Is the energy efficient home credit refundable?

Are energy efficient home improvement tax credits refundable

The credit is nonrefundable, so you can't get back more on the credit than you owe in taxes. You can't apply any excess credit to future tax years.

Is the 2023 energy tax credit refundable

Taxpayers can claim this credit each tax year they install eligible property until the credit begins to phase out in 2033. This is a nonrefundable credit, which means the credit amount received cannot exceed the amount owed in tax.

Are the new energy tax credits refundable

Are energy tax credits refundable Energy tax credits aren't refundable tax credits. This means that you can reduce your total tax to zero if you have a large enough credit. But, you can't get any excess credit amount as a payment to you on your tax return if you have more energy credit than your total tax.

Cached

What is the new energy efficient home credit

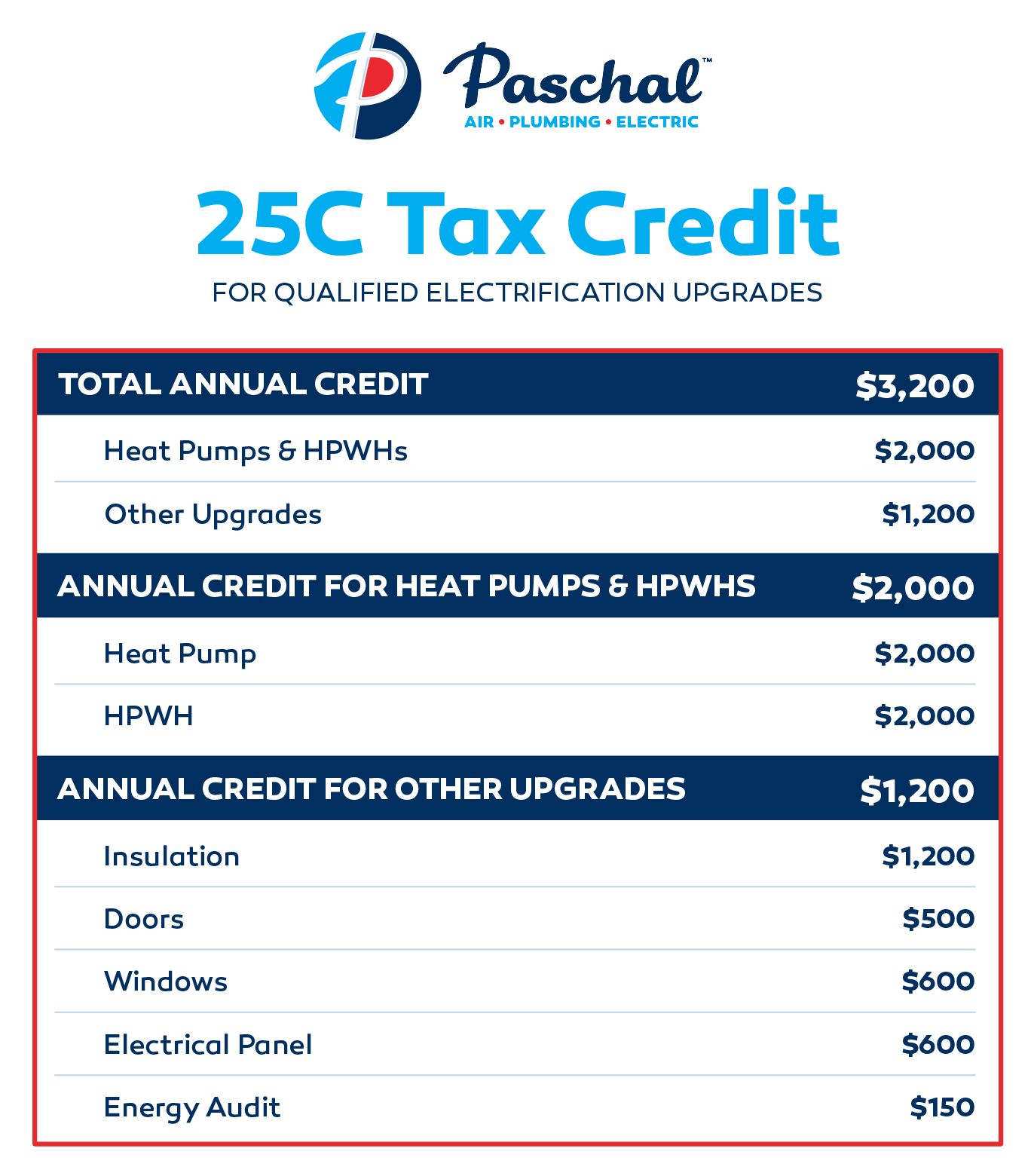

General Overview of the Energy Efficient Home Improvement Credit. Through December 31, 2023, the energy efficient home improvement credit is a $500 lifetime credit. As amended by the IRA, the energy efficient home improvement credit is increased for years after 2023, with an annual credit of generally up to $1,200.

