Is Synchrony owned by GE?

Is Synchrony Bank still owned by GE

History. Synchrony traces its roots to 1932. GE Capital Retail Bank was started during the Great Depression, providing customers a line of credit to purchase GE appliances. The lending arm remained GE Capital Retail Bank until being spun off from its parent company in June 2014.

CachedSimilar

Who is Synchrony owned by

Synchrony Financial (NYSE:SYF)

Institutional investors hold a majority ownership of SYF through the 96.73% of the outstanding shares that they control. This interest is also higher than at almost any other company in the Finance/Rental/Leasing industry.

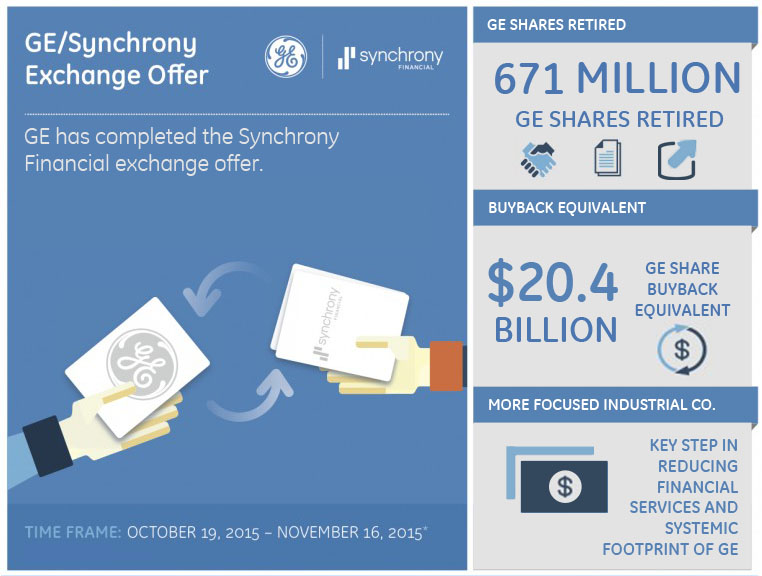

Why did GE spin off Synchrony

GE said that this was an efficient way to return capital to the company while also executing on its strategy to focus on its industrial core and reduce the size of its financial businesses.

Cached

Is GE Money bank the same as Synchrony Bank

GE Capital Retail Bank acquired MetLife Bank from MetLife in 2011. As of June 2, 2014, GE Capital Retail Bank is now known as Synchrony Bank.

CachedSimilar

Is Capital One buying out Synchrony Bank

Capital One Agrees to Buy Synchrony's Portfolio of Walmart Loans. Capital One Financial Corp. said it will buy Synchrony Financial's $9 billion portfolio of loans left over from a partnership with Walmart Inc., following months of acrimonious negotiations.

What is Synchrony Bank affiliated with

Synchrony Bank is an online bank that offers competitive deposit products and credit cards for retailers and healthcare providers. It began as a division within General Electric (GE), which was founded in 1932, and launched an IPO in 2014 on the New York Stock Exchange.

Is CareCredit a GE Capital

CareCredit®, a division of GE Money.

What 3 companies will GE split into

General Electric on Monday revealed the names of the three distinct companies that will result from the conglomerate's historic split: GE HealthCare, GE Aerospace and GE Vernova.

What is another name for Synchrony Bank

GE Capital Retail Bank’s

Since GE Capital Retail Bank's name was tainted by its unscrupulous activities, it re-branded by changing its name to Synchrony Bank. Currently, Synchrony Bank is a subsidiary of a publicly-traded company named Synchrony Financial.

Why did Walmart drop Synchrony

The WSJ reported that Walmart filed an $800 million lawsuit against Synchrony, claiming lost revenue by Synchrony's underwriting standards. The suit was later dropped, around the time Walmart shifted their relationship to Capital One.

Why did Walmart stop using Synchrony Bank

Before striking up a partnership with Capital One in 2023, Walmart used Synchrony as its credit card issuer for 19 years. The retailer filed suit against Synchrony that year, alleging Synchrony's underwriting standards caused Walmart financial harm, according to The Wall Street Journal.

Does Capital One own Synchrony

Capital One Agrees to Buy Synchrony's Portfolio of Walmart Loans. Capital One Financial Corp. said it will buy Synchrony Financial's $9 billion portfolio of loans left over from a partnership with Walmart Inc., following months of acrimonious negotiations.

Who is CareCredit owned by

Synchrony

CareCredit, from Synchrony, is one of the largest and most popular health, wellness and beauty credit cards in the nation, serving millions of families each year.

What is GE finance called now

GE Consumer Finance business becomes Latitude Financial Services.

Who bought out GE

Haier

GE Appliances

| Trade name | GE Appliances |

|---|---|

| Area served | North America |

| Key people | Kevin Nolan, President & CEO Rick Hasselbeck, CCO |

| Products | Home appliances |

| Owners | Haier (90%) KKR (10%) |

What other companies are owned by GE

GE Additive.GE Aviation.GE Capital.GE Digital.GE Power.GE Renewable Energy.GE Research.

What was Synchrony formerly known as

*Note: On June 2, 2014, GE Capital Retail Bank changed its name to Synchrony Bank and is part of the GE Capital Retail Finance business.

What are the cons of Synchrony

ConsNo branch locations: Synchrony does not have any physical branches as a way to reduce costs for the bank and its customers. However, this could be a drawback for customers who prefer to have a physical branch they can visit.No checking account option: Synchrony does not currently offer one.

Is there a class action lawsuit against Synchrony Bank

The deadline for exclusion and objection is March 15, 2023. The final approval hearing for the Synchrony Bank calls settlement is scheduled for April 25, 2023. In order to receive settlement benefits, class members must submit a valid claim form by March 30, 2023.

Why is Walmart suing Synchrony

Remember when Walmart sued Synchrony on their credit card, claiming that Synchrony was refusing to underwrite weak credit card accounts The WSJ reported that Walmart filed an $800 million lawsuit against Synchrony, claiming lost revenue by Synchrony's underwriting standards.