Is return inwards a debit or credit?

What type of account is return inwards

A return inwards book is an account that records all returned goods and reduces the total accounts receivable of the business. These inward returns include both sales and purchase returns. Unlike other receivables, inward returns do not appear on the income statement.

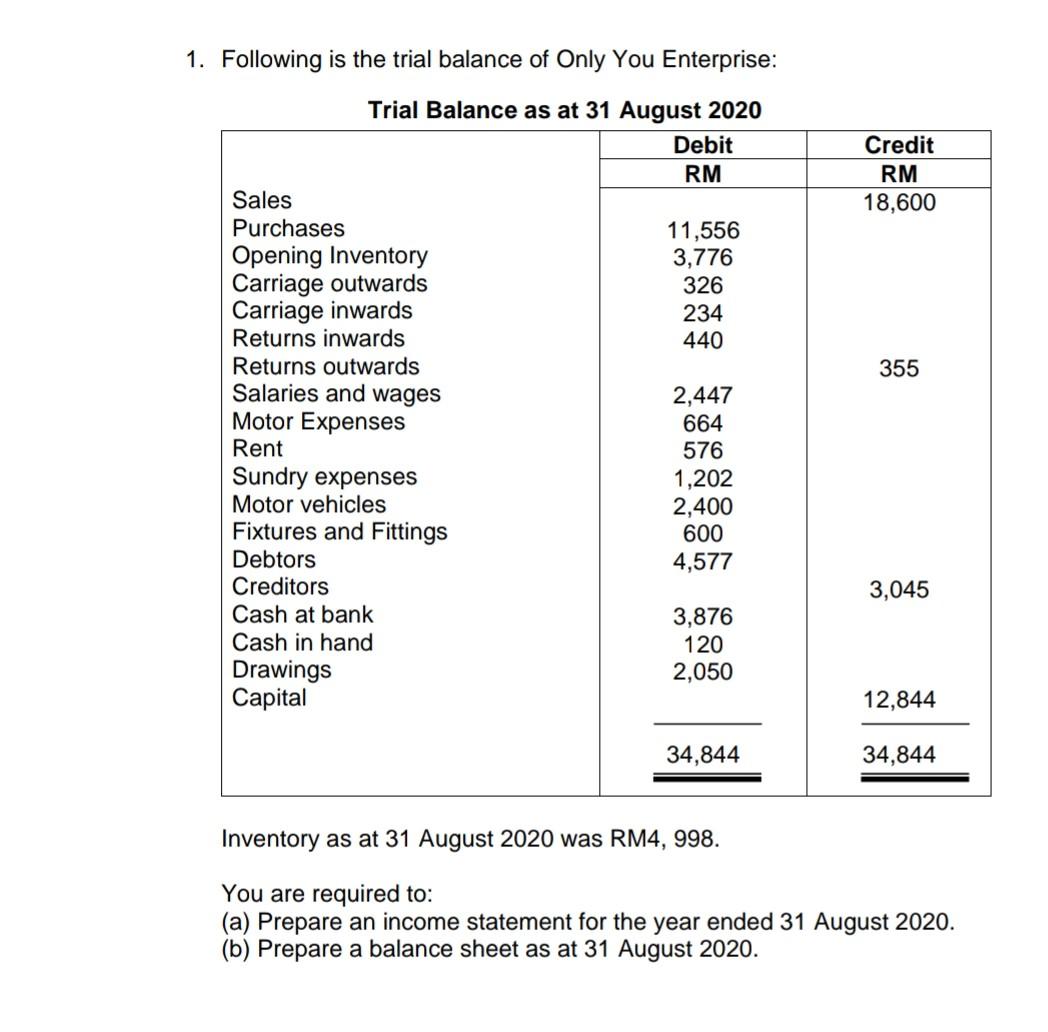

Where does return inwards go in trial balance

Return inwards is the flow of goods in the business which were sold. It is deducted from the sales balance to show the actual position of the firm and deduct the amount which is returned as it is no more a part of sales and is with the firm itself.

Is return inwards a credit

As the name suggests, return inwards refers to the return of goods after selling has occurred. The accounting transaction includes debit and credit. The debit will receive transactions for accounts payable, while the credit column will include purchased inventories.

Is return inwards an asset or liability

Return inwards reduces sales of the seller. It also creates a liability in the books – a payable in favor of the buyer. Return outwards reduces purchases of the buyer. It also creates an asset in the books -a receivable from the seller.

What is return inwards and outward in trial balance

Goods which we purchased on credit if returns back it is called return outwards(Purchase return) where as goods which we have sold and returned by the customer is called return inwards(Sales Return)

What is return inwards in accounting

Return inwards is defined as the receipt back of the goods by the seller which is originally sold to the buyer because of excess goods or defective goods. While return outwards is defined as the return back of the goods by the buyer to the seller from where the goods were initially purchased.

Is a return a credit

A refund is issued when you return a purchased item or receive a discount, for instance. The refund amount is credited back to your credit card account, and it typically appears as a credit on your statement.

What is returns outwards or inwards

Goods which we purchased on credit if returns back it is called return outwards(Purchase return) where as goods which we have sold and returned by the customer is called return inwards(Sales Return)

Is return inwards a loss

Returns Inwards are items returned TO the company, leading to a reduction (Cr) in Receivable or Cash and an Increase (Dr) in a Returns Inwards Account( which is not an income account – on the Statement of profit or loss it is subtracted from sales (sales is a credit balance).

What is return inward and outward entry

Goods which we purchased on credit if returns back it is called return outwards(Purchase return) where as goods which we have sold and returned by the customer is called return inwards(Sales Return)

Is a return an expense

Sales returns are known as a contra revenue account and they have a direct effect on the net income, thereby reducing the income. They cannot be considered as an expense but they do contribute to the loss of income. Also read: Cash Book.

How do returns affect credit

Do credit card refunds affect your credit. Yes, refunds can affect your credit score. A refund can lower your credit utilization — or the total amount of credit you've used compared to your overall credit limit. Credit utilization is something credit rating agencies look at closely when determining your credit score.

What is return inwards

Return inwards is defined as the receipt back of the goods by the seller which is originally sold to the buyer because of excess goods or defective goods. While return outwards is defined as the return back of the goods by the buyer to the seller from where the goods were initially purchased.

What is return inwards and return outwards in accounting

Goods which we purchased on credit if returns back it is called return outwards(Purchase return) where as goods which we have sold and returned by the customer is called return inwards(Sales Return)

Why is return inwards a debit

Answer. It refers to goods returned to the buyer, reducing receivable cash and increasing the debited amounts. Therefore, it will be subtracted from the sales amount in the income statement.

What is a return inward

Return inwards is defined as the receipt back of the goods by the seller which is originally sold to the buyer because of excess goods or defective goods. While return outwards is defined as the return back of the goods by the buyer to the seller from where the goods were initially purchased.

Is return inward an expenses or an income

The returns inward will reduce fixed accounts transactions and expenses administration in nature. In simpler words, return inwards will be a receipt sent by the seller for the products sold by the buyer. Therefore, it is considered as sales returns.

Do sales returns increase debit or credit

In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance.

Is return inwards an income

Return Inwards – This is a reduction in revenue for the business. Customer – This is a reduction in receivables for the business.

Is return inwards a direct expense

It is treated as a direct expense and is always reflected on the debit (Dr.)