List. From the menu bar, select List > Fixed Asset Item List.Add a New Item. Click the “Item” button in the lower-left corner of the list window.Select Account.Purchase Information Section.Asset Information Section.Save.

Is purchase an expense or liability

expense

Purchases is an expense of the business – so it decreases the profit (and hence the equity) and if it is on credit then it increases the liability. Separately, if any of the purchases are unsold then we have inventory.

Is equipment capitalized or expensed

If a long-term asset is used in the business's operations, it will belong in property, plant, and equipment or intangible assets. In this situation, the asset is typically capitalized.

What is included as an expense

An expense is a cost that businesses incur in running their operations. Expenses include wages, salaries, maintenance, rent, and depreciation. Expenses are deducted from revenue to arrive at profits.

What can be classified as expenses

Examples of expenses include rent, utilities, wages, salaries, maintenance, depreciation, insurance, and the cost of goods sold. Expenses are usually recurring payments needed to operate a business.

What are non expense items

A non-operating expense is a cost from activities that aren't directly related to core, day-to-day company operations. Examples of non-operating expenses include interest payments and one-time expenses related to the disposal of assets or inventory write-downs.

What is not an expense account

An expense account is not a savings account. It is not a checking account. It is not an investment account. An expense account is used to track your expenses. This can be helpful if you are trying to save money or if you need to stay on budget.

Why is purchases an expense

A purchase is classified as a “cost” when it is something that is related to an asset. It's an “expense” when it is related to the ongoing operations of a business. For example, if you own a retail business of some kind and you buy a new building.

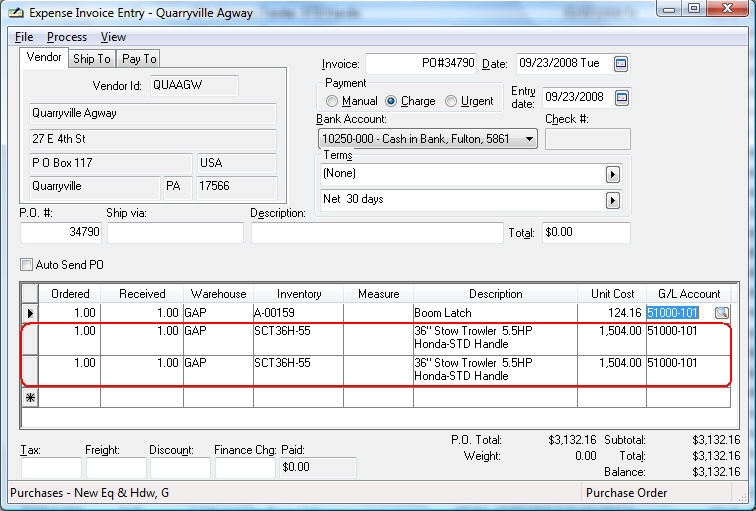

How do I record purchase of new equipment in QuickBooks

How to Add a Fixed Asset Item in QuickBooksOpen the Fixed Asset Item List.Add a New Item.Select Account.Input Purchase Information.Fill in the Asset Information.Save and Close.

Can I list previously purchased equipment as a business expense

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment for the current tax year — instead of writing off the purchase over the course of several years, which is called depreciation. The equipment can be new or used, as long as it's new to you.

What purchases are liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities can be contrasted with assets. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

Is purchase an inventory or expense

When you purchase inventory, it is not an expense. Instead you are purchasing an asset. When you sell that inventory THEN it becomes an expense through the Cost of Goods Sold account.

What does equipment expensed mean

What is Office Equipment Expense Office equipment expense is the cost incurred to maintain and operate office equipment. This cost is charged to expense as incurred. Office equipment expense is usually classified within the selling, general and administrative grouping of expenses in the income statement.