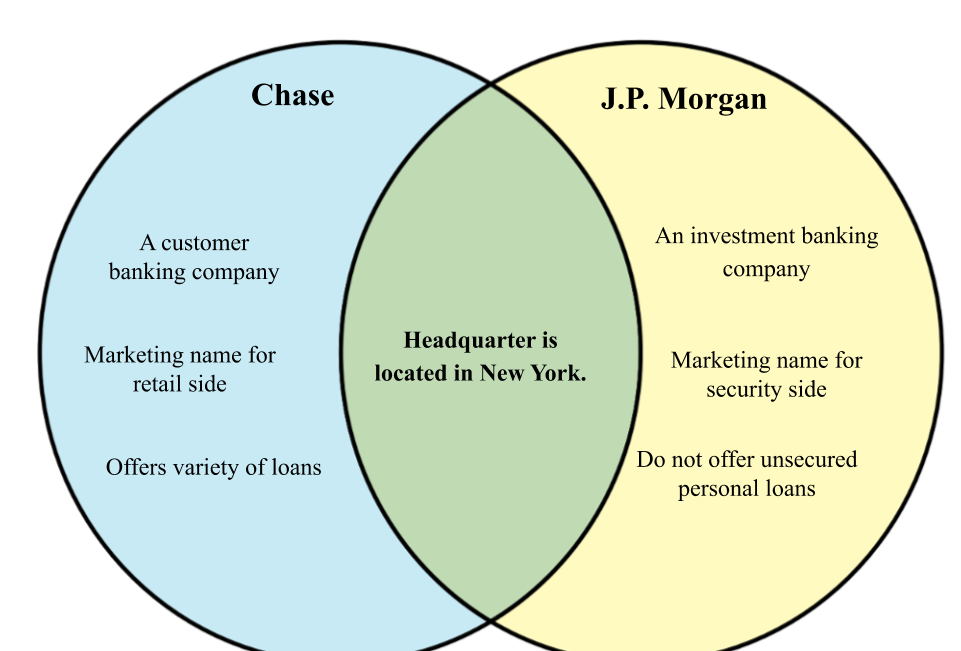

Is there a difference between J.P. Morgan and Chase?

Can I cash a J.P. Morgan check at Chase bank

Chase Bank will cash just about any type of check, including payroll checks, personal checks, government checks, tax checks, and cashier's checks for customers. For non-customers, Chase will only cash checks drawn on a Chase account.

Which is better Wells Fargo or JP Morgan Chase

JPMorgan Chase & Co's brand is ranked #72 in the list of Global Top 100 Brands, as rated by customers of JPMorgan Chase & Co. Their current market cap is $451.20B. Wells Fargo's brand is ranked #139 in the list of Global Top 1000 Brands, as rated by customers of Wells Fargo. Their current market cap is $156.41B.

What is the difference between JP Morgan Chase and Bank of America

Chase has a somewhat larger presence when it comes to branch locations, with just over 4,800 compared to Bank of America's roughly 3,800. The two banks have comparable checking accounts. Both charge the same monthly fee, but Bank of America makes it slightly easier to get that fee waived.

What are the big 4 investment banks

In the U.S., the top investment banking companies include the Big Four Banks — JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo.

Can I cash a Chase check at a Chase bank without an account

Answer and Explanation: Yes, a person can cash the Chase personal check while not having an account at the Chase bank. Chase bank does not impose any prices for existing customers while cashing any check at the branch of…

Does Walmart cash JP Morgan Chase checks

Additionally, clients can continue to take advantage of Positive Pay check cashing services offered at all Chase branches. Employees of JPMorgan clients can cash checks at dedicated check cashing windows at participating Wal-Mart retail locations.

What is the minimum amount to join JP Morgan private bank

J.P. Morgan Private Bank – $10 million

However, this service requires $10 million in assets to become a member. If you qualify as an individual or business, you can expect the following privileges: Personal and business banking.

Is Chase the number 1 bank in America

1. JPMorgan Chase & Co. Established in 1799, JPMorgan Chase & Co. is a global investment bank and financial services company that's based in New York. It offers a wide range of banking products including deposit accounts, credit cards, home loans, auto loans and business banking.

What is the best bank to bank with

The Best Banks of 2023TD Bank: Best for customer service.Regions Bank: Best for avoiding monthly fees.U.S. Bank: Best in-person bank for CDs.Chase Bank: Best for a large branch network.Axos Bank: Best for online account options.Capital One Bank: Best online checking account.

Should I switch to Chase Bank

Chase ranked second in the 2023 J.D. Power U.S. National Banking Satisfaction Study. Chase has a good basic checking account but its savings rates are low, and some fees are high and hard to avoid.

What are the top 3 investment banks

The largest investment banks are noted with the following:JPMorgan Chase.Goldman Sachs.BofA Securities.Morgan Stanley.Citigroup.UBS.Credit Suisse.Deutsche Bank.

What is the hardest investment bank to get into

Goldman Sachs

Goldman Sachs is generally regarded as the leading investment bank in most business areas, and is the toughest Bulge Bracket investment bank to break into. Goldman has a very strong reputation within the industry and among corporations. They advise on the majority of high profile M&A deals and other major transactions.

How much does Chase Bank charge to cash a check without an account

If you own an account in chase bank, you can directly go to Chase bank and present your check to get credited to your account. If you are not an account holder at Chase bank, as a non-customer, a small fee of $6 should pay.

Where can I cash a $20000 check without a bank account

Cash it at the issuing bank (this is the bank name that is pre-printed on the check) Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.) Cash the check at a check-cashing store. Deposit at an ATM onto a pre-paid card account or checkless debit card account.

What bank will cash a check without an account

You don't have to have an account with Regions to cash checks. Regions offers check cashing services — including handwritten, out-of-state, insurance, two-party, tax refunds, business, government and payroll — so you can get your cash immediately.

How much money do you need to open an account at J.P. Morgan

In most cases, you may open a J.P. Morgan account with as little as $1,000. You may purchase shares of any of the J.P. Morgan Funds, except the tax-exempt funds, for an Individual Retirement Account including an IRA Rollover or other retirement account.

What are the requirements for a J.P. Morgan account

To open your account, we require your name, address, date of birth, and other information that will allow us to identify you. Shares of the JP Morgan Funds are registered for sale to US residents only. You must provide your valid US address when opening an account.

What are the top 3 banks in America

List of largest banks in the United States

| Rank | Bank name | Headquarters location |

|---|---|---|

| 1 | JPMorgan Chase | New York City |

| 2 | Bank of America | Charlotte |

| 3 | Citigroup | New York City |

| 4 | Wells Fargo | San Francisco |

Which bank is safest in USA

5 Safest Banks in the U.S.

| Bank | Assets |

|---|---|

| JP Morgan Chase | $3.2 trillion |

| Bank of America | $2.42 trillion |

| Citi | $1.77 trillion |

| Wells Fargo | $1.72 trillion |

Who is the number 1 bank in America

JPMorgan Chase

The 15 largest banks in the US

| RANK | BANK NAME | TOTAL ASSETS |

|---|---|---|

| 1 | JPMorgan Chase | $3.27 trillion |

| 2 | Bank of America | $2.52 trillion |

| 3 | Citigroup | $1.72 trillion |

| 4 | Wells Fargo | $1.69 trillion |