Is sales return and allowances an asset?

Is sales return and allowance an asset or liability

Where do purchase returns and allowances go Purchase returns and allowances do not appear on the balance sheet as they are not liabilities. Instead, they must be recorded in a type of account known as a contra revenue account.

Is sales return an asset or expense

Sales returns are known as a contra revenue account and they have a direct effect on the net income, thereby reducing the income. They cannot be considered as an expense but they do contribute to the loss of income. Also read: Cash Book.

What is sales return and allowances classified as

Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance.

CachedSimilar

What is sales return and allowances on a balance sheet

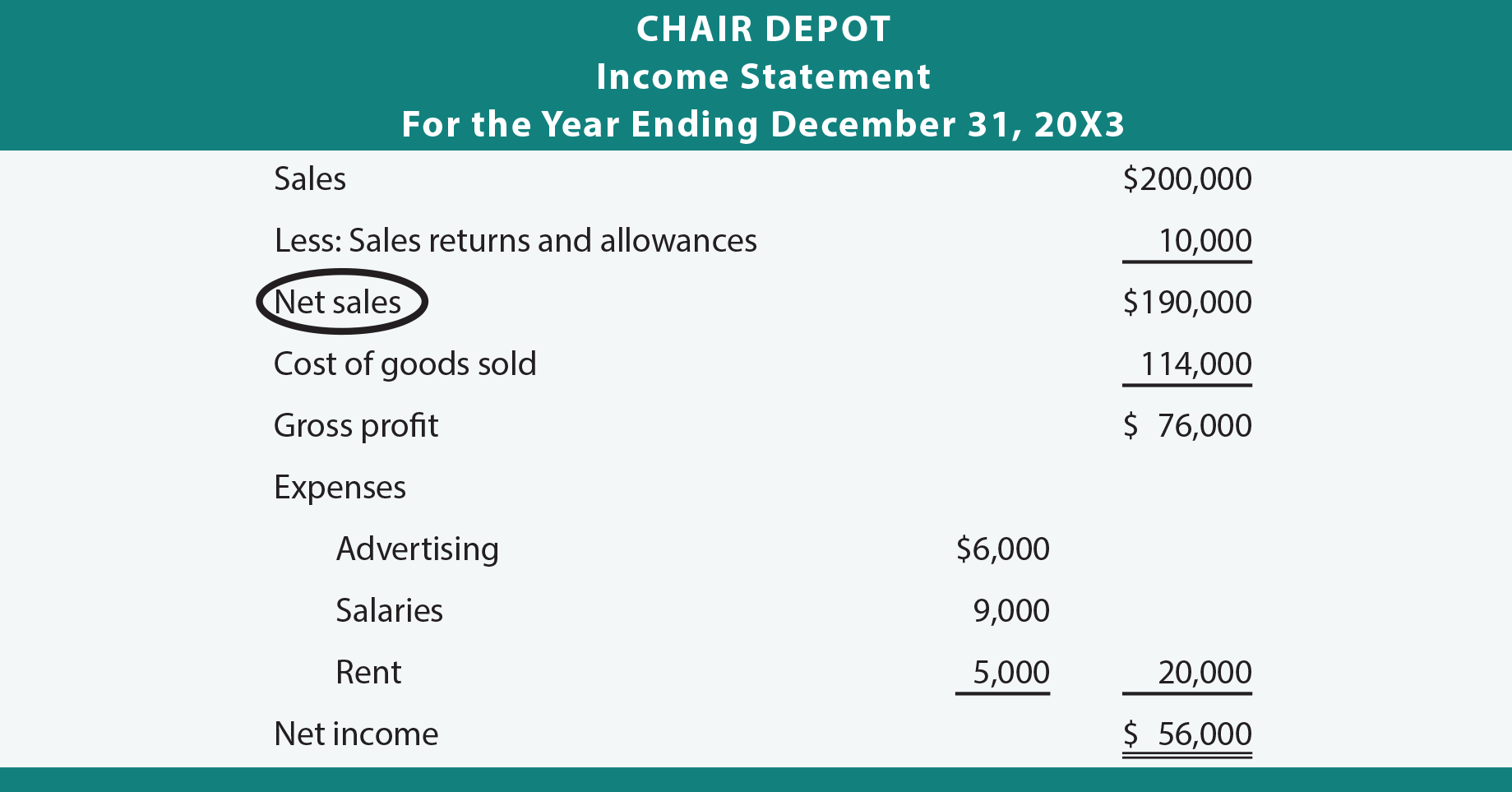

Sales returns and allowances is a line item appearing in the income statement. This line item is presented as a subtraction from the gross sales line item, and is intended to reduce sales by the amount of product returns from customers and sales allowances granted.

Cached

Is sales returns and allowances a liability account True or false

The correct answer is false.

Is sales revenue an asset liability or equity

Is sales revenue an asset No, sales revenue is not considered an asset. For accounting purposes, sales revenue is recorded on a company's income statement, not on the balance sheet with the company's other assets.

Is sales revenue an asset or liability

Is sales revenue an asset No, sales revenue is not considered an asset. For accounting purposes, sales revenue is recorded on a company's income statement, not on the balance sheet with the company's other assets.

How do you record sales returns and allowances

When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory to put the returned items back.

How do you record sales return and allowances

When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory to put the returned items back.

Is sales returns and allowances a credit account

Sales discounts and sales returns & allowances are contra accounts to Sales and have a normal debit balance.

How do you record sales return and allowance

When merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory to put the returned items back.

Is sales returns and allowances an expense account

Explanation: The Sales Returns and Allowances account is used to record the amount of customer returns and allowances due to factors such as product defects or product damage. It is not an expense account but a contra revenue account.

Is sales an asset liability or revenue

Is sales revenue an asset No, sales revenue is not considered an asset. For accounting purposes, sales revenue is recorded on a company's income statement, not on the balance sheet with the company's other assets.

Is sales revenue considered a current asset

Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets. The Current Assets account is important because it demonstrates a company's short-term liquidity and ability to pay its short-term obligations.

Is revenue an asset or income

For accounting purposes, revenue is recorded on the income statement rather than on the balance sheet with other assets. Revenue is used to invest in other assets, pay off liabilities, and pay dividends to shareholders. Therefore, revenue itself is not an asset.

Is a revenue a liability or equity

Revenue And Expenses Are Sub-Categories Of Equity.

However, to maintain the basic accounting equation, either the liability or the equity side must increase by an equal amount. But in selling services no liability is incurred so equity must increase. An increase in revenue must lead to an increase in equity.

Is revenue a liability or owner’s equity

The main accounts that influence owner's equity include revenues, gains, expenses, and losses. Owner's equity will increase if you have revenues and gains.

What type of account is sales returns and allowances in Quickbooks

contra revenue accounts

Examples of a contra revenue accounts include sales returns, sales discounts, and sales allowances. You debit the contra revenue accounts and credit the corresponding revenue accounts.

What type of account is sales allowance

The sales allowance account is a contra account, since it offsets gross sales. The result of the pairing of the gross sales and sales allowance accounts is net sales. There is normally a debit balance in the sales allowance account.

Is sale returns and allowances debit or credit

Sales discounts and sales returns & allowances are contra accounts to Sales and have a normal debit balance.