Is Southwest credit legit?

Is Southwest Credit Collections legit

Is SWC Group legitimate Yes, SWC Group, formerly known as Southwest Credit Systems, is a legitimate debt collection agency based in Carrollton, Texas. It was founded in 1974 and has over 200 employees. SWC Group has been Better Business Bureau accredited since 1976 with a current BBB rating of B.

Cached

Who does Southwest Credit Agency collect for

Southwest Credit Systems collects delinquent debts for unpaid traffic tolls; government agencies; utility service providers; telecommunications and cable companies; property management companies; and education lenders.

Cached

Who is Southwest Credit company

Southwest Credit Systems, L.P. is one of the nation's leading providers of debt collection services. Founded in 1974 they have 40 years of debt collection experience in the cable, property management, telecommunications, highway toll, government, utility, and education industries.

What is Southwest Credit Services

What is Southwest Credit Systems Southwest Credit Systems, LP is a small, legitimate debt collection agency headquartered in Carrollton, Texas, and it's not a scam. It provides accounts receivable management and consumer service solutions for: cable companies.

Cached

Does collections really hurt your credit

Collection accounts have a significant negative impact on your credit scores. Collections can appear from unsecured accounts, such as credit cards and personal loans. In contrast, secured loans such as mortgages or auto loans that default would involve foreclosure and repossession, respectively.

How do I know if a collection notice is real

These scammers can be very convincing, which is why you need to spot the signs of a fake debt collection:They Ask for Info They Should Already Have.They Won't Share Their Info with You.They Threaten or Lie to You.They Insist You Pay Right Now.They Ask You to Pay by Untraceable Methods.

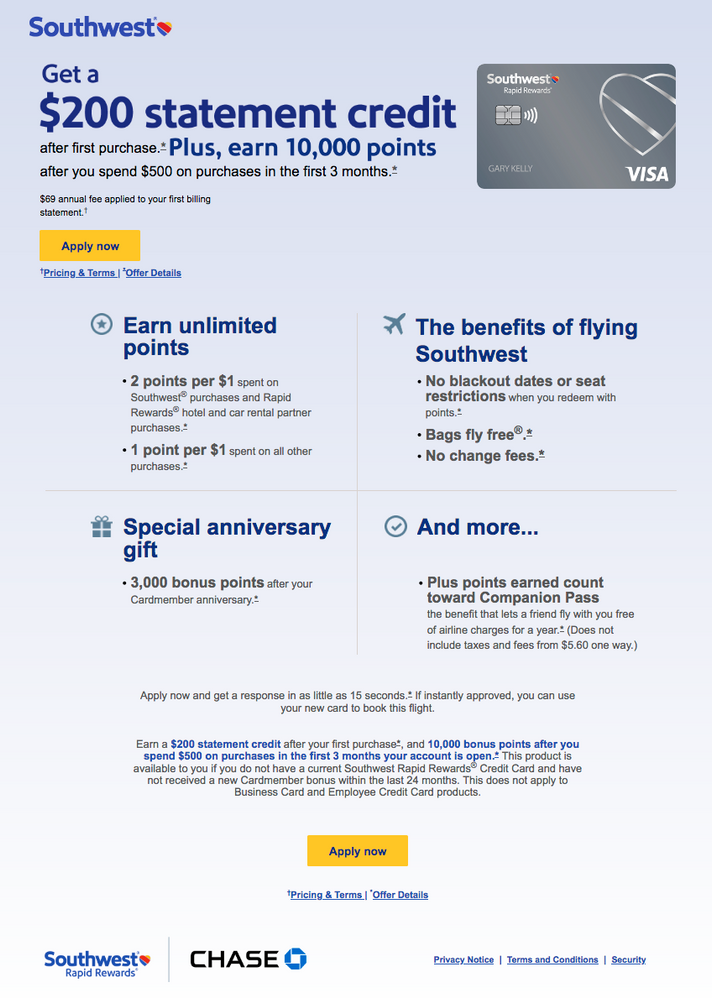

What bank owns Southwest credit card

JPMorgan Chase

We have partnered with JPMorgan Chase to offer a co-branded credit card to allow Rapid Rewards Members the opportunity to earn points for everyday purchases.

What credit score does Southwest require

670 credit score

Credit Score Needed for Southwest Credit Card

For the Southwest credit cards, you have the best approval odds with a minimum 670 credit score. This score is the start of “good credit”, the second-best credit score tier. The best rating — excellent credit — typically starts with a 740 credit score.

Is Southwest credit card part of Chase

Southwest Rapid Rewards® Credit Cards. Earn points to use toward your Southwest flights for personal and business needs with a Southwest Rapid Rewards® Credit Card from Chase.

How do I convert my Southwest credit to cash

You can redeem your funds by going to the Southwest website at Southwest.com, by phone, through the mobile app, or at a Southwest ticket counter for future flights. You can reach Southwest customer service at 1-800-I-FLY-SWA (1-800-435-9792).

How long can you keep Southwest credit

Flight credits don't expire. Are Southwest LUV Vouchers® flight credits No. A Southwest LUV Voucher is issued by Southwest® and can be applied toward a future flight.

How many points will my credit score drop with a collection

100 points

Collection accounts can decrease your credit score by up to 100 points. That is particularly true if your credit score was good before. A collection account can significantly reduce your credit score because it affects your payment history, which deems for 35% of your credit score.

Is it better to pay collections or not

And if you have multiple debt collections on your credit report, paying off a single collections account may not significantly raise your credit scores. But if you have a recent debt collection and it's the only negative item on your credit report, paying it off could have a positive effect on your score.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Should I ignore a collection agency

If you get a summons notifying you that a debt collector is suing you, don't ignore it. If you do, the collector may be able to get a default judgment against you (that is, the court enters judgment in the collector's favor because you didn't respond to defend yourself) and garnish your wages and bank account.

What credit score do you need for the Southwest credit card

670

In order to get one of the Southwest Rapid Rewards® credit cards, you'll probably need at least a FICO® score of 670.

Can you use Southwest credit card for anything

Can you use a Southwest card anywhere Yes. Visa cards are accepted everywhere that credit cards can be used to pay the bill. Aside from the Southwest Rapid Rewards® Plus Credit Card, Southwest credit cards are good for international travel as well because they don't charge foreign transaction fees.

What is the starting limit for Southwest credit card

The starting credit limit for the Southwest Rapid Rewards® Premier Credit Card is $2,000 or more. Everyone who gets approved for the Southwest Premier Card is guaranteed a credit limit of at least $2,000, and particularly creditworthy applicants could get limits a lot higher than that.

Why do I keep getting denied for Southwest credit card

There can be many reasons why your Southwest Priority Card application was denied, such as: A low credit score. Too much existing debt. Not enough disposable income.

What bank is behind Southwest credit card

JPMorgan Chase

We have partnered with JPMorgan Chase to offer a co-branded credit card to allow Rapid Rewards Members the opportunity to earn points for everyday purchases.