Is tax deductible a good thing?

Does tax deductible mean you get the money back

A tax deduction reduces your adjusted gross income or AGI and thus your taxable income on your tax return. As a result, this either increases your tax refund or reduces your taxes owed.

How much do tax deductions save you

For most non-business deductions, the savings are based upon your tax bracket. For example, if you are in the 12% tax bracket, a $1,000 deduction would save you $120 in taxes. On the other hand, if you are in the 32% tax bracket, the $1,000 deduction will save you $320 in taxes.

What happens when something is tax deductible

A deductible for taxes is an expense that a taxpayer or business can subtract from adjusted gross income, which reduces their taxable income, thereby reducing the amount of taxes owed.

Cached

Do you pay anything after deductible

Once you've reached your deductible, you typically pay a copayment or coinsurance for all services covered by your plan. The insurance company takes care of payment for the remaining balance. The amount of the copay depends on your health insurance and the type of service you're receiving.

What happens if you don’t spend your deductible

If you do not meet the deductible in your plan, your insurance will not pay for your medical expenses—specifically those that are subject to the deductible—until this deductible is reached.

Who benefits most from tax deductions

Lower Income Households Receive More Benefits as a Share of Total Income. Overall, higher-income households enjoy greater benefits, in dollar terms, from the major income and payroll tax expenditures.

What does 100% tax deductible mean

When something is tax deductible — meaning that it's able to be legally subtracted from taxable income — it serves as a taxpayer advantage. When you apply tax deductions, you'll lower the amount of your taxable income, which, in turn, lessens the amount of tax you'll have to pay the Internal Revenue Service that year.

What does tax deduction mean

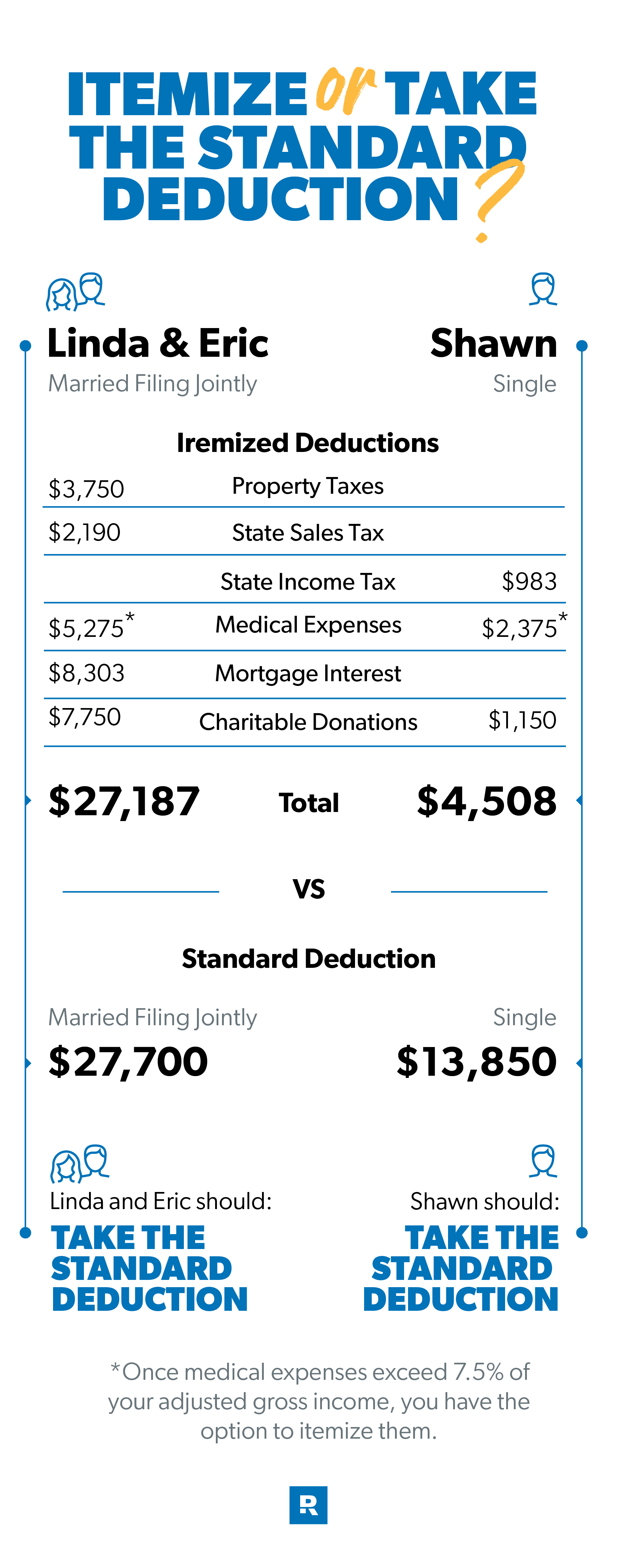

A tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state/local taxes paid, mortgage interest, and charitable contributions.

Do I pay 100% before deductible

A deductible is the amount you pay for health care services before your health insurance begins to pay. How it works: If your plan's deductible is $1,500, you'll pay 100 percent of eligible health care expenses until the bills total $1,500. After that, you share the cost with your plan by paying coinsurance.

How long does it take to pay off a deductible

Your deductible automatically resets to $0 at the beginning of your policy period. Most policy periods are 1 year long. After the new policy period starts, you'll be responsible for paying your deductible until it's fulfilled.

Is it better to have a deductible or not for health insurance

If you are generally healthy and don't have pre-existing conditions, a plan with a higher deductible might be a better choice for you. Your monthly premium is lower, since you're only visiting the doctor for annual checkups, and you're not in need of frequent health care services.

Is everything free after deductible

Once you've reached your deductible, you typically pay a copayment or coinsurance for all services covered by your plan. The insurance company takes care of payment for the remaining balance. The amount of the copay depends on your health insurance and the type of service you're receiving.

How do deductions lower a person’s taxes

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

How do more tax deductions help

A tax deduction lowers your taxable income and thus reduces your tax liability. You subtract the amount of the tax deduction from your income, making your taxable income lower. The lower your taxable income, the lower your tax bill.

What is a $300 deductible

Typical out-of-pocket costs include deductibles, co-payments, co-insurance or extra costs for getting treatment outside of your health plan's network. Deductibles. A deductible is usually a flat dollar amount (like $300) that is subtracted from the amount your health insurance plan will pay for your medical bills.

What is considered a high deductible IRS

For 2023, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,400 for an individual or $2,800 for a family. An HDHP's total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) can't be more than $7,050 for an individual or $14,100 for a family.

Is a tax deduction or credit better

Tax credits are generally considered to be better than tax deductions because they directly reduce the amount of tax you owe. The effect of a tax deduction on your tax liability depends on your marginal tax bracket.

Do I pay full price until I meet my deductible

The amount you pay for covered health care services before your insurance plan starts to pay. With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself. A fixed amount ($20, for example) you pay for a covered health care service after you've paid your deductible.

Is it better to have a $500 deductible or $1000

A $1,000 deductible is better than a $500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you'll pay lower premiums. Choosing an insurance deductible depends on the size of your emergency fund and how much you can afford for monthly premiums.

Why would you want a deductible

Insurance policies use deductibles to ensure a measure of financial stability on the part of the insurer by reducing the severity of claims. A policy that is properly structured provides protection against catastrophic loss. A deductible provides a cushion between any given minimal loss and a truly catastrophic loss.