Can I write off energy efficient appliances on my taxes

Homeowners can claim a federal tax credit for making certain improvements to their homes or installing appliances that are designed to boost energy efficiency. Solar, wind, geothermal, and fuel cell technology are all eligible for the residential clean energy credit.

Is there a lifetime limit on residential energy credit

No. There is no lifetime limit for either credit; the limits for the credits are determined on a yearly basis. For example, beginning in 2023, a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made.

Is a new HVAC system tax deductible 2023

Known as the Energy Efficient Home Improvement Tax Credit, this program allows you to earn a tax credit of up to $3,200 a year. The program started on January 1, 2023, and will run until December 31, 2032, which means you may be eligible if you upgrade or replace any HVAC unit within the next decade.

Which tax credit is refundable

the Earned Income Tax Credit

One refundable tax credit for moderate- and low-income taxpayers is the Earned Income Tax Credit. The IRS estimates four out of five workers claim the EITC, which means millions of taxpayers are putting EITC dollars to work for them.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Is new EV tax credit refundable or nonrefundable

You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the two years, you can claim the credit. The credit is nonrefundable, so you can't get back more on the credit than you owe in taxes.

Are energy-efficient washer and dryer tax deductible

Smaller household appliances like energy-efficient refrigerators or washing machines might not qualify for tax credits, but homeowners should research if they qualify for rebates. Many energy-efficient appliances offer applicable rebates through a utility provider.

Can you write off an energy-efficient hot water heater

Yes. There is a $1,200 aggregate yearly tax credit maximum for all building envelope components, home energy audits, and energy property. Electric or natural gas heat pump water heaters, electric or natural gas heat pumps, and biomass stoves and biomass boilers have a separate aggregate yearly credit limit of $2,000.

How do I claim energy efficient windows on my taxes

How do I apply for a windows, doors and/or skylights tax creditMake sure you've saved a copy of the Manufacturer's Certification Statement for your records, but you do not need to file this with your tax return. More details here.When you submit your 2023 tax return, file Form 5695 (Residential Energy Credits) here.

Can I deduct a new HVAC system on my taxes

Non-Business Energy Tax Credit.

This tax credit can be claimed for any eligible home improvements you made in 2023. The credit covers 10% of the cost of the equipment, including items such as home insulation, exterior doors, electric heat pumps, and central air conditioning systems.

Can I claim a new AC unit on my taxes

You can claim 30% of the project cost, up to a $600 maximum credit. The air conditioner must meet the following efficiency requirements: Split Systems: ENERGY STAR certified* equipment with SEER2 ≥ 16.

What are examples of nonrefundable tax credits

Examples of nonrefundable tax credits include:Adoption Tax Credit.Electric Vehicle Tax Credit.Foreign Tax Credit.Mortgage Interest Tax Credit.Residential Energy Property Credit.Credit for the Elderly or the Disabled.Credit for Other Dependents.The Saver's Credit.

How to get the biggest tax refund in 2023

Follow these six tips to potentially get a bigger tax refund this year:Try itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

How to get $5,000 tax refund

The IRS says if you welcomed a new family member in 2023, you could be eligible for an extra $5,000 in your refund. This is for people who had a baby, adopted a child, or became a legal guardian. But you must meet these criteria:You didn't receive the advanced Child Tax Credit payments for that child in 2023.

Is energy credit nonrefundable

The residential energy property credit is nonrefundable. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

What is the income limit for the $7500 EV tax credit

EV Tax Credit Income Limits 2023

The EV tax credit income limit for married couples who are filing jointly is $300,000. And, if you file as head of household and make more than $225,000, you also won't be able to claim the electric vehicle tax credit.