Is the 3600 Child Tax Credit refundable?

Is the child tax credit still fully refundable

Is the child tax credit taxable No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and you may be able to get a portion of the credit back in the form of a refund.

Cached

How much of the child credit is refundable

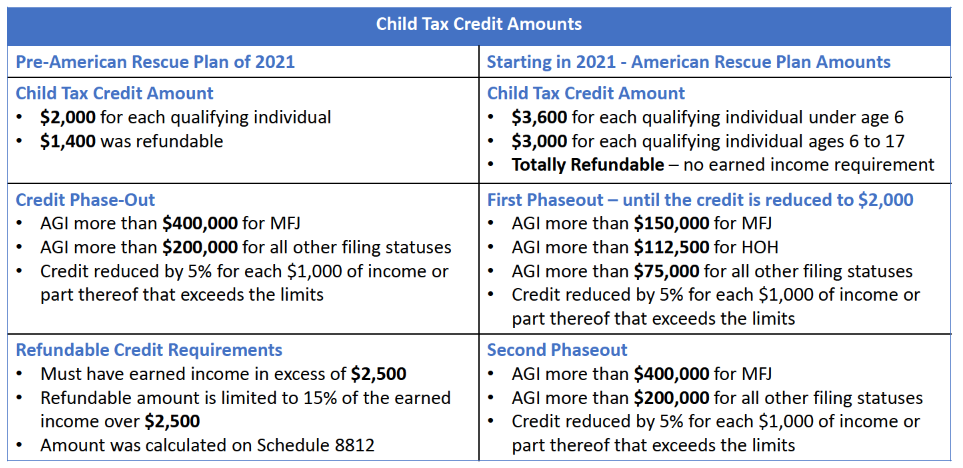

Know that for CTC/ACTC: The maximum amount of CTC per qualifying child is $2,000. The refundable part of the credit, ACTC, is worth up to $1,500 for each qualifying child.

Do we have to pay back Biden child tax credit

The budget also calls for permanently making the child tax credit fully refundable, which means people would still be eligible even if their tax liability was less than the credit amount.

What is the IRS 3600 child tax credit

The maximum credit amount has increased to $3,000 per qualifying child between ages 6 and 17 and $3,600 per qualifying child under age 6. If you're eligible, you could receive part of the credit in 2023 through advance payments of up to: $250 per month for each qualifying child age 6 to 17 at the end of 2023.

When did the Child Tax Credit become refundable

2001

Originally, the tax credit was $400 per child younger than age 17 and nonrefundable for most families. In 1998, the tax credit was increased to $500 per child younger than age 17. The tax credit amount increased again and was made refundable in 2001 to coordinate with the earned income tax credit.

Is the Child Tax Credit a partially refundable credit

Child Tax Credit and Child and Dependent Care Tax Credit

The Child Tax Credit is nonrefundable and reduces the taxpayer's tax liability. To qualify, the child must: Be a U.S. citizen under age 17.

Do you pay taxes on Child Tax Credit

Advance Child Tax Credit payments are not income and will not be reported as income on your 2023 tax return. Advance Child Tax Credit payments are advance payments of your tax year 2023 Child Tax Credit.

Is the Child Tax Credit a loan

No, the Child Tax Credit is not a loan. It is a refundable tax credit available to American children.

How does the child tax credit work

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return). Parents and guardians with higher incomes may be eligible to claim a partial credit.

Can I claim both the child tax credit and the child and dependent care credit

Yes, you may claim the child tax credit (CTC)/additional child tax credit (ACTC) or credit for other dependents (ODC) as well as the child and dependent care credit on your return, if you qualify for those credits.

When to expect tax refund 2023 with EITC

The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

When can I expect my tax refund 2023

Estimated 2023 IRS Income Tax Return Chart

| IRS Accepts an E-Filed Return By: | Direct Deposit Sent (Or Paper Check Mailed 1 week later): |

|---|---|

| Jan. 23, 2023 | Feb. 3 (Feb. 10)** |

| Jan. 30, 2023 | Feb. 10 (Feb. 17)** |

| Feb. 6 | Feb. 17 (Feb. 24)** |

| Feb. 13 | Feb. 24 (Mar. 3)** |

What makes child tax credit refundable or nonrefundable

What is the difference between a refundable and nonrefundable tax credit (A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero. A refundable tax credit allows taxpayers to lower their tax liability to zero and still receive a refund.)

When did the child tax credit become refundable

2001

Originally, the tax credit was $400 per child younger than age 17 and nonrefundable for most families. In 1998, the tax credit was increased to $500 per child younger than age 17. The tax credit amount increased again and was made refundable in 2001 to coordinate with the earned income tax credit.

When to expect refund 2023

Most people with no issues on their tax return should receive their refund within 21 days of filing electronically if they choose direct deposit.

What is the tax refund for 2023

The IRS has announced it will start accepting tax returns on January 23, 2023 (as we predicted as far back as October 2023). So, early tax filers who are a due a refund can often see the refund as early as mid- or late February. That's without an expensive “tax refund loan” or other similar product.

How does the Child Tax Credit work

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return). Parents and guardians with higher incomes may be eligible to claim a partial credit.

What is a refundable tax credit

A refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability. An example of a refundable tax credit is the Earned Income Tax Credit.

Is Child Tax Credit partially refundable

The Child Tax Credit is a fully refundable tax credit for families with qualifying children.

What does it mean the Child Tax Credit is partially refundable

A partially refundable credit limits the amount you can receive back. You can receive up to $1,500 per eligible child as a refund if your child tax credits exceed your tax liability by claiming the additional child tax credit (ACTC).