Is there a credit check for pre-approved line of credit?

Does pre-approved line of credit hurt credit score

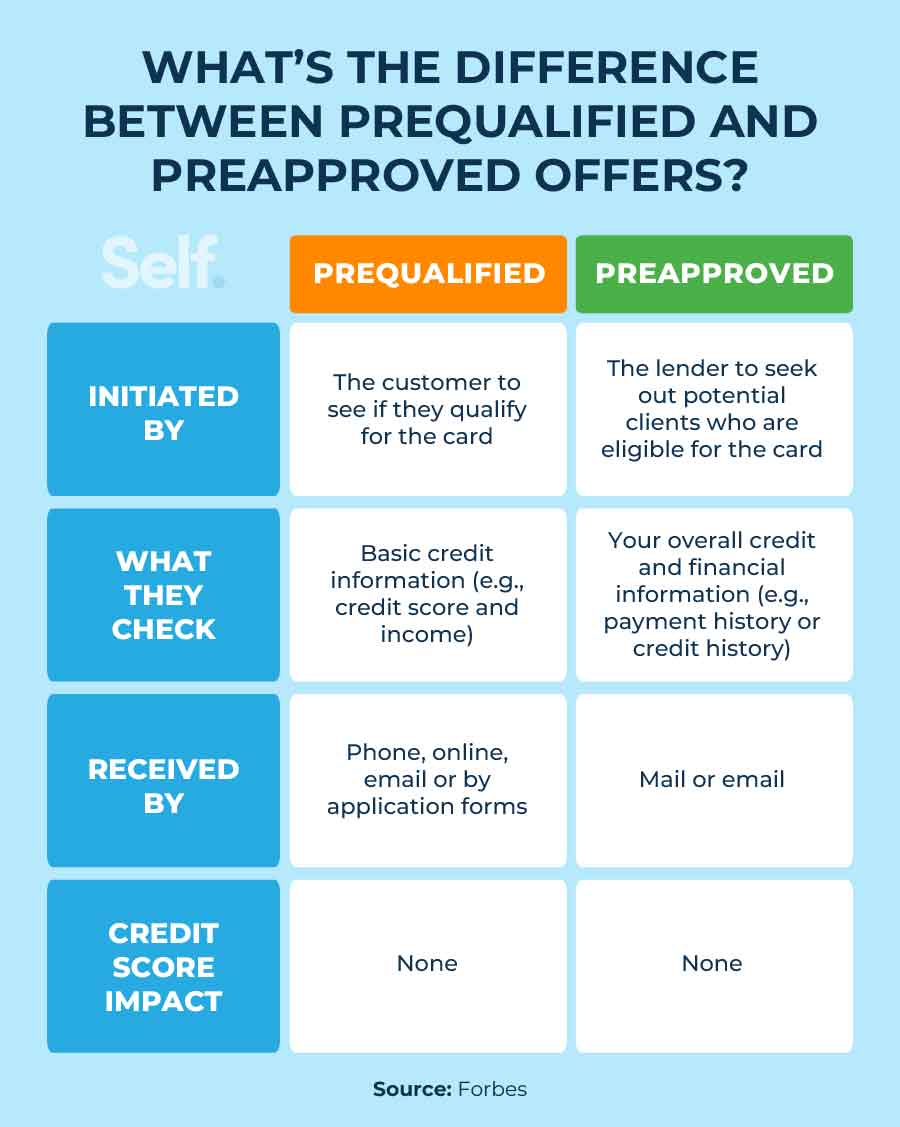

Here's the good news: Preapproved credit card offers do not impact your credit score in any way. That's because creditors only place a “soft pull” on your credit report to determine your eligibility. You'll only see an impact if you move forward with the application.

Cached

What does pre-approved for a line of credit mean

A pre-approved line of credit is an offer from a lender to accept an available line of credit. When you receive this kind of offer, it means the lender has already run a soft credit check and conditionally approved you. You'll still need to go through a hard credit check to officially secure this LOC.

