Is there a downside to Series I bonds?

What are the disadvantages of I bonds

Cons of Buying I BondsMaximum investment each year is $10,000.Yield is taxed as ordinary income.Must open a TreasuryDirect account to buy and sell.Interest is added to the principal; you don't receive income.You do not receive statements, so you must log in to TreasuryDirect to view.

Cached

Is it a good idea to buy a Series I bond

Are I bonds a good investment for you I bonds can make good short-term investments, but you should feel comfortable holding them for at least one year and ideally, five years before cashing them in. They can be a good fit for seniors who want to earn interest on their savings while also keeping their nest egg safe.

What is the loophole for Series I bonds

This means you and your spouse can lock in more than $10,000 at the 0.90% fixed rate. Some call this the I Bonds gift loophole, but this strategy is just following the rules that the US Treasury has set for gifting I Bonds to other individuals.

Cached

Can a Series I bond lose money

You can count on a Series I bond to hold its value; that is, the bond's redemption value will not decline. Question: What is the inflation rate November 1 of each year. For example, the earnings rate announced on May 1 reflects an inflation rate from the previous October through March.

CachedSimilar

Why not to invest in I bonds

Variable interest rates are a risk you can't discount when you buy an I bond, and it's not like you can just sell the bond when the rate falls. You're locked in for the first year, unable to sell at all. Even after that, there's a penalty of three months' interest if you sell before five years.

Can I buy $10000 worth of I bonds every year

While there's no limit on how often you can buy I bonds, there is a limit on how much a given Social Security number can purchase annually. Here are the annual limits: Up to $10,000 in I bonds annually online. Up to $5,000 in paper I bonds with money from a tax refund.

Why not to buy Series I bonds

Variable interest rates are a risk you can't discount when you buy an I bond, and it's not like you can just sell the bond when the rate falls. You're locked in for the first year, unable to sell at all. Even after that, there's a penalty of three months' interest if you sell before five years.

How long should you hold Series I bonds

You can cash in (redeem) your I bond after 12 months. However, if you cash in the bond in less than 5 years, you lose the last 3 months of interest.

Are I bonds safe if the market crashes

The short answer is bonds tend to be less volatile than stocks and often perform better during recessions than other financial assets. However, they also come with their own set of risks, including default risk and interest rate risk.

Can married couples buy $20000 in I bonds

$10,000 limit: Up to $10,000 of I bonds can be purchased, per person (or entity), per year. A married couple can each purchase $10,000 per year ($20,000 per year total). 7.12% interest: The yield on I bonds has two components—a fixed rate and an inflation rate.

Do you pay taxes on I bonds

Yes, you are required to pay federal income taxes on the interest earned by inherited series I savings bonds. The interest is taxed in the year it is earned and must be reported on the beneficiary's tax return. The amount of tax owed depends on the beneficiary's tax bracket and the amount of interest earned.

What is a better investment than I bonds

TIPs offer comparable inflation protection relative to I Bonds at higher yields, a significant advantage. TIPs are also somewhat riskier, more volatile securities, with quite a bit of interest rate risk. Both asset classes are good investments, but TIPs are slightly better, due to their higher yields.

Are I bonds a good investment in 2023

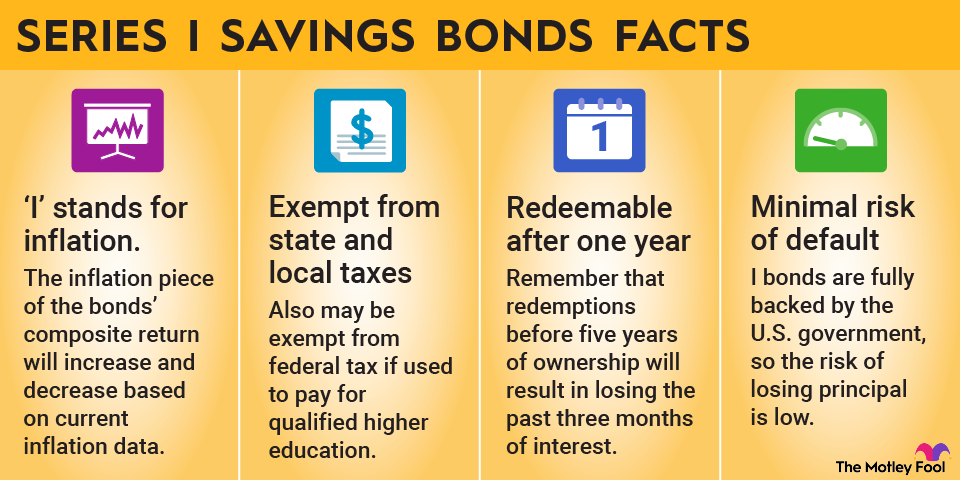

I bonds issued from May 1, 2023, to Oct. 31, 2023, have a composite rate of 4.30%. That includes a 0.90% fixed rate and a 1.69% inflation rate. Because I bonds are fully backed by the U.S. government, they are considered a relatively safe investment.

What are the three major risks when investing in bonds

Risk Considerations: The primary risks associated with corporate bonds are credit risk, interest rate risk, and market risk. In addition, some corporate bonds can be called for redemption by the issuer and have their principal repaid prior to the maturity date.

What is the safest investment if the stock market crashes

Bonds

Buy Bonds during a Market Crash

Government bonds are generally considered the safest investment, though they are decidedly unsexy and usually offer meager returns compared to stocks and even other bonds.

Can my wife and I both buy $10000 I bonds

$10,000 limit: Up to $10,000 of I bonds can be purchased, per person (or entity), per year. A married couple can each purchase $10,000 per year ($20,000 per year total).

How do I avoid taxes on I bonds

You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs. That includes expenses you pay for yourself, your spouse or a qualified dependent. Only certain qualified higher education costs are covered, including: Tuition.

Are I bonds still a good investment in 2023

I bonds issued from May 1, 2023, to Oct. 31, 2023, have a composite rate of 4.30%. That includes a 0.90% fixed rate and a 1.69% inflation rate. Because I bonds are fully backed by the U.S. government, they are considered a relatively safe investment.

Will I bonds be a good investment in 2023

The interest rate for Series I Bonds is unimpressive in some economic environments. But during the high inflation period of 2023-2023, however, these bonds are extremely attractive. Bonds issued in the six months leading up to October 2023 paid an impressive 9.62% interest rate.

What will May 2023 I Bond rate be

The 4.30% composite rate for I bonds issued from May 2023 through October 2023 applies for the first six months after the issue date. The composite rate combines a 0.90% fixed rate of return with the 3.38% annualized rate of inflation as measured by the Consumer Price Index for all Urban Consumers (CPI-U).