What credit score is needed for line of credit

670 or higher

Opening a personal LOC usually requires a credit history of no defaults, a credit score of 670 or higher, and reliable income. Having savings helps, as does collateral in the form of stocks or certificates of deposit (CDs), though collateral is not required for a personal LOC.

Is there credit check for pre-approval

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have. The good news is that this ding on your credit score is only temporary.

How do you get approved for a line of credit

To land one, you'll need to present a credit score in the upper-good range — 700 or more — accompanied by a history of being punctual about paying debts. Similar to a personal loan or a credit card, an unsecured personal line of credit gets bank approval based on an applicant's ability to repay the debt.

Does Capital One pull credit for pre approval

Capital One pre-approvals do not affect your credit score, as they're done using a soft “pull,” or inquiry. But if you decide to submit an application for any Capital One card, Capital One will conduct a hard inquiry, which will lead to a slight, but temporary decrease in your credit score.

Why is a line of credit denied

A history of missing or late payments, especially recently, increases the possibility that you'll be denied new credit, so paying your bills on time is important. Even if you're approved for a credit card account or line of credit, you may have a lower credit limit and higher interest rate because of your credit score.

What credit score is needed for a 20000 line of credit

660 or higher

You will likely need a credit score of 660 or higher for a $20,000 personal loan. Most lenders that offer personal loans of $20,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.

Does Capital One pull credit for pre-approval

Capital One pre-approvals do not affect your credit score, as they're done using a soft “pull,” or inquiry. But if you decide to submit an application for any Capital One card, Capital One will conduct a hard inquiry, which will lead to a slight, but temporary decrease in your credit score.

Can you be denied a pre-approved credit card

It isn't common, but a credit card issuer could deny your application even after sending you a pre-approved offer of credit. The exact reason for such a denial can vary from one applicant to the next.

Can you get denied for a line of credit

You already owe money

If the ratio is too high, your credit application may be denied. The more you owe in relation to both your income and the credit limit, the harder it will be to qualify for a new credit card or line of credit.

How hard is it to get line of credit

A personal line of credit is an unsecured loan. That is, you ask the lender to trust you to make repayment. To land one, you'll need to present a credit score in the upper-good range — 700 or more — accompanied by a history of being punctual about paying debts.

Does Capital One pre approval mean anything

If you've received a Capital One pre approval letter in the mail, it simply means you meet the bank's requirements for approval, and your chances of being approved for the credit card offer you have received are high.

Is Capital One credit line increase a hard pull

While Capital One might choose to increase your credit limit because you've been a responsible cardholder, it also accepts requests for increases. Unlike several issuers who carry out hard credit pulls when cardholders request credit limit increases, Capital One makes its decision based on a soft pull.

Does it hurt to apply for a line of credit

As part of the application process for a line of credit, the lender may perform a hard inquiry on your credit reports. This could temporarily lower your credit scores by a few points. After you're approved and you accept the line of credit, it generally appears on your credit reports as a new account.

How long does it take to get approved for a line if credit

The approval process and timeline for a line of credit approval may vary depending on the lender, but typically takes anywhere from two days to one week.

How much of a $1,500 credit line should I use

NerdWallet suggests using no more than 30% of your limits, and less is better. Charging too much on your cards, especially if you max them out, is associated with being a higher credit risk.

Can I get a line of credit with a 600 credit score

Yes, you can get a personal loan with a 600 credit score — there are even lenders that specialize in offering fair credit personal loans. But keep in mind that if you have a credit score between 580 and 669, you'll generally be considered a “subprime” borrower — meaning lenders might see you as a more risky investment.

Why did I get pre-approved then denied

Buyers are denied after pre-approval because they increase their debt levels beyond the lender's debt-to-income ratio parameters. The debt-to-income ratio is a percentage of your income that goes towards debt. When you take on new debt without an increase in your income, you increase your debt-to-income ratio.

Why was I preapproved and then denied credit card

A credit card issuer may hesitate to approve your application if you have a lot of hard inquiries on your credit report, especially within a short period of time. The frequent credit applications could suggest to the lender that your financial circumstances have changed negatively.